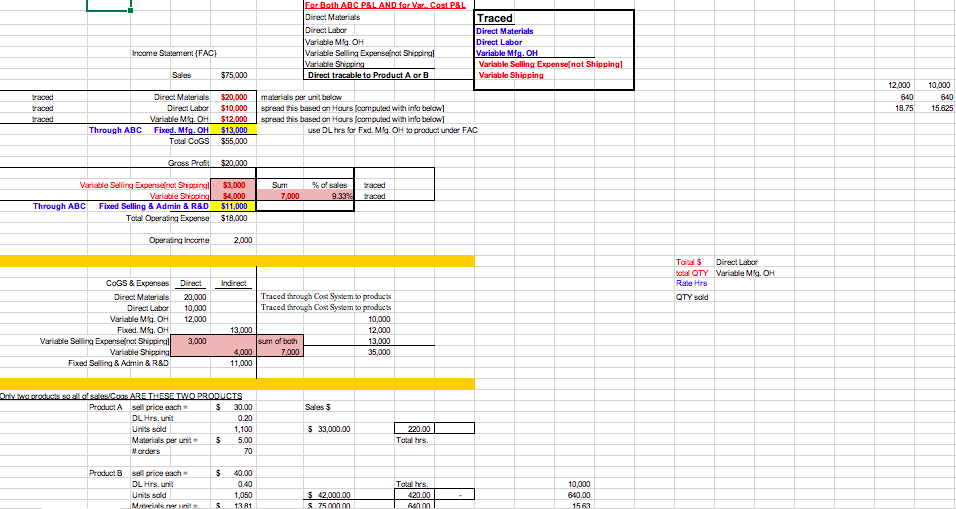

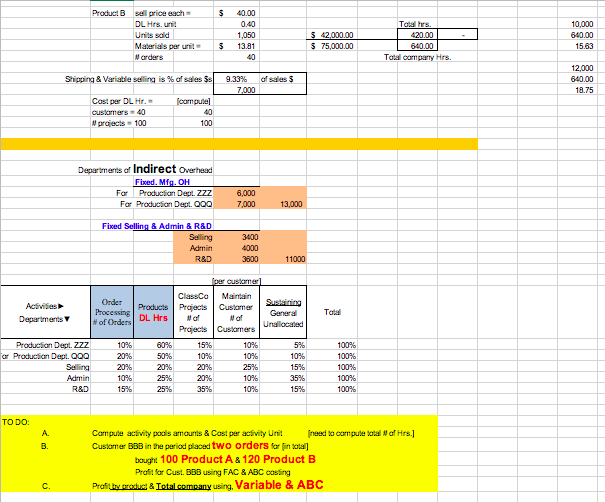

For Both ABC P&L AND for Var. Cost P&L Direct Materials Direct Labor Variable M. OH Variable Selling Expensenal Shipping Variable Shipping Direct tracable to Product A or B Traced Direct Materials Direct Labor Variable Mfg. OH Variable Selling Expense[not Shipping] Variable Shipping Income Statement {FAC) Sales $75,000 traced traced 12,000 640 18.75 10,000 640 15.625 Direct Materials Direct Labor Variable M9, OH Fixed. MOH Total CoGS $20,000 $10,000 $12.000 $13,000 $55,000 materials per unit below spread this based on Hours computed with info below] spread this based on Hours loomputed with info below use DL hrs for Fxd. MS. OH to product under FAC Through ABC Grass Prati $20,000 traced Surn 7,000 % af salas 9.33% Variable Selling Expertsonal Shippingl $3.000 Variable Shipping $4.000 Through ABC Fixed Selling & Admin & R&D $11,000 Total Operating Expense $18,000 Operating Income 2,000 Indirect Direct 20,000 10,000 12,000 Taitals Direct Labor total QTY Variable MOH Rate Hrs QTY sold COGS & Expenses Direct Materials Direct Labor Variable M. OH Fixed. M. OH Variable Selling Expensent Shipping Variable Shipping! Fixed Selling & Admin & R&D Traced through Cost System to products Traced through Cost System to products 10,000 12,000 sur af both 13,000 7,000 35,000 13.000 3,000 4,000 11,000 Sales 5 Only a products sold scoss ARE THESE TWO PRODUCTS Product Asell price each $ 30.00 DL Hrs. unit 0.20 Units sold 1,100 Materials per unit $ 5.00 Norders 70 $ 33,000.00 220.00 Total hrs. $ Product B sell price each DL Hrs. unit Units sold Materialen 40.00 0.40 1,050 13 81 $ 42,000.00 $75 man Totaltrs 420.00 Run 10,000 640.00 15 R3 Products $ sell price each DL Hrs. unit Units sold Materials per unit Marders 40.00 0.40 1,050 13.81 40 $ 42,000.00 $ 75,000.00 Total hrs. 420.00 640.00 Total company Hirs. 10,000 640.00 15.63 $ Shipping & Variable selling is % of sales 38 al sales 5 9.33% 7,000 12,000 640.00 18.75 compute] Cast per DL Hr. customers 40 M projects - 100 100 Departments al Indirect Overhead Fixed. Mfg. OH For Production Dept. ZZZ For Production Depl. 000 6,000 7,000 13,000 Fixed Selling & Admin & R&D Selling Admin R&D 3400 4000 3800 11000 Activities Departments Order Processing #of Orders Total per customer] ClassCo Maintain Products Projects Sustaining Customer General DL Hrs Projects Customers Unallocated 60% 15% 10% 5% 50% 10% 10% 10% 20% 20% 25% 15% 25% 20% 10% 35% 25% 35% 10% 15% 100% 100% Production Dept. ZZZ or Production Dept. 000 Selling Admin R&D 10% 20% 20% 10% 15% 100% 100% 100% TO DO A. B. Compute activity pools amounts & Cast per activity Unit Ineed to compute total of Hrs.) Customer BBB in the period placed two orders for in total] bought 100 Product A & 120 Product B Profit for Cust. 333 using FAC & ABC casting Profily product & Total company using. Variable & ABC c. For Both ABC P&L AND for Var. Cost P&L Direct Materials Direct Labor Variable M. OH Variable Selling Expensenal Shipping Variable Shipping Direct tracable to Product A or B Traced Direct Materials Direct Labor Variable Mfg. OH Variable Selling Expense[not Shipping] Variable Shipping Income Statement {FAC) Sales $75,000 traced traced 12,000 640 18.75 10,000 640 15.625 Direct Materials Direct Labor Variable M9, OH Fixed. MOH Total CoGS $20,000 $10,000 $12.000 $13,000 $55,000 materials per unit below spread this based on Hours computed with info below] spread this based on Hours loomputed with info below use DL hrs for Fxd. MS. OH to product under FAC Through ABC Grass Prati $20,000 traced Surn 7,000 % af salas 9.33% Variable Selling Expertsonal Shippingl $3.000 Variable Shipping $4.000 Through ABC Fixed Selling & Admin & R&D $11,000 Total Operating Expense $18,000 Operating Income 2,000 Indirect Direct 20,000 10,000 12,000 Taitals Direct Labor total QTY Variable MOH Rate Hrs QTY sold COGS & Expenses Direct Materials Direct Labor Variable M. OH Fixed. M. OH Variable Selling Expensent Shipping Variable Shipping! Fixed Selling & Admin & R&D Traced through Cost System to products Traced through Cost System to products 10,000 12,000 sur af both 13,000 7,000 35,000 13.000 3,000 4,000 11,000 Sales 5 Only a products sold scoss ARE THESE TWO PRODUCTS Product Asell price each $ 30.00 DL Hrs. unit 0.20 Units sold 1,100 Materials per unit $ 5.00 Norders 70 $ 33,000.00 220.00 Total hrs. $ Product B sell price each DL Hrs. unit Units sold Materialen 40.00 0.40 1,050 13 81 $ 42,000.00 $75 man Totaltrs 420.00 Run 10,000 640.00 15 R3 Products $ sell price each DL Hrs. unit Units sold Materials per unit Marders 40.00 0.40 1,050 13.81 40 $ 42,000.00 $ 75,000.00 Total hrs. 420.00 640.00 Total company Hirs. 10,000 640.00 15.63 $ Shipping & Variable selling is % of sales 38 al sales 5 9.33% 7,000 12,000 640.00 18.75 compute] Cast per DL Hr. customers 40 M projects - 100 100 Departments al Indirect Overhead Fixed. Mfg. OH For Production Dept. ZZZ For Production Depl. 000 6,000 7,000 13,000 Fixed Selling & Admin & R&D Selling Admin R&D 3400 4000 3800 11000 Activities Departments Order Processing #of Orders Total per customer] ClassCo Maintain Products Projects Sustaining Customer General DL Hrs Projects Customers Unallocated 60% 15% 10% 5% 50% 10% 10% 10% 20% 20% 25% 15% 25% 20% 10% 35% 25% 35% 10% 15% 100% 100% Production Dept. ZZZ or Production Dept. 000 Selling Admin R&D 10% 20% 20% 10% 15% 100% 100% 100% TO DO A. B. Compute activity pools amounts & Cast per activity Unit Ineed to compute total of Hrs.) Customer BBB in the period placed two orders for in total] bought 100 Product A & 120 Product B Profit for Cust. 333 using FAC & ABC casting Profily product & Total company using. Variable & ABC c