Question

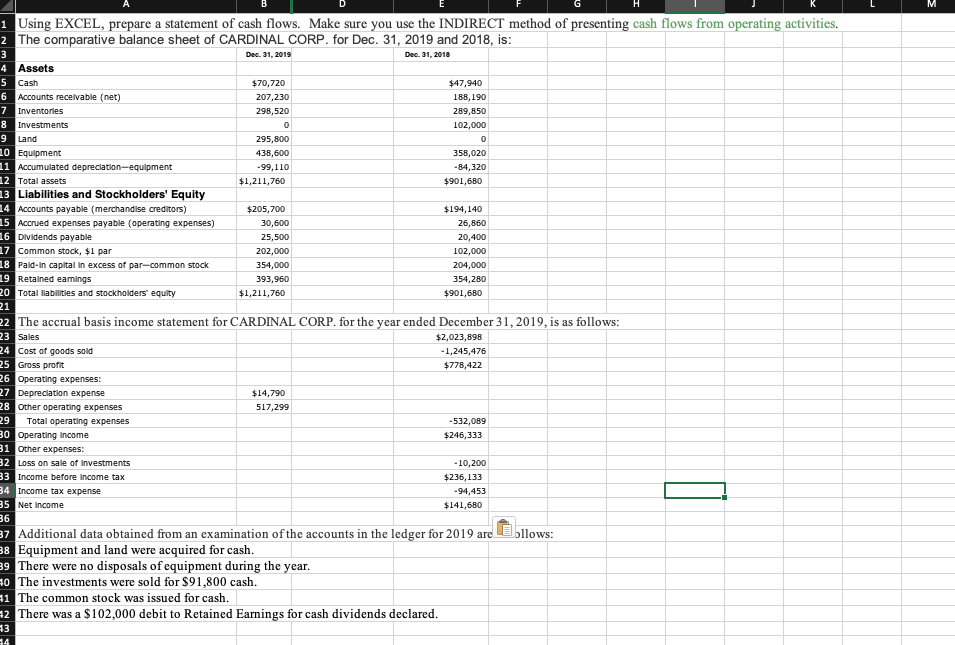

For CARDINAL CORPORATION, using EXCEL, prepare a statement of cash flows. Make sure you use the INDIRECT method of presenting cash flows from operating activities.

For CARDINAL CORPORATION, using EXCEL, prepare a statement of cash flows. Make sure you use the INDIRECT method of presenting cash flows from operating activities. I strongly encourage you to transfer the amounts below to your EXCEL spreadsheet first. The comparative balance sheet of CARDINAL CORP. for Dec. 31, 2019 and 2018, is: Dec. 31, 2019 Dec. 31, 2018 Assets Cash $70,720 $47,940 Accounts receivable (net) 207,230 188,190 Inventories 298,520 289,850 Investments 0 102,000 Land 295,800 0 Equipment 438,600 358,020 Accumulated depreciationequipment (99,110) (84,320) Total assets $1,211,760 $901,680 Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) $205,700 $194,140 Accrued expenses payable (operating expenses) 30,600 26,860 Dividends payable 25,500 20,400 Common stock, $1 par 202,000 102,000 Paid-in capital in excess of parcommon stock 354,000 204,000 Retained earnings 393,960 354,280 Total liabilities and stockholders' equity $1,211,760 $901,680 The accrual basis income statement for CARDINAL CORP. for the year ended December 31, 2019, is as follows: Sales $2,023,898 Cost of goods sold (1,245,476) Gross profit $778,422 Operating expenses: Depreciation expense $14,790 Other operating expenses 517,299 Total operating expenses (532,089) Operating income $246,333 Other expenses: Loss on sale of investments (10,200) Income before income tax $236,133 Income tax expense (94,453) Net income $141,680 Additional data obtained from an examination of the accounts in the ledger for 2019 are as follows: Equipment and land were acquired for cash. There were no disposals of equipment during the year. The investments were sold for $91,800 cash. The common stock was issued for cash. There was a $102,000 debit to Retained Earnings for cash dividends declared.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started