Question

For Case 1, the share price and EPS after the cash dividends are respectively: Select one: a. $ 40.0/ share $ 1.10 b. $ 37.5/

For Case 1, the share price and EPS after the cash dividends are respectively:

Select one:

a. $ 40.0/ share $ 1.10

b. $ 37.5/ share $ 0.85

c. $ 37.5/ share $ 0.95

d. $ 35.0/ share $ 0.70

e. none of the above

For Case 2, the share price and EPS after the stock repurchase are respectively:

Select one:

a. $ 35.0/ share $ 2.00

b. $ 37.5/ share $ 1.00

c. $ 40.0/ share $ 0.90

d. $ 37.5/ share $ 1.50

e. $ 40.0/ share $ 1.00

For Case 3, the share price and EPS after the stock dividends are respectively:

Select one:

a. $ 36.4/ share $ 0.79

b. $ 37.4/ share $ 0.89

c. $ 38.4/ share $ 0.99

d. $ 39.4/ share $ 1.09

e. $ 40.4/ share $ 1.19

If you are Flychuckers shareholder, you would:

Select one:

a. prefer Case 1 to the 2 other cases because it gives you the highest net worth on a per share bases

b. prefer Case 2 to the 2 other cases because it gives you the highest net worth on a per share bases

c. prefer Case 3 to the 2 other cases because it gives you the highest net worth on a per share bases

d. you are indifferent, all cases give you the same net worth

e. do not have enough information to make up your mind

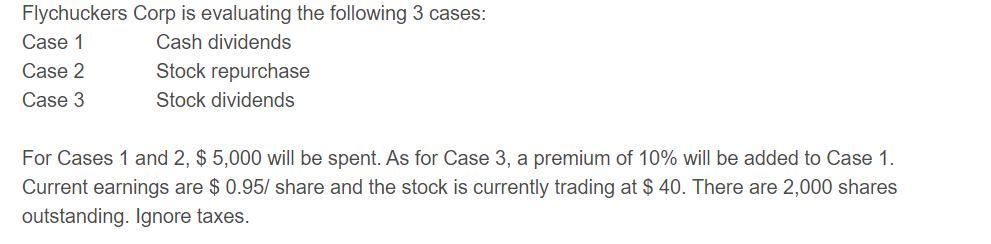

Flychuckers Corp is evaluating the following 3 cases: Case 1 Cash dividends Case 2 Stock repurchase Case 3 Stock dividends For Cases 1 and 2, $ 5,000 will be spent. As for Case 3, a premium of 10% will be added to Case 1. Current earnings are $ 0.95/ share and the stock is currently trading at $ 40. There are 2,000 shares outstanding. Ignore taxesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started