Question

For Case 31 Management of Corporate Capital Structure. Apply the M&M theory to complete the worksheet for the recapitalization alternative on page430. Again use excel

For Case 31 Management of Corporate Capital Structure.

Apply the M&M theory to complete the worksheet for the recapitalization alternative on page430. Again use excel spreadsheet and correct cell formula. Based on your calculation result, do you think the recapitalization alternative will deter the hostile tender offer at $61 a share?

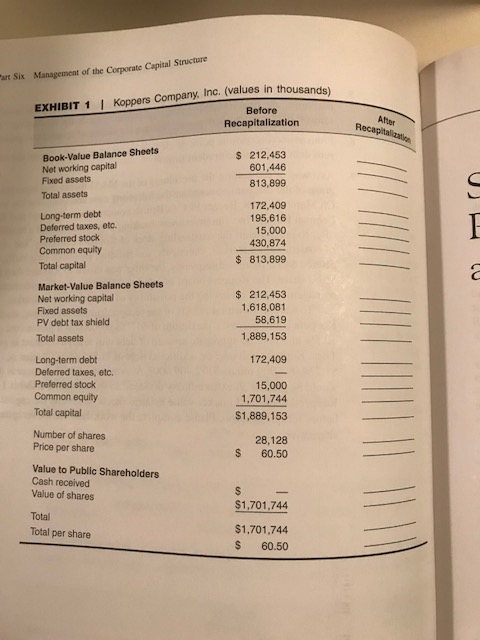

As a way of illustrating the usefulness of the M&M theory and consolidating you grasp of mechanics consider the following case and complete the worksheet. On March 3, 1988 Beazer PLC (a British construction company) and Shearson Lenman Hutton Inc. (an investment banking firm) commenced a hostile tender offer to purchase all the outstanding stock of Koppers Company, Inc. a producer of construction materials, chemicals and building products. Originally , the raiders offered $45 a share; subsequently the offer was raised to $56 and then finally to $61 a share. The Koppers board asserted that the offers were inadequate and its management was reviewing the possibility of a major recapitalization. To tes the valuation effects of the reapitalizaion alternative, assume that Koppers could borrow a maximum of $1,738,095,000 at a pretax cost of debt of 10.5% and that the aggregate amount of debt will remain constant in perpetuity. Thus, Koppers will take on additional debt of $1,565,686,000 (that is $1,738,095,000 minus $172,409,000). Also, assume that the proceeds would be paid as an extrodinary dividen dividend to shareholders. Exhibit 1 presents Koppers' book and market value balance sheets, assuming the capital structure before recapitalizaion. Please complete the worksheet for the capitalization alternative.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started