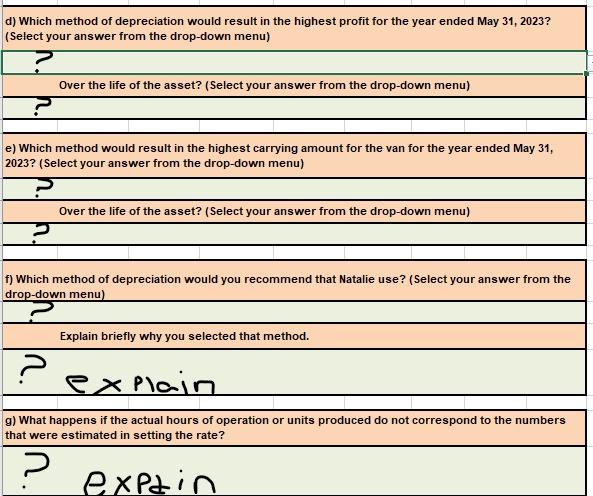

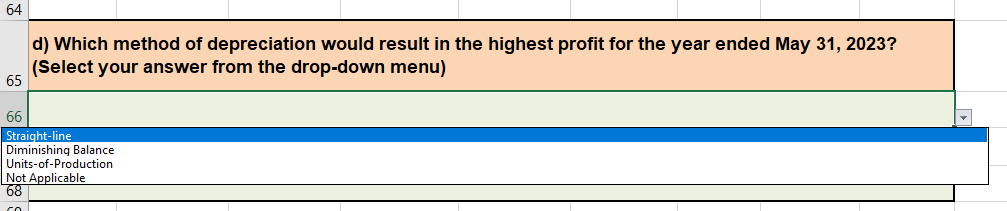

FOR D 1&2 E 1&2 F1 CHOOSE FROM THE MULTIPLE CHOICE BELOWAND FOR F2 AND G GIVE EXPLANATION  AND FOR F2 AND G GIVE EXPLANATION

AND FOR F2 AND G GIVE EXPLANATION

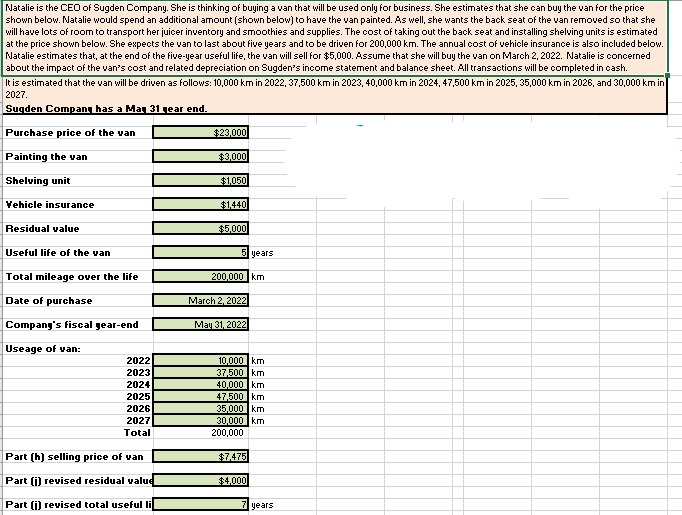

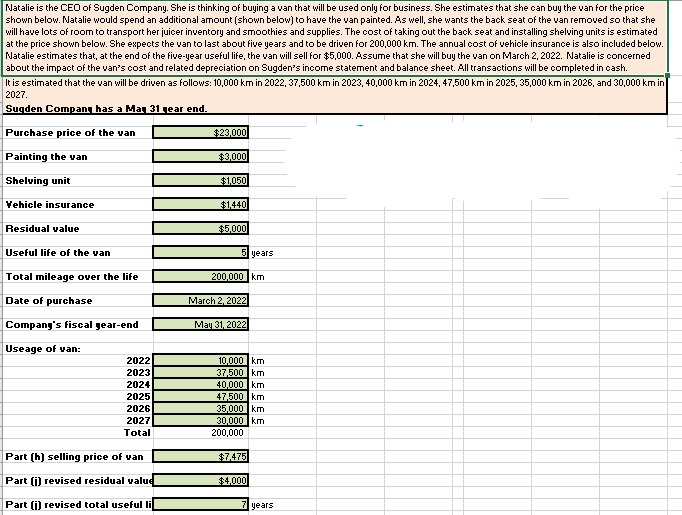

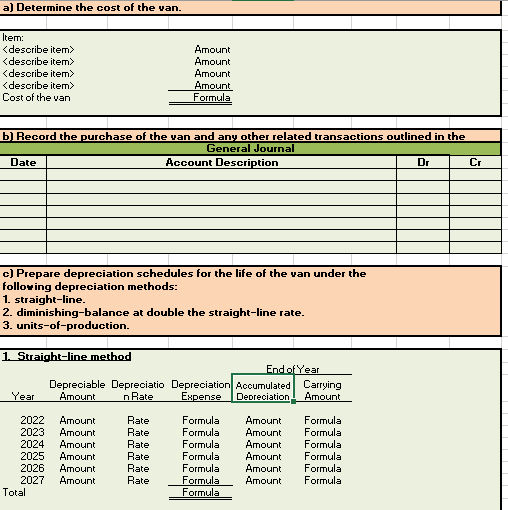

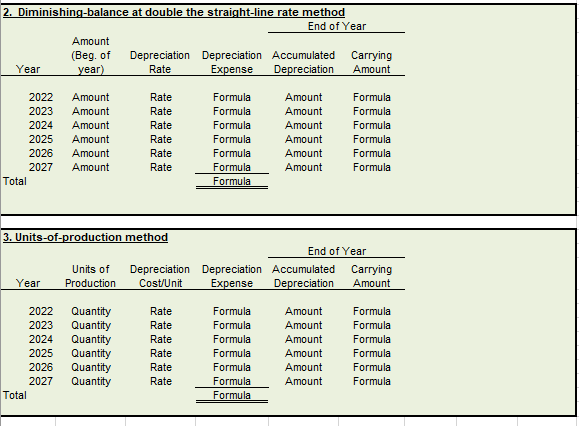

Natalie is the CEO of Sugden Company. She is thinking of buying a van that will be used only for business. She estimates that she can buy the van for the price shown below. Natalie would spend an additional amount (shown below) to have the van painted. As well, she wants the back seat of the van removed so that she will have lots of room to transport her juicer inventory and smoothies and supplies. The cost of taking out the back seat and installing shelving units is estimated at the price shown below. She expects the van to last about five years and to be driven for 200,000 km. The annual cost of vehicle insurance is also included below. Natalie estimates that at the end of the five-year useful life, the van will sell for $5,000. Assume that she will buy the van on March 2, 2022. Natalie is concerned about the impact of the van's cost and related depreciation on Sugden's income statement and balance sheet. All transactions will be completed in cash. It is estimated that the van will be driven as follows: 10.000 km in 2022, 37.500 km in 2023,40,000 km in 2024, 47.500 km in 2025, 35,000 km in 2026, and 30.000 km in 2027 Suqden Company has a Ma, 31 gear end. Purchase price of the van $23,000 Painting the van $3,000 Shelving unit $1050 Vehicle insurance $1,440 Residual value $5,000 Useful life of the van 5 years 200.000 km Total mileage over the life Date of purchase Company's fiscal year-end March 2, 2022 May 31 2022 Useage of van: 2022 2023 2024 2025 2026 2027 Total 10,000km 37,500km 40,000 km 47 500 km 35,000 km 30,000km 200,000 Part (h) selling price of van $7.475 $4,000 Part (i) revised residual value Part (i) revised total useful til 7 years a) Determine the cost of the van. Item:

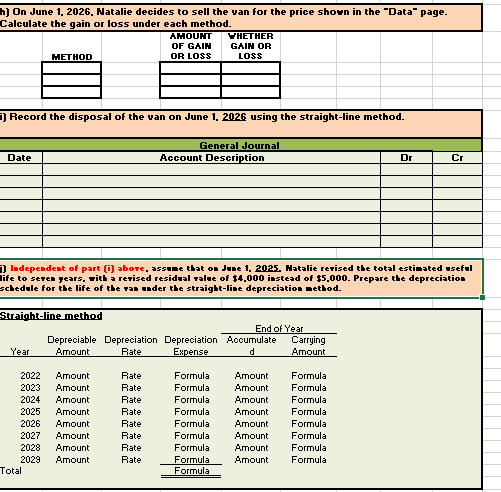

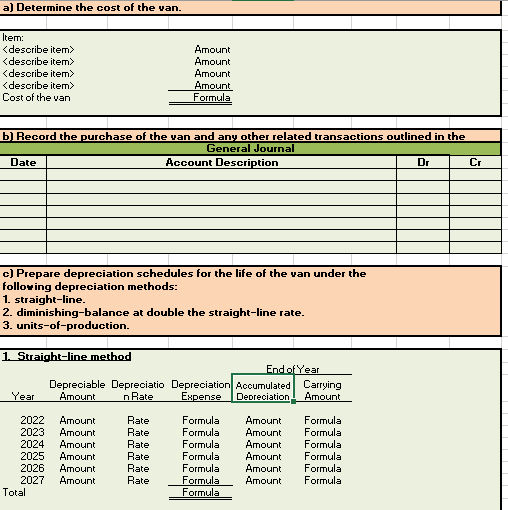

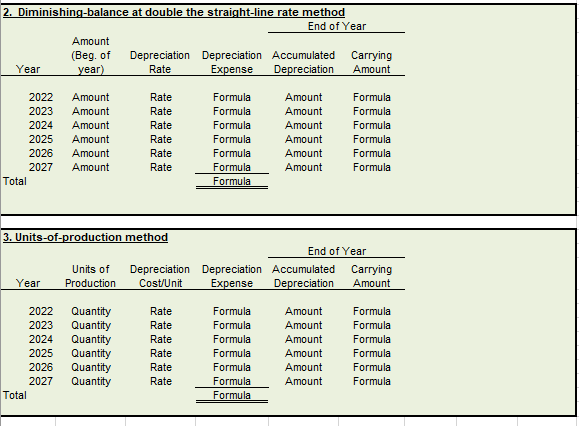

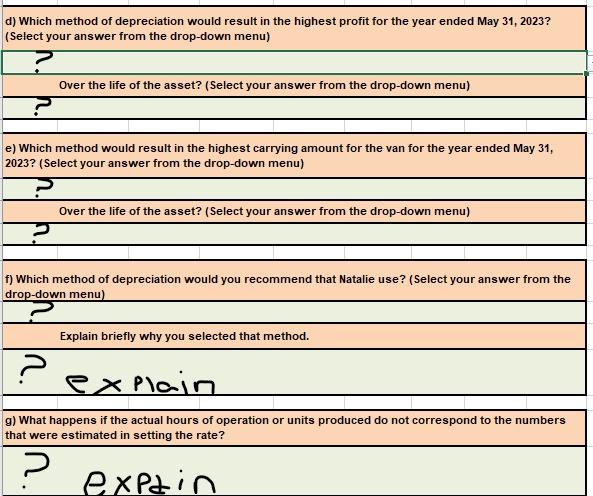

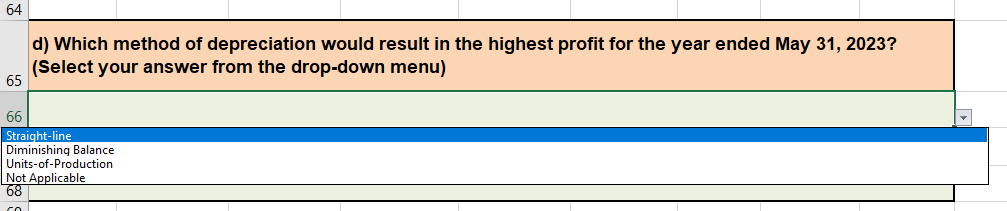

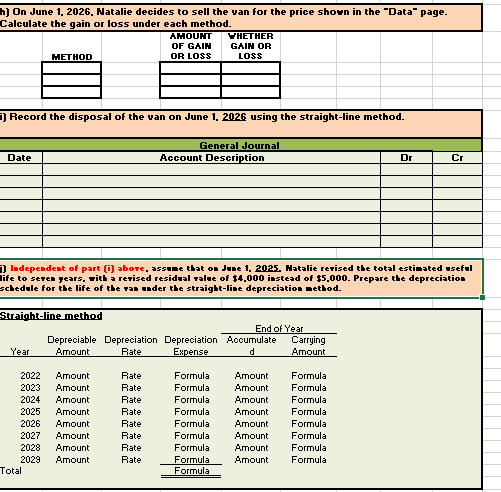

Cost of the van Amount Amount Amount Amount Formula b) Record the purchase of the van and any other related transactions outlined in the General Journal Date Account Description Dr Cr c) Prepare depreciation schedules for the life of the van under the following depreciation methods: 1. straight-line. 2. diminishing-balance at double the straight-line rate. 3. units-of-production. 1 Straight-line method End of Year Depreciable Depreciatio Depreciation Accumulated Carrying Year Amount n Rate Expense Depreciation Amount 2022 2023 2024 2025 2026 2027 Total Amount Amount Amount Amount Amount Amount Rate Rate Rate Rate Rate Rate Formula Formula Formula Formula Formula Formula Formula Amount Amount Amount Amount Amount Amount Formula Formula Formula Formula Formula Formula 2. Diminishing-balance at double the straight-line rate method End of Year Amount (Beg. of Depreciation Depreciation Accumulated Carrying Year year) Rate Expense Depreciation Amount 2022 2023 2024 2025 2026 2027 Total Amount Amount Amount Amount Amount Amount Rate Rate Rate Rate Rate Rate Formula Formula Formula Formula Formula Formula Formula Amount Amount Amount Amount Amount Amount Formula Formula Formula Formula Formula Formula 3. Units-of-production method Units of Production Depreciation Cost/Unit End of Year Depreciation Accumulated Carrying Expense Depreciation Amount Year 2022 2023 2024 2025 2026 2027 Total Quantity Quantity Quantity Quantity Quantity Quantity Rate Rate Rate Rate Rate Rate Formula Formula Formula Formula Formula Formula Formula Amount Amount Amount Amount Amount Amount Formula Formula Formula Formula Formula Formula d) Which method of depreciation would result in the highest profit for the year ended May 31, 2023? (Select your answer from the drop-down menu) Over the life of the asset? (Select your answer from the drop-down menu) e) Which method would result in the highest carrying amount for the van for the year ended May 31, 2023? (Select your answer from the drop-down menu) Over the life of the asset? (Select your answer from the drop-down menu) f) Which method of depreciation would you recommend that Natalie use? (Select your answer from the drop-down menu) Explain briefly why you selected that method. ex Plain g) What happens if the actual hours of operation or units produced do not correspond to the numbers that were estimated in setting the rate? > exPzin 64 d) Which method of depreciation would result in the highest profit for the year ended May 31, 2023? (Select your answer from the drop-down menu) 65 66 Straight-line Diminishing Balance Units-of-Production Not Applicable 68 co h) On June 1, 2026. Natalie decides to sell the van for the price shown in the "Data" page. Calculate the gain or loss under each method. AMOUNT YHETHER OF GAIN GAIN OR HETHOD OR LOSS LOSS i) Record the disposal of the van on June 1, 2026 using the straight-line method. General Journal Account Description Date Dr Cr i) Independent of part (1) abort, assume that on June 1, 2025. Hatalie rerised the total estimated useful life to seven years, with a retised residual value of $4,000 instead of $5,000. Prepare the depreciation schedule for the life of the man under the straight-line depreciation method. Straight-line method End of Year Depreciable Depreciation Depreciation Accumulate Carrying Year Amount Rate Expense d Amount 2022 2023 2024 2025 2026 2027 2028 2029 Total Amount Amount Amount Amount Amount Amount Amount Amount Rate Rate Rate Rate Rate Rate Rate Rate Formula Formula Formula Formula Formula Formula Formula Formula Formula Amount Amount Amount Amount Amount Amount Amount Amount Formula Formula Formula Formula Formula Formula Formula Formula

AND FOR F2 AND G GIVE EXPLANATION

AND FOR F2 AND G GIVE EXPLANATION