for d8=0 , with clear steps thank you

for d8=0 , with clear steps thank you

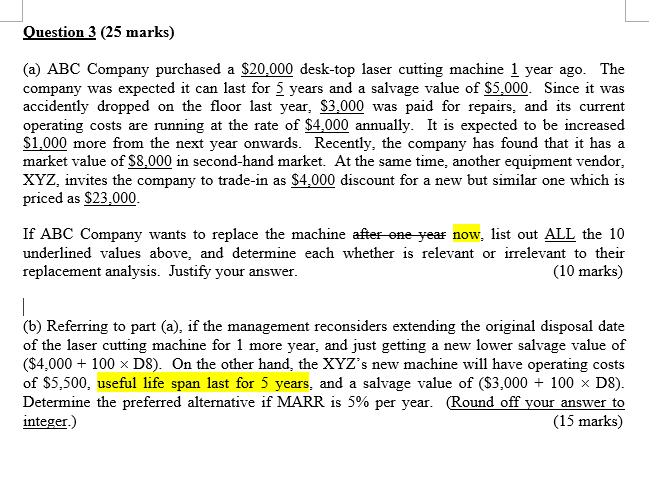

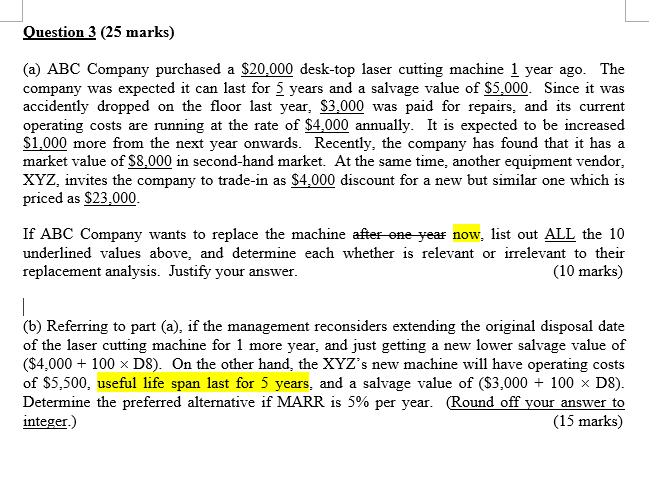

Question 3 (25 marks) (a) ABC Company purchased a $20.000 desk-top laser cutting machine 1 year ago. The company was expected it can last for 5 years and a salvage value of $5,000. Since it was accidently dropped on the floor last year, $3,000 was paid for repairs, and its current operating costs are running at the rate of $4,000 annually. It is expected to be increased $1,000 more from the next year onwards. Recently, the company has found that it has a market value of $8,000 in second-hand market. At the same time, another equipment vendor, XYZ, invites the company to trade-in as $4.000 discount for a new but similar one which is priced as $23,000. If ABC Company wants to replace the machine after one year now, list out ALL the 10 underlined values above, and determine each whether is relevant or irrelevant to their replacement analysis. Justify your answer. (10 marks) (b) Referring to part (a), if the management reconsiders extending the original disposal date of the laser cutting machine for 1 more year, and just getting a new lower salvage value of ($4,000 + 100 x D8). On the other hand, the XYZ's new machine will have operating costs of $5,500, useful life span last for 5 years, and a salvage value of ($3,000 + 100 x D8). Determine the preferred alternative if MARR is 5% per year. Round off your answer to integer.) (15 marks) Question 3 (25 marks) (a) ABC Company purchased a $20.000 desk-top laser cutting machine 1 year ago. The company was expected it can last for 5 years and a salvage value of $5,000. Since it was accidently dropped on the floor last year, $3,000 was paid for repairs, and its current operating costs are running at the rate of $4,000 annually. It is expected to be increased $1,000 more from the next year onwards. Recently, the company has found that it has a market value of $8,000 in second-hand market. At the same time, another equipment vendor, XYZ, invites the company to trade-in as $4.000 discount for a new but similar one which is priced as $23,000. If ABC Company wants to replace the machine after one year now, list out ALL the 10 underlined values above, and determine each whether is relevant or irrelevant to their replacement analysis. Justify your answer. (10 marks) (b) Referring to part (a), if the management reconsiders extending the original disposal date of the laser cutting machine for 1 more year, and just getting a new lower salvage value of ($4,000 + 100 x D8). On the other hand, the XYZ's new machine will have operating costs of $5,500, useful life span last for 5 years, and a salvage value of ($3,000 + 100 x D8). Determine the preferred alternative if MARR is 5% per year. Round off your answer to integer.) (15 marks)

for d8=0 , with clear steps thank you

for d8=0 , with clear steps thank you