Answered step by step

Verified Expert Solution

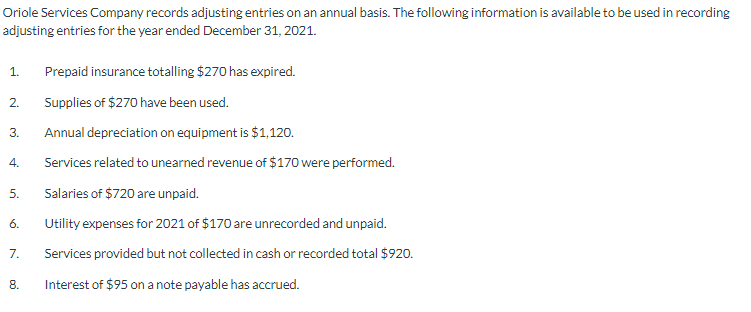

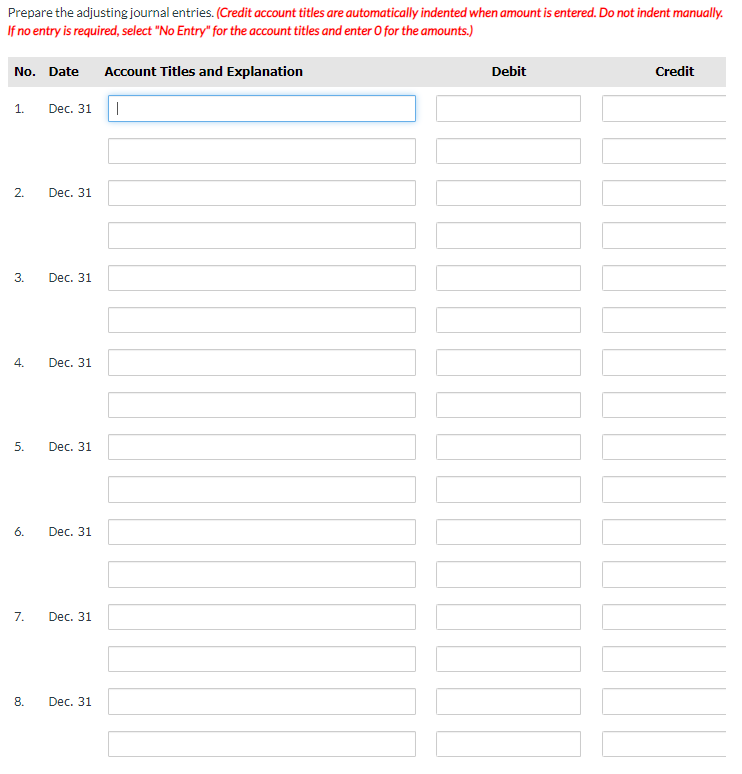

Question

1 Approved Answer

For each adjustment, prepare a basic analysis, a debit-credit analysis. Use the following format, in which the first one has been done: No. Basic Type

For each adjustment, prepare a basic analysis, a debit-credit analysis. Use the following format, in which the first one has been done:

| No. | Basic Type | Increase/Decrease | Specific Account | Amount | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. | Debit | Expense | Increases | Insurance Expense | $270 | ||||||

| Credit | Asset | Decreases | Prepaid Insurance | 270 | |||||||

| 2. | Debit | select a Basic Type RevenueOwner's EquityLiabilityContra AssetsAssetExpenseDrawingsContra Liability | select an effect IncreasesDecreases | enter a Specific Account | enter a dollar amount | ||||||

| Credit | select a Basic Type AssetContra LiabilityLiabilityContra AssetsOwner's EquityDrawingsExpenseRevenue | select an effect IncreasesDecreases | enter a Specific Account | enter a dollar amount | |||||||

| 3. | Debit | select a Basic Type ExpenseRevenueAssetDrawingsContra LiabilityOwner's EquityLiabilityContra Assets | select an effect IncreasesDecreases | enter a Specific Account | enter a dollar amount | ||||||

| Credit | select a Basic Type AssetRevenueContra AssetsContra LiabilityExpenseDrawingsOwner's EquityLiability | select an effect IncreasesDecreases | enter a Specific Account | enter a dollar amount | |||||||

| 4. | Debit | select a Basic Type AssetOwner's EquityLiabilityContra AssetsDrawingsExpenseRevenueContra Liability | select an effect IncreasesDecreases | enter a Specific Account | enter a dollar amount | ||||||

| Credit | select a Basic Type LiabilityRevenueContra LiabilityOwner's EquityContra AssetsExpenseDrawingsAsset | select an effect IncreasesDecreases | enter a Specific Account | enter a dollar amount | |||||||

| 5. | Debit | select a Basic Type LiabilityContra LiabilityDrawingsContra AssetsAssetOwner's EquityRevenueExpense | select an effect IncreasesDecreases | enter a Specific Account | enter a dollar amount | ||||||

| Credit | select a Basic Type RevenueContra AssetsExpenseLiabilityDrawingsAssetContra LiabilityOwner's Equity | select an effect IncreasesDecreases | enter a Specific Account | enter a dollar amount | |||||||

| 6. | Debit | select a Basic Type LiabilityContra AssetsContra LiabilityExpenseOwner's EquityRevenueAssetDrawings | select an effect IncreasesDecreases | enter a Specific Account | enter a dollar amount | ||||||

| Credit | select a Basic Type RevenueDrawingsLiabilityExpenseAssetContra LiabilityOwner's EquityContra Assets | select an effect IncreasesDecreases | enter a Specific Account | enter a dollar amount | |||||||

| 7. | Debit | select a Basic Type Contra LiabilityRevenueLiabilityContra AssetsDrawingsAssetExpenseOwner's Equity | select an effect IncreasesDecreases | enter a Specific Account | enter a dollar amount | ||||||

| Credit | select a Basic Type LiabilityRevenueAssetExpenseContra LiabilityOwner's EquityDrawingsContra Assets | select an effect IncreasesDecreases | enter a Specific Account | enter a dollar amount | |||||||

| 8. | Debit | select a Basic Type LiabilityAssetRevenueDrawingsContra AssetsContra LiabilityExpenseOwner's Equity | select an effect IncreasesDecreases | enter a Specific Account | enter a dollar amount | ||||||

| Credit | select a Basic Type LiabilityRevenueAssetDrawingsOwner's EquityContra LiabilityContra AssetsExpense | select an effect IncreasesDecreases | enter a Specific Account |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started