Answered step by step

Verified Expert Solution

Question

1 Approved Answer

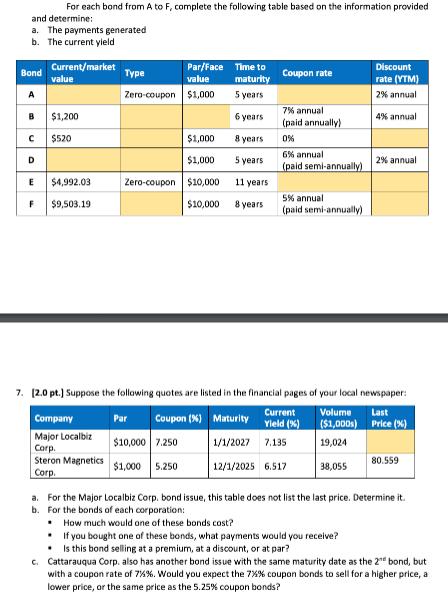

For each bond from A to F, complete the following table based on the information provided and determine: a. The payments generated b. The

For each bond from A to F, complete the following table based on the information provided and determine: a. The payments generated b. The current yield Current/market Bond A B C D E F value $1,200 $520 $4,992.03 $9,503.19 Par/Face value Zero-coupon $1,000 Type $1,000 $1,000 Zero-coupon $10,000 $10,000 Time to maturity 5 years 6 years 8 years 5 years 11 years 8 years Coupon rate 7% annual (paid annually) 0% 6% annual (paid semi-annually) 5% annual (paid semi-annually) Current Yield (%) Discount rate (YTM) 2% annual 1/1/2027 7.135 12/1/2025 6.517 4% annual 7. [2.0 pt.] Suppose the following quotes are listed in the financial pages of your local newspaper: Volume Last Company Par Coupon (%) Maturity ($1,000s) Price (%) Major Localbiz $10,000 7.250 19,024 Corp. Steron Magnetics $1,000 5.250 Corp. 38,055 2% annual 80.559 a. For the Major Localbiz Corp. bond issue, this table does not list the last price. Determine it. b. For the bonds of each corporation: . How much would one of these bonds cost? If you bought one of these bonds, what payments would you receive? . Is this bond selling at a premium, at a discount, or at par? c. Cattarauqua Corp. also has another bond issue with the same maturity date as the 2 bond, but with a coupon rate of 7% %. Would you expect the 7% % coupon bonds to sell for a higher price, a lower price, or the same price as the 5.25% coupon bonds?

Step by Step Solution

★★★★★

3.52 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Based on the information provided we can calculate the current yield for each corporations bond as f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started