Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Select the best answer for each of the following. Explain the reasons for your selection. a. In planning and performing an audit, auditors are

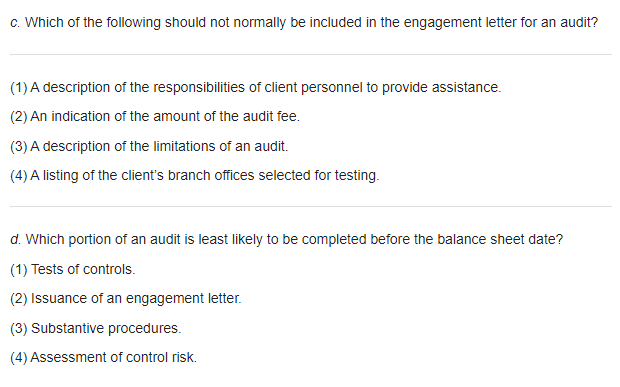

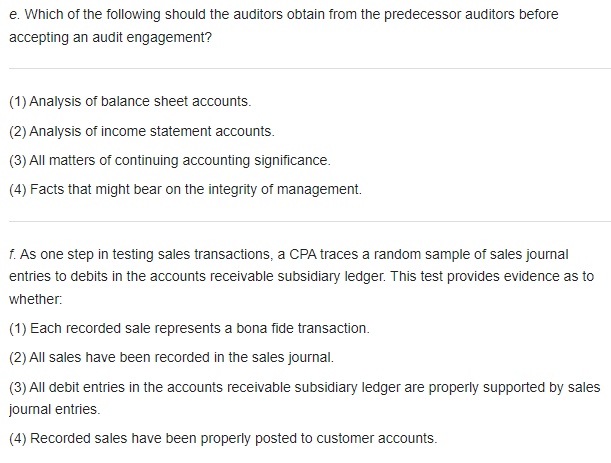

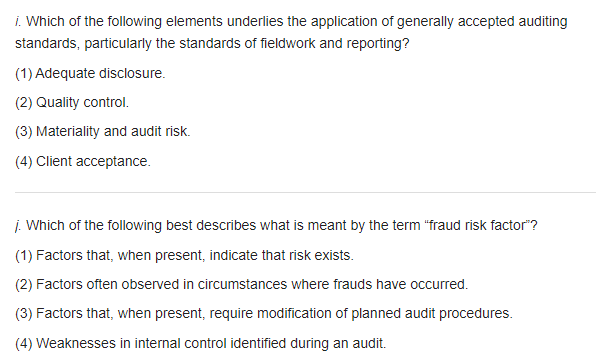

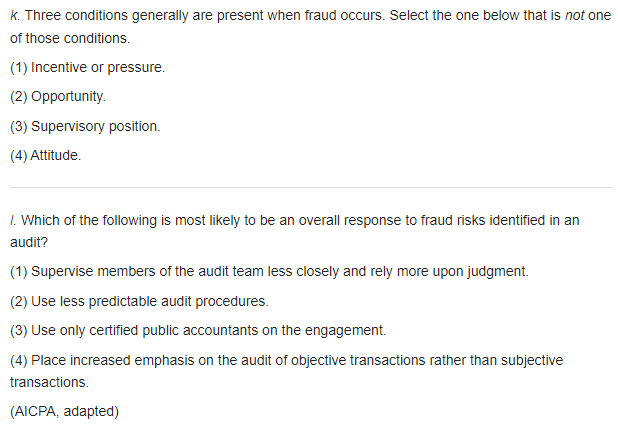

Select the best answer for each of the following. Explain the reasons for your selection. a. In planning and performing an audit, auditors are concerned about risk factors for two distinct types of fraud: fraudulent financial reporting and misappropriation of assets. Which of the following is a risk factor for misappropriation of assets? (1) Generous performance-based compensation systems. (2) Management preoccupation with increased financial performance. (3) An unreliable accounting system. (4) Strained relationships between management and the auditors. b. The audit committee of a company must be made up of. (1) Representatives from the client's management, investors, suppliers, and customers. (2) The audit partner, the chief financial officer, the legal counsel, and at least one outsider. (3) Representatives of the major equity interests, such as preferred and common stockholders. (4) Members of the board of directors who are not officers or employees. c. Which of the following should not normally be included in the engagement letter for an audit? (1) A description of the responsibilities of client personnel to provide assistance. (2) An indication of the amount of the audit fee. (3) A description of the limitations of an audit. (4) A listing of the client's branch offices selected for testing. d. Which portion of an audit is least likely to be completed before the balance sheet date? (1) Tests of controls. (2) Issuance of an engagement letter. (3) Substantive procedures. (4) Assessment of control risk. e. Which of the following should the auditors obtain from the predecessor auditors before accepting an audit engagement? (1) Analysis of balance sheet accounts. (2) Analysis of income statement accounts. (3) All matters of continuing accounting significance. (4) Facts that might bear on the integrity of management. f. As one step in testing sales transactions, a CPA traces a random sample of sales journal entries to debits in the accounts receivable subsidiary ledger. This test provides evidence as to whether: (1) Each recorded sale represents a bona fide transaction. (2) All sales have been recorded in the sales journal. (3) All debit entries in the accounts receivable subsidiary ledger are properly supported by sales journal entries. (4) Recorded sales have been properly posted to customer accounts. g. The primary objective of tests of details of transactions performed as substantive procedures is to: (1) Comply with generally accepted auditing standards. (2) Attain assurance about the reliability of the accounting system. (3) Detect material misstatements in the financial statements. (4) Evaluate whether management's policies and procedures are operating effectively. h. The risk that the auditors will conclude, based on substantive procedures, that a material misstatement does not exist in an account balance when, in fact, such misstatement does exist is referred to as (1) Business risk. (2) Engagement risk. (3) Control risk. (4) Detection risk. i. Which of the following elements underlies the application of generally accepted auditing standards, particularly the standards of fieldwork and reporting? (1) Adequate disclosure. (2) Quality control. (3) Materiality and audit risk. (4) Client acceptance. j. Which of the following best describes what is meant by the term "fraud risk factor"? (1) Factors that, when present, indicate that risk exists. (2) Factors often observed in circumstances where frauds have occurred. (3) Factors that, when present, require modification of planned audit procedures. (4) Weaknesses in internal control identified during an audit. k. Three conditions generally are present when fraud occurs. Select the one below that is not one of those conditions. (1) Incentive or pressure. (2) Opportunity. (3) Supervisory position. (4) Attitude. I. Which of the following is most likely to be an overall response to fraud risks identified in an audit? (1) Supervise members of the audit team less closely and rely more upon judgment. (2) Use less predictable audit procedures. (3) Use only certified public accountants on the engagement. (4) Place increased emphasis on the audit of objective transactions rather than subjective transactions. (AICPA, adapted) Select the best answer for each of the following. Explain the reasons for your selection. a. In planning and performing an audit, auditors are concerned about risk factors for two distinct types of fraud: fraudulent financial reporting and misappropriation of assets. Which of the following is a risk factor for misappropriation of assets? (1) Generous performance-based compensation systems. (2) Management preoccupation with increased financial performance. (3) An unreliable accounting system. (4) Strained relationships between management and the auditors. b. The audit committee of a company must be made up of. (1) Representatives from the client's management, investors, suppliers, and customers. (2) The audit partner, the chief financial officer, the legal counsel, and at least one outsider. (3) Representatives of the major equity interests, such as preferred and common stockholders. (4) Members of the board of directors who are not officers or employees. c. Which of the following should not normally be included in the engagement letter for an audit? (1) A description of the responsibilities of client personnel to provide assistance. (2) An indication of the amount of the audit fee. (3) A description of the limitations of an audit. (4) A listing of the client's branch offices selected for testing. d. Which portion of an audit is least likely to be completed before the balance sheet date? (1) Tests of controls. (2) Issuance of an engagement letter. (3) Substantive procedures. (4) Assessment of control risk. e. Which of the following should the auditors obtain from the predecessor auditors before accepting an audit engagement? (1) Analysis of balance sheet accounts. (2) Analysis of income statement accounts. (3) All matters of continuing accounting significance. (4) Facts that might bear on the integrity of management. f. As one step in testing sales transactions, a CPA traces a random sample of sales journal entries to debits in the accounts receivable subsidiary ledger. This test provides evidence as to whether: (1) Each recorded sale represents a bona fide transaction. (2) All sales have been recorded in the sales journal. (3) All debit entries in the accounts receivable subsidiary ledger are properly supported by sales journal entries. (4) Recorded sales have been properly posted to customer accounts. g. The primary objective of tests of details of transactions performed as substantive procedures is to: (1) Comply with generally accepted auditing standards. (2) Attain assurance about the reliability of the accounting system. (3) Detect material misstatements in the financial statements. (4) Evaluate whether management's policies and procedures are operating effectively. h. The risk that the auditors will conclude, based on substantive procedures, that a material misstatement does not exist in an account balance when, in fact, such misstatement does exist is referred to as (1) Business risk. (2) Engagement risk. (3) Control risk. (4) Detection risk. i. Which of the following elements underlies the application of generally accepted auditing standards, particularly the standards of fieldwork and reporting? (1) Adequate disclosure. (2) Quality control. (3) Materiality and audit risk. (4) Client acceptance. j. Which of the following best describes what is meant by the term "fraud risk factor"? (1) Factors that, when present, indicate that risk exists. (2) Factors often observed in circumstances where frauds have occurred. (3) Factors that, when present, require modification of planned audit procedures. (4) Weaknesses in internal control identified during an audit. k. Three conditions generally are present when fraud occurs. Select the one below that is not one of those conditions. (1) Incentive or pressure. (2) Opportunity. (3) Supervisory position. (4) Attitude. I. Which of the following is most likely to be an overall response to fraud risks identified in an audit? (1) Supervise members of the audit team less closely and rely more upon judgment. (2) Use less predictable audit procedures. (3) Use only certified public accountants on the engagement. (4) Place increased emphasis on the audit of objective transactions rather than subjective transactions. (AICPA, adapted) Select the best answer for each of the following. Explain the reasons for your selection. a. In planning and performing an audit, auditors are concerned about risk factors for two distinct types of fraud: fraudulent financial reporting and misappropriation of assets. Which of the following is a risk factor for misappropriation of assets? (1) Generous performance-based compensation systems. (2) Management preoccupation with increased financial performance. (3) An unreliable accounting system. (4) Strained relationships between management and the auditors. b. The audit committee of a company must be made up of. (1) Representatives from the client's management, investors, suppliers, and customers. (2) The audit partner, the chief financial officer, the legal counsel, and at least one outsider. (3) Representatives of the major equity interests, such as preferred and common stockholders. (4) Members of the board of directors who are not officers or employees. c. Which of the following should not normally be included in the engagement letter for an audit? (1) A description of the responsibilities of client personnel to provide assistance. (2) An indication of the amount of the audit fee. (3) A description of the limitations of an audit. (4) A listing of the client's branch offices selected for testing. d. Which portion of an audit is least likely to be completed before the balance sheet date? (1) Tests of controls. (2) Issuance of an engagement letter. (3) Substantive procedures. (4) Assessment of control risk. e. Which of the following should the auditors obtain from the predecessor auditors before accepting an audit engagement? (1) Analysis of balance sheet accounts. (2) Analysis of income statement accounts. (3) All matters of continuing accounting significance. (4) Facts that might bear on the integrity of management. f. As one step in testing sales transactions, a CPA traces a random sample of sales journal entries to debits in the accounts receivable subsidiary ledger. This test provides evidence as to whether: (1) Each recorded sale represents a bona fide transaction. (2) All sales have been recorded in the sales journal. (3) All debit entries in the accounts receivable subsidiary ledger are properly supported by sales journal entries. (4) Recorded sales have been properly posted to customer accounts. g. The primary objective of tests of details of transactions performed as substantive procedures is to: (1) Comply with generally accepted auditing standards. (2) Attain assurance about the reliability of the accounting system. (3) Detect material misstatements in the financial statements. (4) Evaluate whether management's policies and procedures are operating effectively. h. The risk that the auditors will conclude, based on substantive procedures, that a material misstatement does not exist in an account balance when, in fact, such misstatement does exist is referred to as (1) Business risk. (2) Engagement risk. (3) Control risk. (4) Detection risk. i. Which of the following elements underlies the application of generally accepted auditing standards, particularly the standards of fieldwork and reporting? (1) Adequate disclosure. (2) Quality control. (3) Materiality and audit risk. (4) Client acceptance. j. Which of the following best describes what is meant by the term "fraud risk factor"? (1) Factors that, when present, indicate that risk exists. (2) Factors often observed in circumstances where frauds have occurred. (3) Factors that, when present, require modification of planned audit procedures. (4) Weaknesses in internal control identified during an audit. k. Three conditions generally are present when fraud occurs. Select the one below that is not one of those conditions. (1) Incentive or pressure. (2) Opportunity. (3) Supervisory position. (4) Attitude. I. Which of the following is most likely to be an overall response to fraud risks identified in an audit? (1) Supervise members of the audit team less closely and rely more upon judgment. (2) Use less predictable audit procedures. (3) Use only certified public accountants on the engagement. (4) Place increased emphasis on the audit of objective transactions rather than subjective transactions. (AICPA, adapted) Select the best answer for each of the following. Explain the reasons for your selection. a. In planning and performing an audit, auditors are concerned about risk factors for two distinct types of fraud: fraudulent financial reporting and misappropriation of assets. Which of the following is a risk factor for misappropriation of assets? (1) Generous performance-based compensation systems. (2) Management preoccupation with increased financial performance. (3) An unreliable accounting system. (4) Strained relationships between management and the auditors. b. The audit committee of a company must be made up of. (1) Representatives from the client's management, investors, suppliers, and customers. (2) The audit partner, the chief financial officer, the legal counsel, and at least one outsider. (3) Representatives of the major equity interests, such as preferred and common stockholders. (4) Members of the board of directors who are not officers or employees. c. Which of the following should not normally be included in the engagement letter for an audit? (1) A description of the responsibilities of client personnel to provide assistance. (2) An indication of the amount of the audit fee. (3) A description of the limitations of an audit. (4) A listing of the client's branch offices selected for testing. d. Which portion of an audit is least likely to be completed before the balance sheet date? (1) Tests of controls. (2) Issuance of an engagement letter. (3) Substantive procedures. (4) Assessment of control risk. e. Which of the following should the auditors obtain from the predecessor auditors before accepting an audit engagement? (1) Analysis of balance sheet accounts. (2) Analysis of income statement accounts. (3) All matters of continuing accounting significance. (4) Facts that might bear on the integrity of management. f. As one step in testing sales transactions, a CPA traces a random sample of sales journal entries to debits in the accounts receivable subsidiary ledger. This test provides evidence as to whether: (1) Each recorded sale represents a bona fide transaction. (2) All sales have been recorded in the sales journal. (3) All debit entries in the accounts receivable subsidiary ledger are properly supported by sales journal entries. (4) Recorded sales have been properly posted to customer accounts. g. The primary objective of tests of details of transactions performed as substantive procedures is to: (1) Comply with generally accepted auditing standards. (2) Attain assurance about the reliability of the accounting system. (3) Detect material misstatements in the financial statements. (4) Evaluate whether management's policies and procedures are operating effectively. h. The risk that the auditors will conclude, based on substantive procedures, that a material misstatement does not exist in an account balance when, in fact, such misstatement does exist is referred to as (1) Business risk. (2) Engagement risk. (3) Control risk. (4) Detection risk. i. Which of the following elements underlies the application of generally accepted auditing standards, particularly the standards of fieldwork and reporting? (1) Adequate disclosure. (2) Quality control. (3) Materiality and audit risk. (4) Client acceptance. j. Which of the following best describes what is meant by the term "fraud risk factor"? (1) Factors that, when present, indicate that risk exists. (2) Factors often observed in circumstances where frauds have occurred. (3) Factors that, when present, require modification of planned audit procedures. (4) Weaknesses in internal control identified during an audit. k. Three conditions generally are present when fraud occurs. Select the one below that is not one of those conditions. (1) Incentive or pressure. (2) Opportunity. (3) Supervisory position. (4) Attitude. I. Which of the following is most likely to be an overall response to fraud risks identified in an audit? (1) Supervise members of the audit team less closely and rely more upon judgment. (2) Use less predictable audit procedures. (3) Use only certified public accountants on the engagement. (4) Place increased emphasis on the audit of objective transactions rather than subjective transactions. (AICPA, adapted) Select the best answer for each of the following. Explain the reasons for your selection. a. In planning and performing an audit, auditors are concerned about risk factors for two distinct types of fraud: fraudulent financial reporting and misappropriation of assets. Which of the following is a risk factor for misappropriation of assets? (1) Generous performance-based compensation systems. (2) Management preoccupation with increased financial performance. (3) An unreliable accounting system. (4) Strained relationships between management and the auditors. b. The audit committee of a company must be made up of. (1) Representatives from the client's management, investors, suppliers, and customers. (2) The audit partner, the chief financial officer, the legal counsel, and at least one outsider. (3) Representatives of the major equity interests, such as preferred and common stockholders. (4) Members of the board of directors who are not officers or employees. c. Which of the following should not normally be included in the engagement letter for an audit? (1) A description of the responsibilities of client personnel to provide assistance. (2) An indication of the amount of the audit fee. (3) A description of the limitations of an audit. (4) A listing of the client's branch offices selected for testing. d. Which portion of an audit is least likely to be completed before the balance sheet date? (1) Tests of controls. (2) Issuance of an engagement letter. (3) Substantive procedures. (4) Assessment of control risk. e. Which of the following should the auditors obtain from the predecessor auditors before accepting an audit engagement? (1) Analysis of balance sheet accounts. (2) Analysis of income statement accounts. (3) All matters of continuing accounting significance. (4) Facts that might bear on the integrity of management. f. As one step in testing sales transactions, a CPA traces a random sample of sales journal entries to debits in the accounts receivable subsidiary ledger. This test provides evidence as to whether: (1) Each recorded sale represents a bona fide transaction. (2) All sales have been recorded in the sales journal. (3) All debit entries in the accounts receivable subsidiary ledger are properly supported by sales journal entries. (4) Recorded sales have been properly posted to customer accounts. g. The primary objective of tests of details of transactions performed as substantive procedures is to: (1) Comply with generally accepted auditing standards. (2) Attain assurance about the reliability of the accounting system. (3) Detect material misstatements in the financial statements. (4) Evaluate whether management's policies and procedures are operating effectively. h. The risk that the auditors will conclude, based on substantive procedures, that a material misstatement does not exist in an account balance when, in fact, such misstatement does exist is referred to as (1) Business risk. (2) Engagement risk. (3) Control risk. (4) Detection risk. i. Which of the following elements underlies the application of generally accepted auditing standards, particularly the standards of fieldwork and reporting? (1) Adequate disclosure. (2) Quality control. (3) Materiality and audit risk. (4) Client acceptance. j. Which of the following best describes what is meant by the term "fraud risk factor"? (1) Factors that, when present, indicate that risk exists. (2) Factors often observed in circumstances where frauds have occurred. (3) Factors that, when present, require modification of planned audit procedures. (4) Weaknesses in internal control identified during an audit. k. Three conditions generally are present when fraud occurs. Select the one below that is not one of those conditions. (1) Incentive or pressure. (2) Opportunity. (3) Supervisory position. (4) Attitude. I. Which of the following is most likely to be an overall response to fraud risks identified in an audit? (1) Supervise members of the audit team less closely and rely more upon judgment. (2) Use less predictable audit procedures. (3) Use only certified public accountants on the engagement. (4) Place increased emphasis on the audit of objective transactions rather than subjective transactions. (AICPA, adapted) Select the best answer for each of the following. Explain the reasons for your selection. a. In planning and performing an audit, auditors are concerned about risk factors for two distinct types of fraud: fraudulent financial reporting and misappropriation of assets. Which of the following is a risk factor for misappropriation of assets? (1) Generous performance-based compensation systems. (2) Management preoccupation with increased financial performance. (3) An unreliable accounting system. (4) Strained relationships between management and the auditors. b. The audit committee of a company must be made up of. (1) Representatives from the client's management, investors, suppliers, and customers. (2) The audit partner, the chief financial officer, the legal counsel, and at least one outsider. (3) Representatives of the major equity interests, such as preferred and common stockholders. (4) Members of the board of directors who are not officers or employees. c. Which of the following should not normally be included in the engagement letter for an audit? (1) A description of the responsibilities of client personnel to provide assistance. (2) An indication of the amount of the audit fee. (3) A description of the limitations of an audit. (4) A listing of the client's branch offices selected for testing. d. Which portion of an audit is least likely to be completed before the balance sheet date? (1) Tests of controls. (2) Issuance of an engagement letter. (3) Substantive procedures. (4) Assessment of control risk. e. Which of the following should the auditors obtain from the predecessor auditors before accepting an audit engagement? (1) Analysis of balance sheet accounts. (2) Analysis of income statement accounts. (3) All matters of continuing accounting significance. (4) Facts that might bear on the integrity of management. f. As one step in testing sales transactions, a CPA traces a random sample of sales journal entries to debits in the accounts receivable subsidiary ledger. This test provides evidence as to whether: (1) Each recorded sale represents a bona fide transaction. (2) All sales have been recorded in the sales journal. (3) All debit entries in the accounts receivable subsidiary ledger are properly supported by sales journal entries. (4) Recorded sales have been properly posted to customer accounts. g. The primary objective of tests of details of transactions performed as substantive procedures is to: (1) Comply with generally accepted auditing standards. (2) Attain assurance about the reliability of the accounting system. (3) Detect material misstatements in the financial statements. (4) Evaluate whether management's policies and procedures are operating effectively. h. The risk that the auditors will conclude, based on substantive procedures, that a material misstatement does not exist in an account balance when, in fact, such misstatement does exist is referred to as (1) Business risk. (2) Engagement risk. (3) Control risk. (4) Detection risk. i. Which of the following elements underlies the application of generally accepted auditing standards, particularly the standards of fieldwork and reporting? (1) Adequate disclosure. (2) Quality control. (3) Materiality and audit risk. (4) Client acceptance. j. Which of the following best describes what is meant by the term "fraud risk factor"? (1) Factors that, when present, indicate that risk exists. (2) Factors often observed in circumstances where frauds have occurred. (3) Factors that, when present, require modification of planned audit procedures. (4) Weaknesses in internal control identified during an audit. k. Three conditions generally are present when fraud occurs. Select the one below that is not one of those conditions. (1) Incentive or pressure. (2) Opportunity. (3) Supervisory position. (4) Attitude. I. Which of the following is most likely to be an overall response to fraud risks identified in an audit? (1) Supervise members of the audit team less closely and rely more upon judgment. (2) Use less predictable audit procedures. (3) Use only certified public accountants on the engagement. (4) Place increased emphasis on the audit of objective transactions rather than subjective transactions. (AICPA, adapted)

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

step 1 step 2 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started