Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For each entry below make a correcting entry if necessary. If the entry given is correct, then state No entry required. ( Credit account

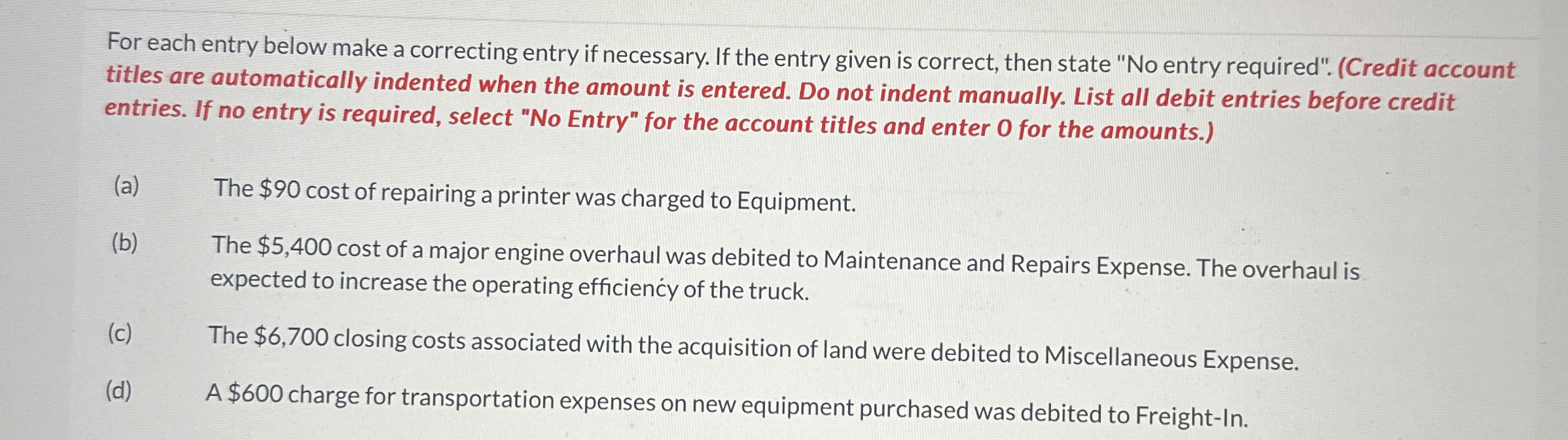

For each entry below make a correcting entry if necessary. If the entry given is correct, then state No entry required". Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select No Entry" for the account titles and enter for the amounts.

a The $ cost of repairing a printer was charged to Equipment.

b The $ cost of a major engine overhaul was debited to Maintenance and Repairs Expense. The overhaul is expected to increase the operating efficieny of the truck.

c The $ closing costs associated with the acquisition of land were debited to Miscellaneous Expense.

d A $ charge for transportation expenses on new equipment purchased was debited to FreightIn

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started