Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For each individual situation, determine the amount that should be reported as cash. 1. Checking account balance $1.128,500; certificate of deposit $1,708,000; cash advance

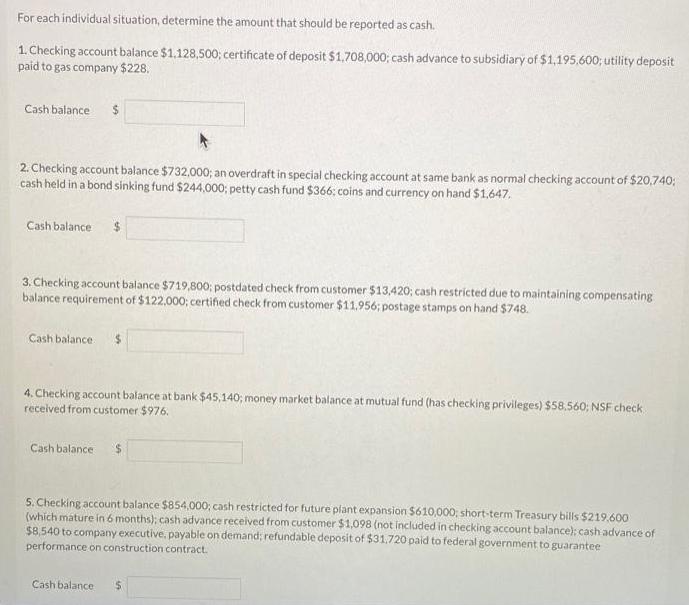

For each individual situation, determine the amount that should be reported as cash. 1. Checking account balance $1.128,500; certificate of deposit $1,708,000; cash advance to subsidiary of $1,195,600; utility deposit paid to gas company $228. Cash balance $ 2. Checking account balance $732,000; an overdraft in special checking account at same bank as normal checking account of $20,740; cash held in a bond sinking fund $244,000; petty cash fund $366; coins and currency on hand $1.647. Cash balance $4 3. Checking account balance $719,800; postdated check from customer $13,420; cash restricted due to maintaining compensating balance requirement of $122.000; certified check from customer $11.956; postage stamps on hand $748. Cash balance $ 4. Checking account balance at bank $45,140; money market balance at mutual fund (has checking privileges) $58.560; NSF check received from customer $976, Cash balance 5. Checking account balance $854,000; cash restricted for future plant expansion $610,000; short-term Treasury bills $219.600 (which mature in 6 months); cash advance received from customer $1,098 (not included in checking account balance): cash advance of $8,540 to company executive, payable on demand; refundable deposit of $31,720 paid to federal government to guarantee performance on construction contract. Cash balance

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Solution 1 Answer Cash Balance 1128500 Explanation 1128500 certificate of deposit classified as temp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started