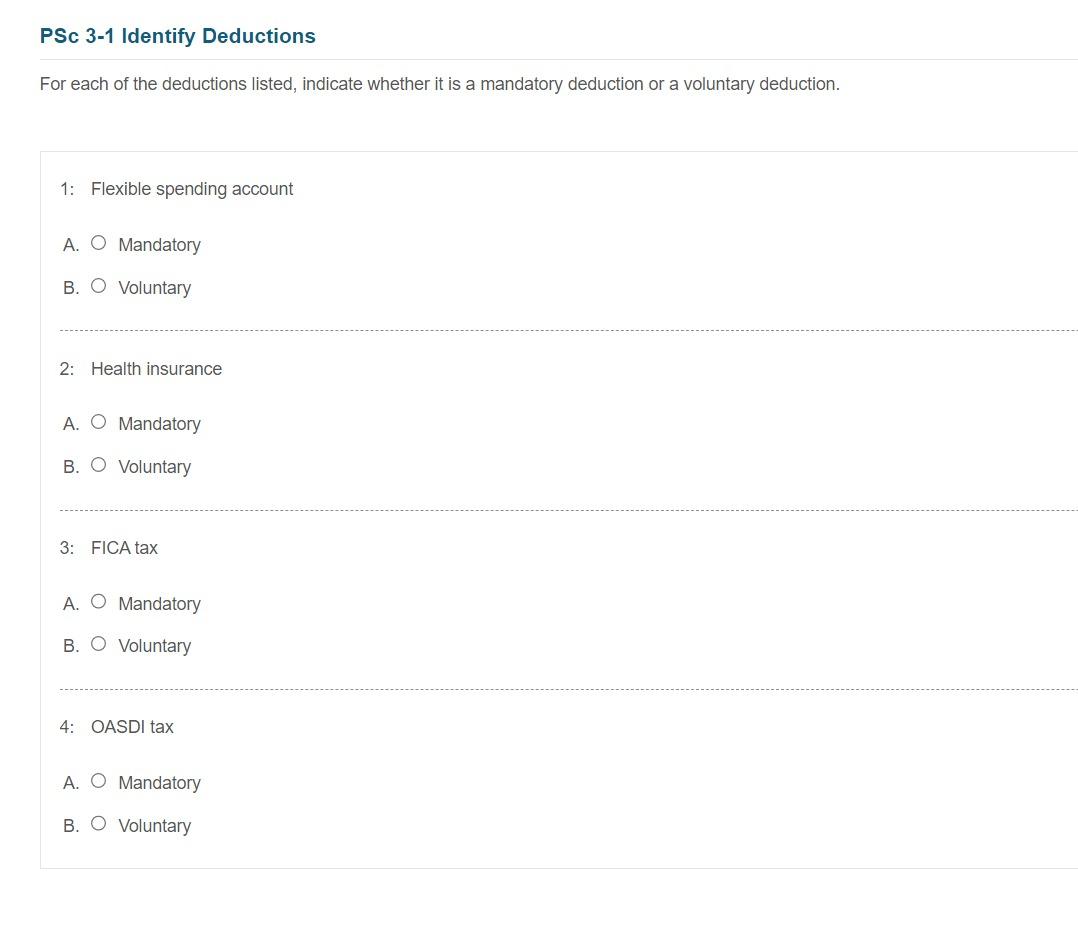

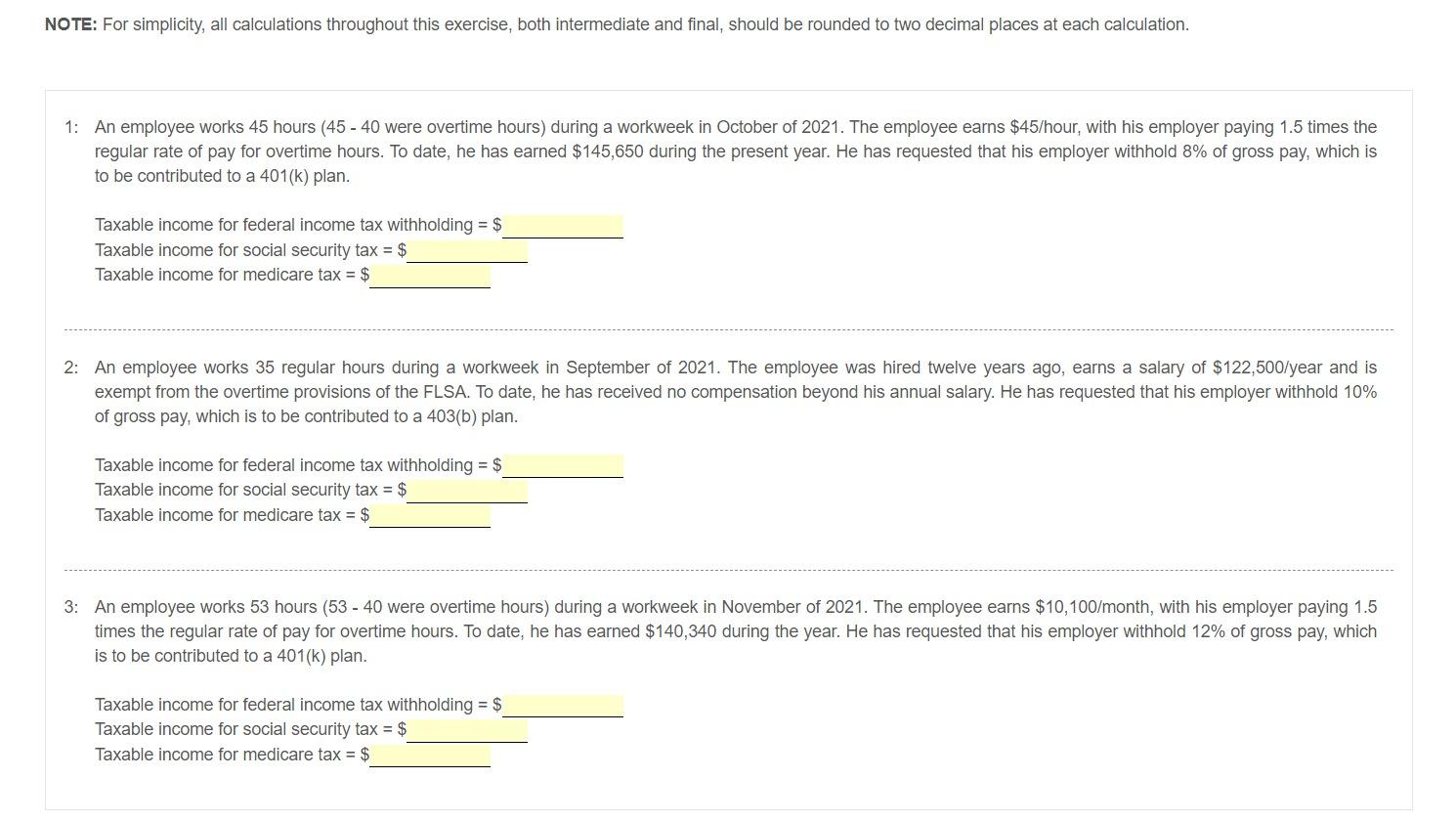

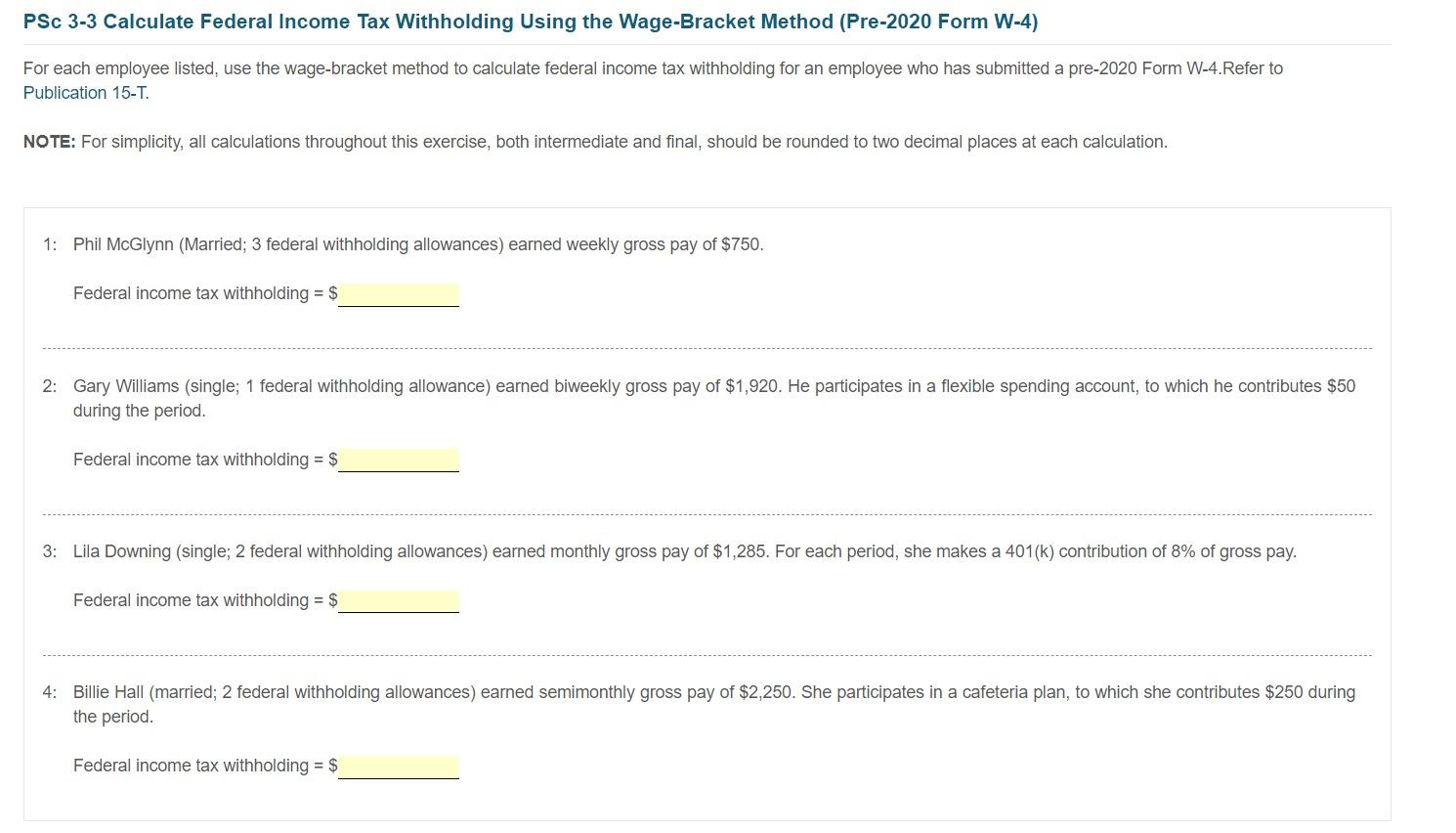

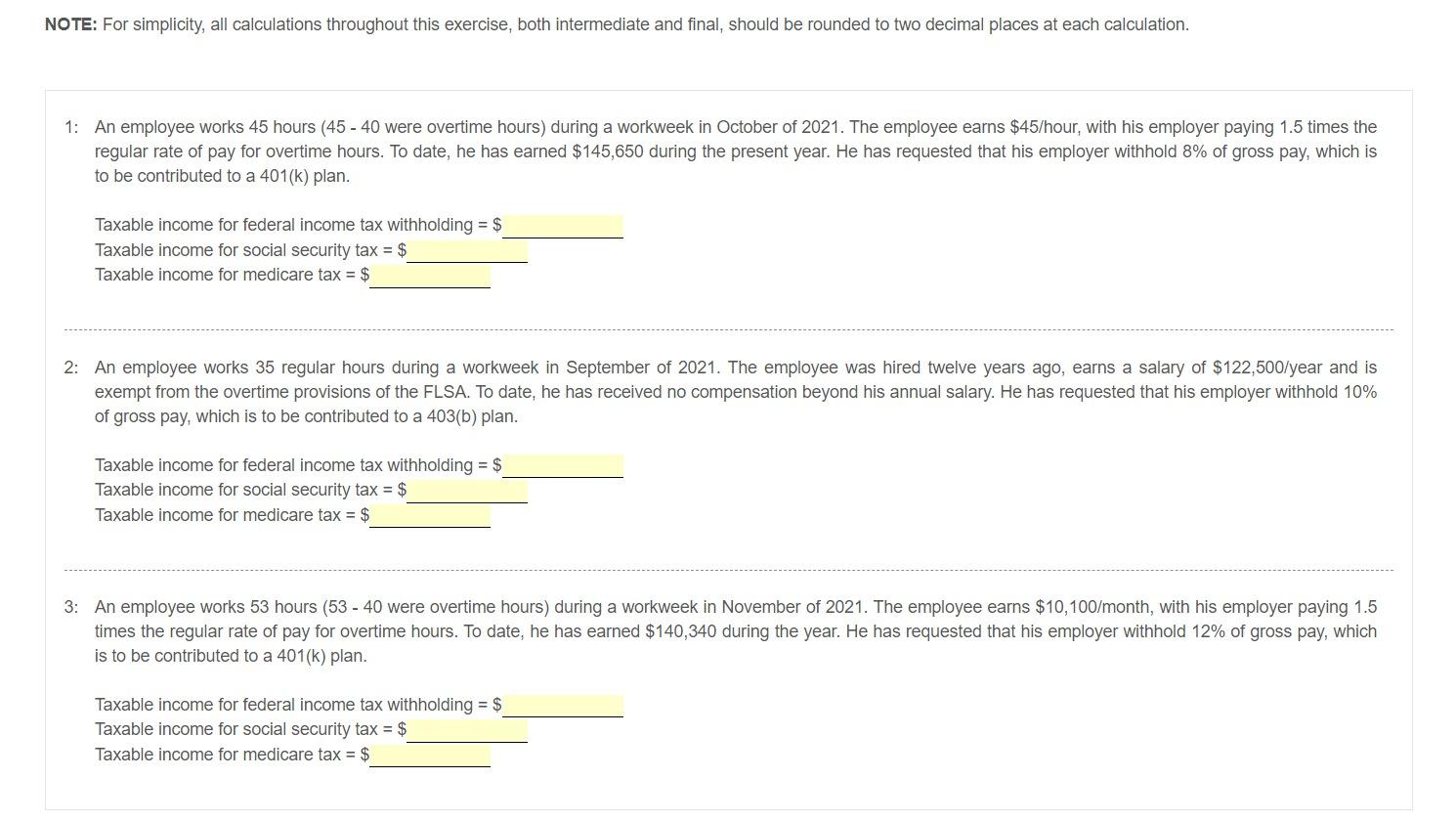

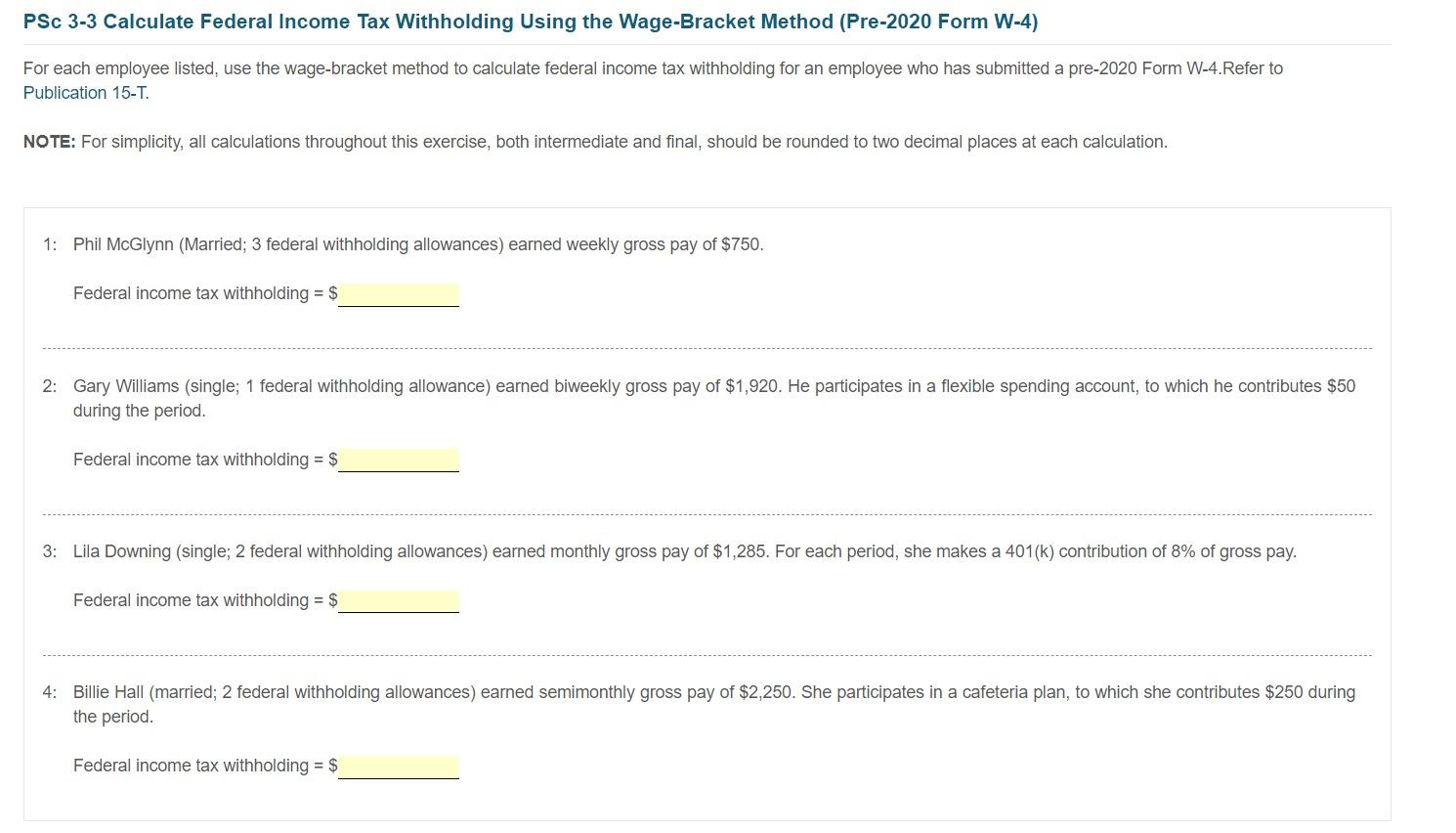

For each of the deductions listed, indicate whether it is a mandatory deduction or a voluntary deduction. 1: Flexible spending account A. Mandatory B. Voluntary 2: Health insurance A. Mandatory B. Voluntary 3: FICA tax A. Mandatory B. Voluntary 4: OASDI tax A. Mandatory B. Voluntary 1: An employee works 45 hours (45 - 40 were overtime hours) during a workweek in October of 2021 . The employee earns $45/ hour, with his employer paying 1.5 times the regular rate of pay for overtime hours. To date, he has earned $145,650 during the present year. He has requested that his employer withhold 8% of gross pay, which is to be contributed to a 401(k) plan. Taxable income for federal income tax withholding =$ Taxable income for social security tax =$ Taxable income for medicare tax =$ 2: An employee works 35 regular hours during a workweek in September of 2021. The employee was hired twelve years ago, earns a salary of $122,500/year and is exempt from the overtime provisions of the FLSA. To date, he has received no compensation beyond his annual salary. He has requested that his employer withhold 10% of gross pay, which is to be contributed to a 403 (b) plan. Taxable income for federal income tax withholding =$ Taxable income for social security tax =$ Taxable income for medicare tax =$ 3: An employee works 53 hours (53 - 40 were overtime hours) during a workweek in November of 2021 . The employee earns $10,100/ month, with his employer paying 1.5 times the regular rate of pay for overtime hours. To date, he has earned $140,340 during the year. He has requested that his employer withhold 12% of gross pay, which is to be contributed to a 401 (k) plan. Taxable income for federal income tax withholding =$ Taxable income for social security tax =$ Taxable income for medicare tax=$ PSc 3-3 Calculate Federal Income Tax Withholding Using the Wage-Bracket Method (Pre-2020 Form W-4) For each employee listed, use the wage-bracket method to calculate federal income tax withholding for an employee who has submitted a pre-2020 Form W-4.Refer to Publication 15-T. NOTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation. 1: Phil McGlynn (Married; 3 federal withholding allowances) earned weekly gross pay of $750. Federal income tax withholding =$ 2: Gary Williams (single; 1 federal withholding allowance) earned biweekly gross pay of $1,920. He participates in a flexible spending account, to which he contributes $50 during the period. Federal income tax withholding = 3: Lila Downing (single; 2 federal withholding allowances) earned monthly gross pay of $1,285. For each period, she makes a 401 ( k) contribution of 8% of gross pay. Federal income tax withholding =$ 4: Billie Hall (married; 2 federal withholding allowances) earned semimonthly gross pay of $2,250. She participates in a cafeteria plan, to which she contributes $250 during the period. Federal income tax withholding =$