Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For each of the exercises below, provide the adjusting entries of the following: a. Accumulated Depreciation Mr. Clean acquired an office equipment from Mr.

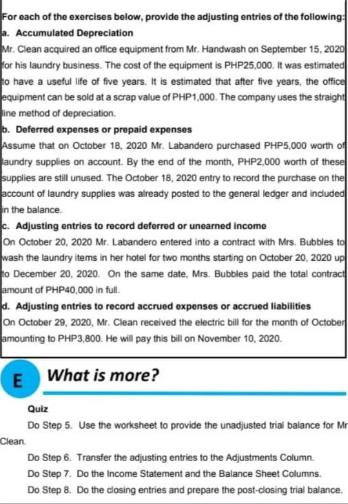

For each of the exercises below, provide the adjusting entries of the following: a. Accumulated Depreciation Mr. Clean acquired an office equipment from Mr. Handwash on September 15, 2020 for his laundry business. The cost of the equipment is PHP25,000. It was estimated to have a useful life of five years. It is estimated that after five years, the office equipment can be sold at a scrap value of PHP1,000. The company uses the straight line method of depreciation. b. Deferred expenses or prepaid expenses Assume that on October 18, 2020 Mr. Labandero purchased PHP5,000 worth of aundry supplies on account. By the end of the month, PHP2,000 worth of these supplies are still unused. The October 18, 2020 entry to record the purchase on the account of laundry supplies was already posted to the general ledger and included in the balance. c. Adjusting entries to record deferred or unearned income On October 20, 2020 Mr. Labandero entered into a contract with Mrs. Bubbles to wash the laundry items in her hotel for two months starting on October 20, 2020 up to December 20, 2020. On the same date, Mrs. Bubbles paid the total contract amount of PHP40,000 in full. d. Adjusting entries to record accrued expenses or accrued liabilities On October 29, 2020, Mr. Clean received the electric bill for the month of October amounting to PHP3,800. He will pay this bill on November 10, 2020. E What is more? Clean Quiz Do Step 5. Use the worksheet to provide the unadjusted trial balance for Mr Do Step 6. Transfer the adjusting entries to the Adjustments Column. Do Step 7. Do the Income Statement and the Balance Sheet Columns. Do Step 8. Do the closing entries and prepare the post-closing trial balance.

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a Accumulated Depreciation Depreciation Expense Accumulated depreciation 25000100053512 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started