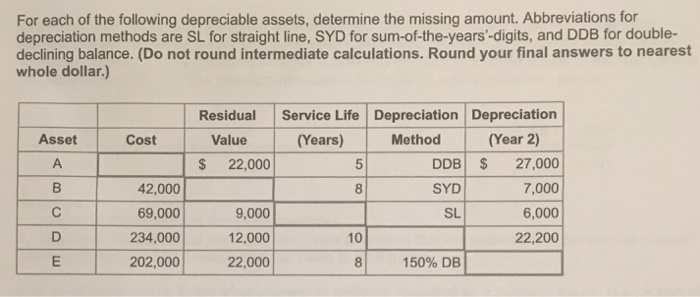

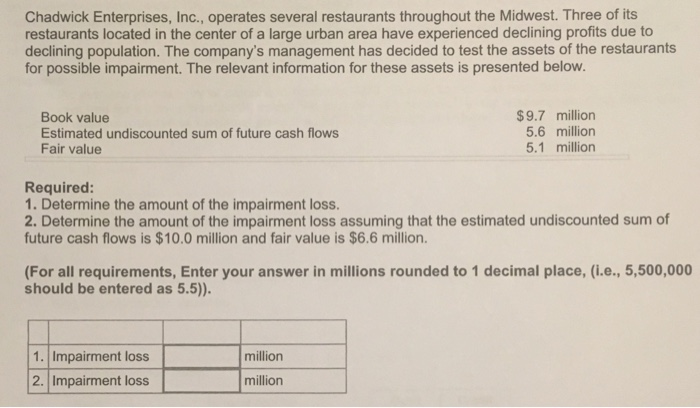

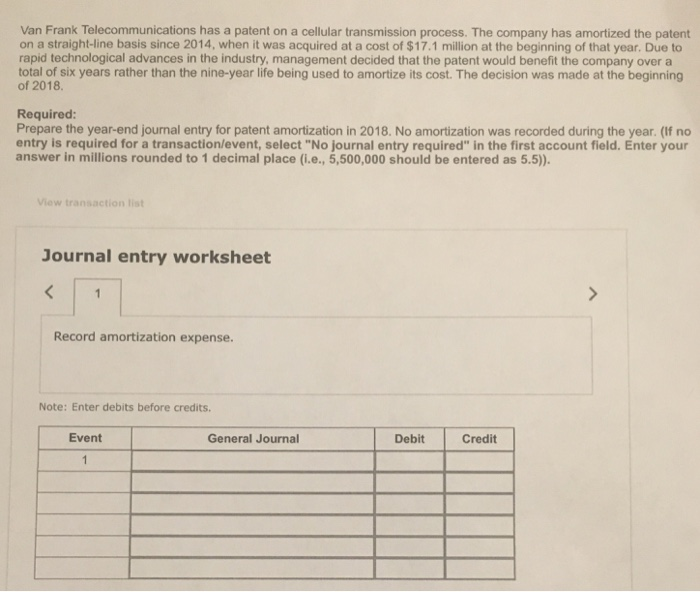

For each of the following depreciable assets, determine the missing amount. Abbreviations for depreciation methods are SL for straight line, SYD for sum-of-the-years'-digits, and DDB for double- declining balance. (Do not round intermediate calculations. Round your final answers to nearest whole dollar.) Residual Service Life Depreciation Depreciation Asset Cost (Years) Method (Year 2) DDB SYD SL 27,000 7,000 6,000 22,200 $ 22,000 42,000 69,000 234,000 202,000 8 9,000 12,000 22,000 10 150% DB Chadwick Enterprises, Inc., operates several restaurants throughout the Midwest. Three of its restaurants located in the center of a large urban area have experienced declining profits due to declining population. The company's management has decided to test the assets of the restaurants for possible impairment. The relevant information for these assets is presented below. $9.7 million 5.6 million 5.1 million Book value Estimated undiscounted sum of future cash flows Fair value Required: 1. Determine the amount of the impairment loss. 2. Determine the amount of the impairment loss assuming that the estimated undiscounted sum of future cash flows is $10.0 million and fair value is $6.6 million. (For all requirements, Enter your answer in millions rounded to 1 decimal place, (i.e., 5,500,000 should be entered as 5.5)). million 1. Impairment loss 2. Impairment loss million Van Frank Telecommunications has a patent on a cellular transmission process. The company has amortized the patent on a straight-line basis since 2014, when it was acquired at a cost of $17.1 million at the beginning of that year. Due to rapid technological advances in the industry, management decided that the patent would benefit the company over a total of six years rather than the nine-year life being used to amortize its cost. The decision was made at the beginning of 2018. Required: Prepare the year-end journal entry for patent amortization in 2018. No amortization was recorded during the year. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answer in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5)) View transaction list Journal entry worksheet Record amortization expense. Note: Enter debits before credits. Event General Journal Debit Credit