Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For each of the following independent cases (1 to 4), compute the missing values. Note: Enter all amounts as positive values. begin{tabular}{|l|r|r|r|r|} hline & multicolumn{1}{|c|}{

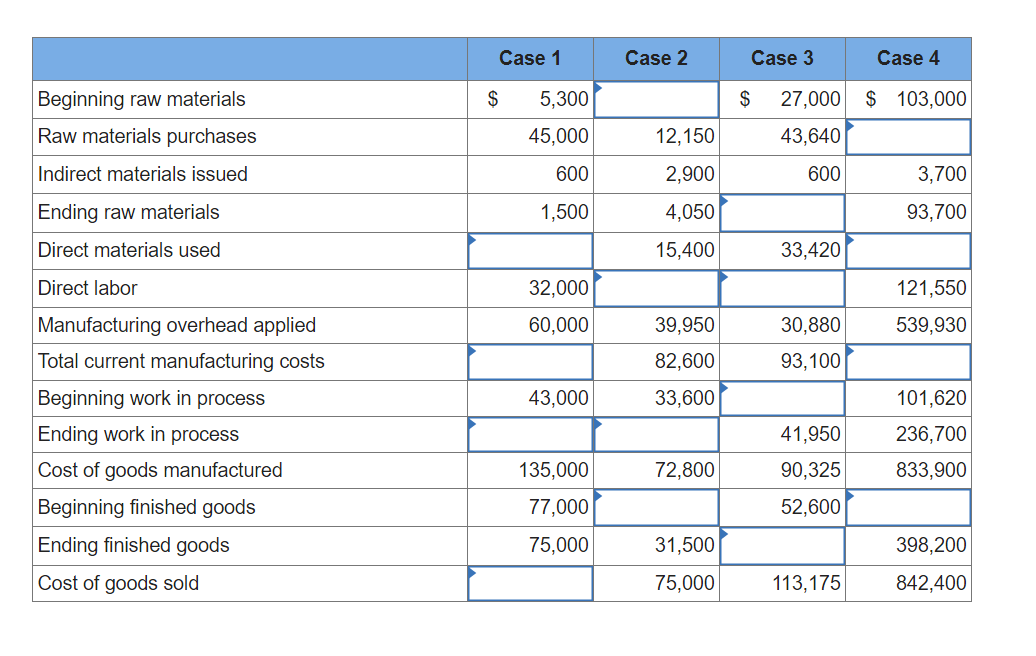

For each of the following independent cases (1 to 4), compute the missing values.

Note: Enter all amounts as positive values.

\begin{tabular}{|l|r|r|r|r|} \hline & \multicolumn{1}{|c|}{ Case 1 } & \multicolumn{1}{c|}{ Case 2 } & \multicolumn{1}{c|}{ Case 3 } & \multicolumn{1}{c|}{ Case 4 } \\ \hline Beginning raw materials & $5,300 & & $27,000 & $103,000 \\ \hline Raw materials purchases & 45,000 & 12,150 & 43,640 & \\ \hline Indirect materials issued & 600 & 2,900 & 600 & 3,700 \\ \hline Ending raw materials & 1,500 & 4,050 & & 93,700 \\ \hline Direct materials used & & 15,400 & 33,420 & \\ \hline Direct labor & 32,000 & & & 121,550 \\ \hline Manufacturing overhead applied & 60,000 & 39,950 & 30,880 & 539,930 \\ \hline Total current manufacturing costs & & 82,600 & 93,100 & \\ \hline Beginning work in process & 43,000 & 33,600 & & 101,620 \\ \hline Ending work in process & & & 41,950 & 236,700 \\ \hline Cost of goods manufactured & 135,000 & 72,800 & 90,325 & 833,900 \\ \hline Beginning finished goods & 77,000 & & 52,600 & \\ \hline Ending finished goods & 75,000 & 31,500 & & 398,200 \\ \hline Cost of goods sold & & 75,000 & 113,175 & 842,400 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started