Question

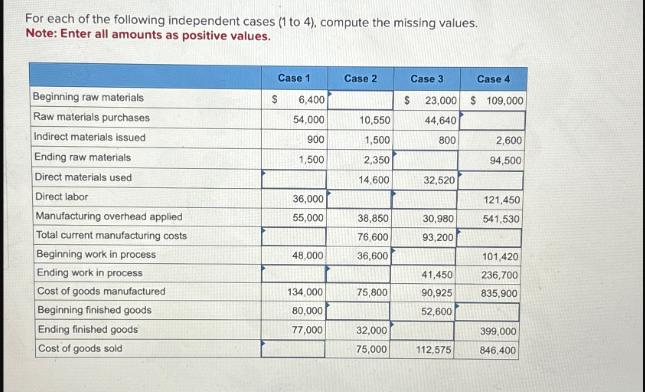

For each of the following independent cases (1 to 4), compute the missing values. Note: Enter all amounts as positive values. Case 1 Case

For each of the following independent cases (1 to 4), compute the missing values. Note: Enter all amounts as positive values. Case 1 Case 2 Case 3 Case 4 Beginning raw materials $ 6,400 $ 23,000 $ 109,000 Raw materials purchases 54,000 10,550 44,640 Indirect materials issued 900 1,500 800 2,600 Ending raw materials 1,500 2,350 94,500 Direct materials used 14.600 32,520 Direct labor 36,000 121,450 Manufacturing overhead applied 55,000 38,850 30,980 541,530 Total current manufacturing costs 76,600 93,200 Beginning work in process 48.000 36,600 101,420 Ending work in process 41,450 236,700 Cost of goods manufactured 134,000 75,800 90,925 835,900 Beginning finished goods 80,000 52,600 Ending finished goods 77,000 32,000 399,000 Cost of goods sold 75,000 112,575 846,400

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting

Authors: Stacey Whitecotton, Robert Libby, Fred Phillips

4th edition

1259964957, 1260413985, 1260565440, 978-1260413984

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App