Question

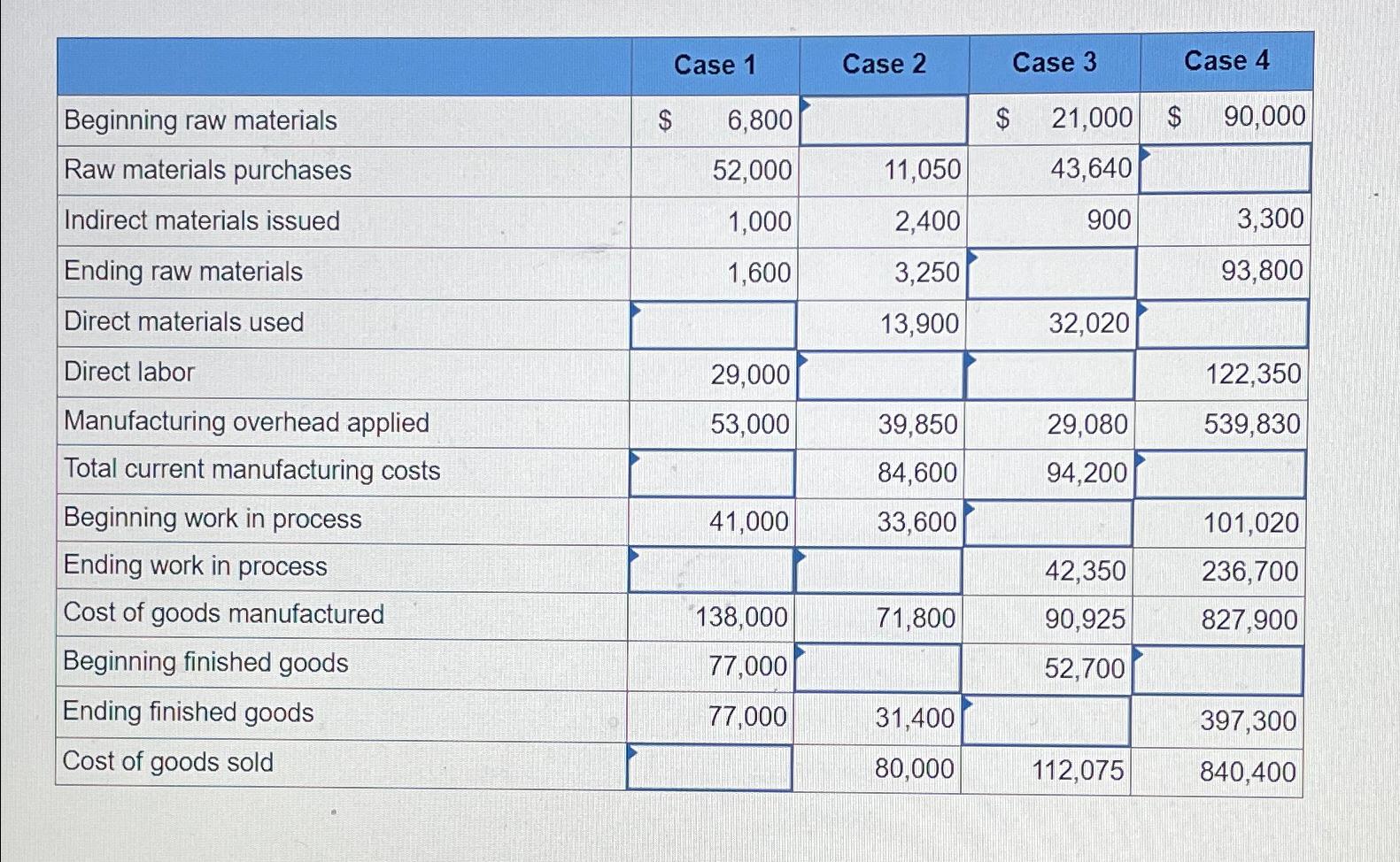

For each of the following independent cases ( 1 ?to 4 ) , ?compute the missing values. Note: Enter all amounts as positive values. Case

For each of the following independent cases ?to ?compute the missing values.

Note: Enter all amounts as positive values.

Case 1 Case 2 Case 3 Case 4 Beginning raw materials $ 6,800 $ 21,000 $ 90,000 Raw materials purchases 52,000 11,050 43,640 Indirect materials issued 1,000 2,400 900 3,300 Ending raw materials 1,600 3,250 93,800 Direct materials used 13,900 32,020 Direct labor 29,000 122,350 Manufacturing overhead applied 53,000 39,850 29,080 539,830 Total current manufacturing costs 84,600 94,200 Beginning work in process 41,000 33,600 101,020 Ending work in process 42,350 236,700 Cost of goods manufactured Beginning finished goods Ending finished goods Cost of goods sold 138,000 71,800 90,925 827,900 77,000 52,700 77,000 31,400 397,300 80,000 112,075 840,400

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting

Authors: Stacey Whitecotton, Robert Libby, Fred Phillips

2nd edition

9780077493677, 78025516, 77493672, 9780077826482, 978-0078025518

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App