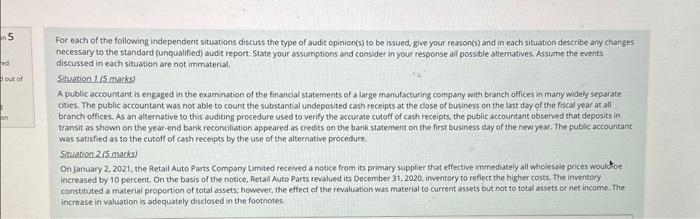

For each of the following independent situations discuss the type of audit opinion(5) to be issued, give your reason(5) and in each situation describe ary changes necessary to the standard (unqualified) audit report. State your assumptions and consider in your response all possible alternatives. Assume the esents discussed in each situation are not immaterial. Situation 1 ( 5 marks) A public accountant is engaged in the examination of the financial statements of a large manufacturing company with branch oflices in many widely separate cities. The public accountant was not able to count the substant al undeposited cash receipts at the ciose of business on the last day of the facal year at all branch offices. As an alternative to this auditing procedure used to verify the axcurate cutoff of cash receipts, the public accountant observed that deposits in transit as shown on the year-end bank reconciliation appeared as credits oe the bank statement on the first business day of the new year. The public accountant Was satisfied as to the cutoff of cash receiphs by the use of the alternative proceduee. Siruaben2(5marks) On January 2, 2021, the Retail Auto Parts Company Limited received a notice from its primary supplier that effective immediately all whiclesale prices wouldoe increased by 10 percent, On the basis of the notice. Retail Auto Parts revalued its December 31,2020 , inventory to reflect the higher costs. The imventory constituted a material proportion of total assets, however, the effect of the revaluation was material to current assets but not to total assets or net income. The increase in valuation is adequately disclosed in the footnotes. For each of the following independent situations discuss the type of audit opinion(5) to be issued, give your reason(5) and in each situation describe ary changes necessary to the standard (unqualified) audit report. State your assumptions and consider in your response all possible alternatives. Assume the esents discussed in each situation are not immaterial. Situation 1 ( 5 marks) A public accountant is engaged in the examination of the financial statements of a large manufacturing company with branch oflices in many widely separate cities. The public accountant was not able to count the substant al undeposited cash receipts at the ciose of business on the last day of the facal year at all branch offices. As an alternative to this auditing procedure used to verify the axcurate cutoff of cash receipts, the public accountant observed that deposits in transit as shown on the year-end bank reconciliation appeared as credits oe the bank statement on the first business day of the new year. The public accountant Was satisfied as to the cutoff of cash receiphs by the use of the alternative proceduee. Siruaben2(5marks) On January 2, 2021, the Retail Auto Parts Company Limited received a notice from its primary supplier that effective immediately all whiclesale prices wouldoe increased by 10 percent, On the basis of the notice. Retail Auto Parts revalued its December 31,2020 , inventory to reflect the higher costs. The imventory constituted a material proportion of total assets, however, the effect of the revaluation was material to current assets but not to total assets or net income. The increase in valuation is adequately disclosed in the footnotes