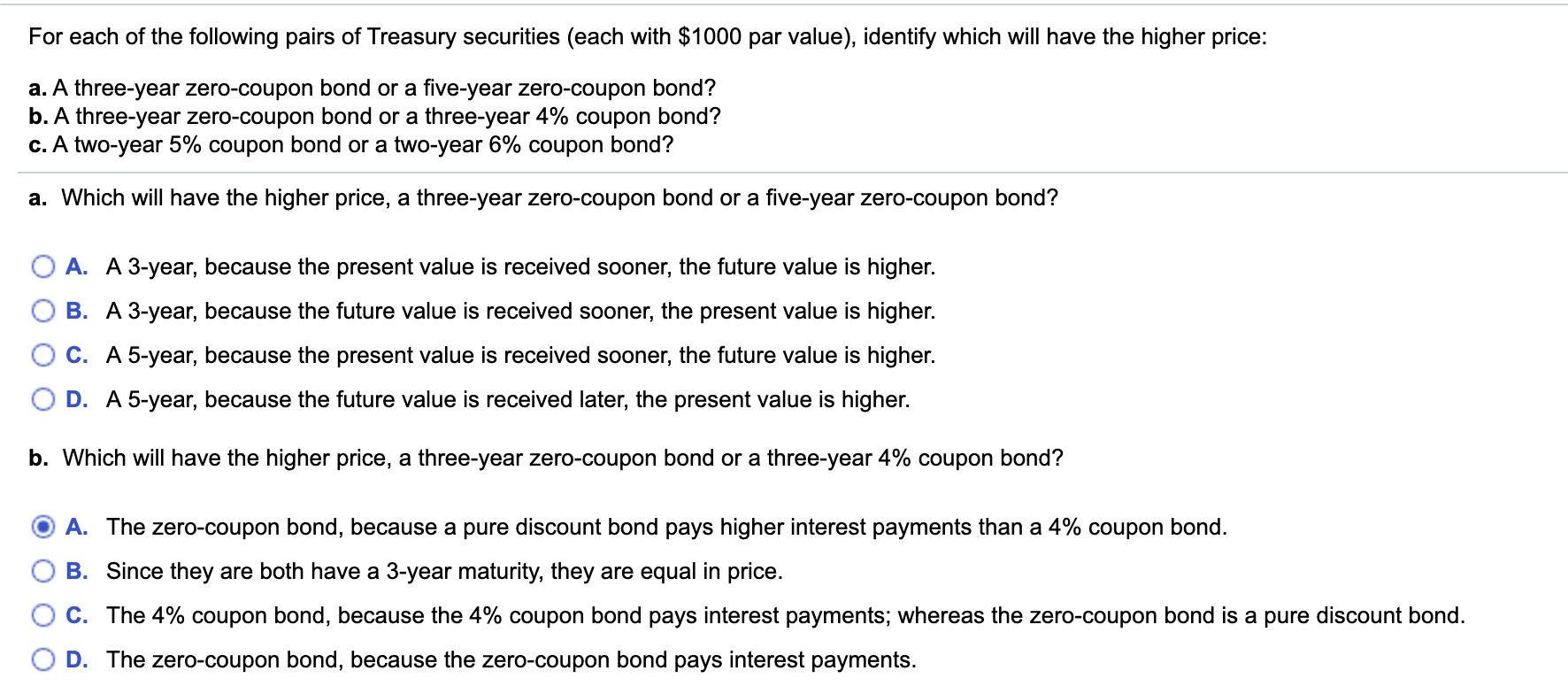

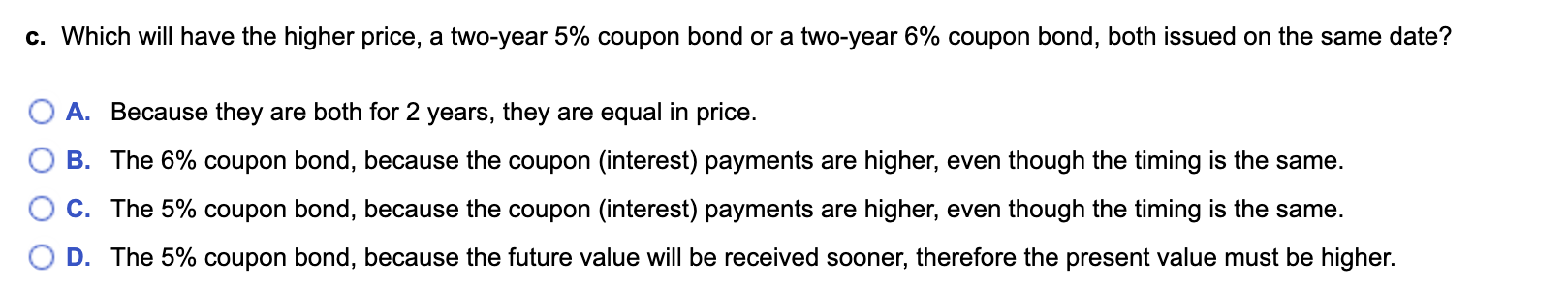

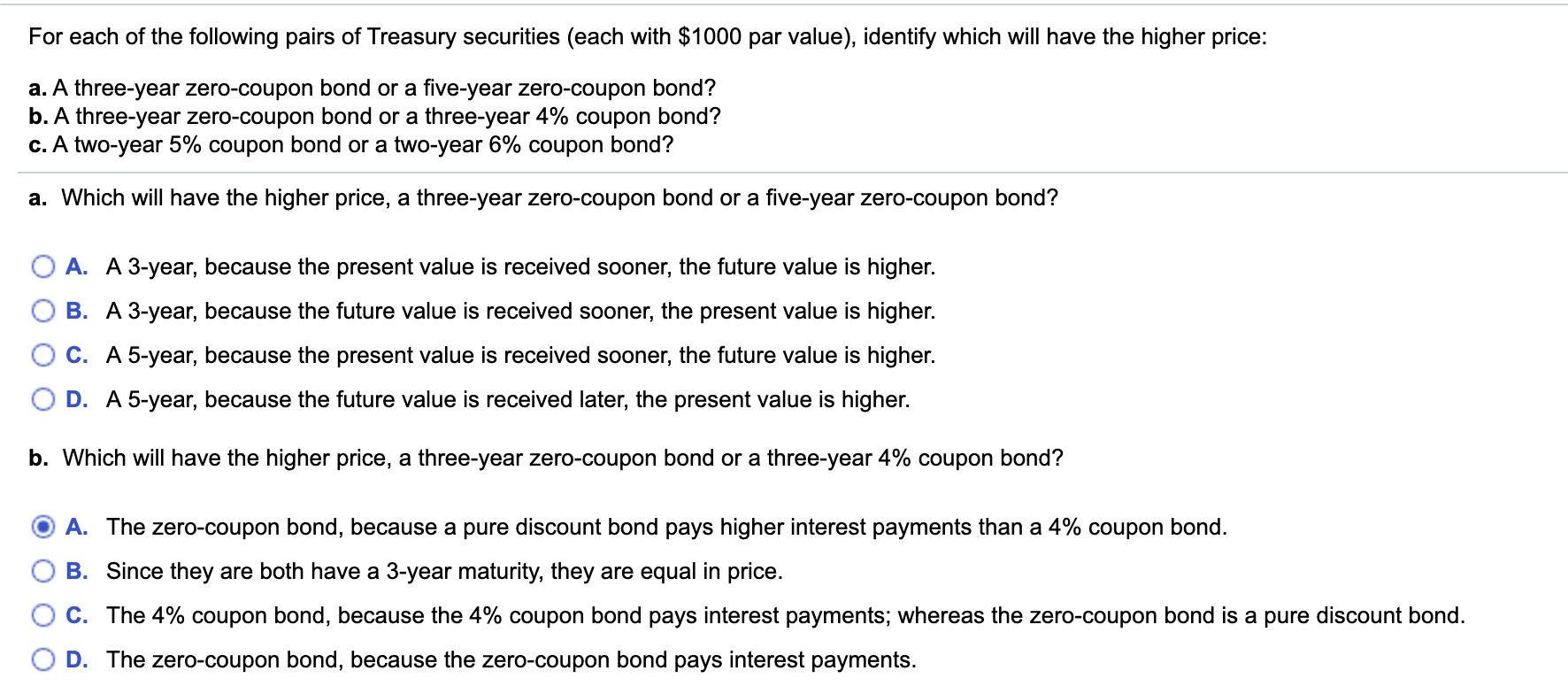

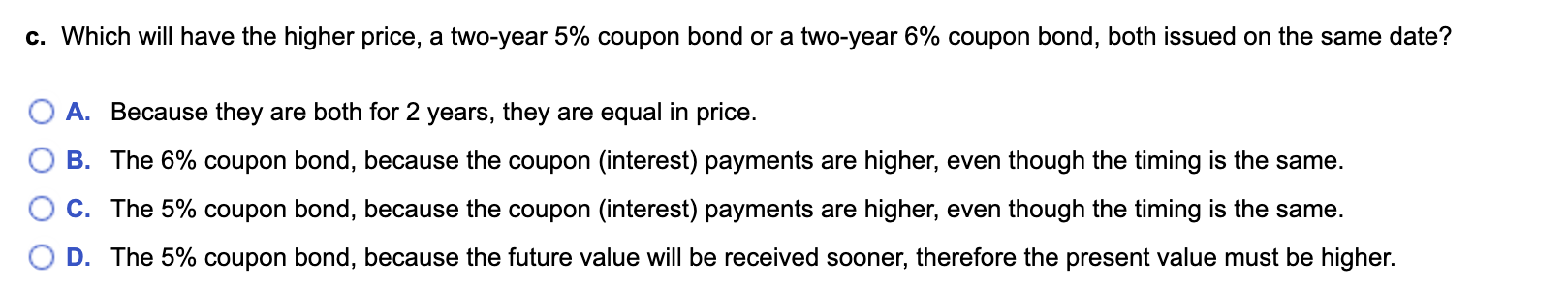

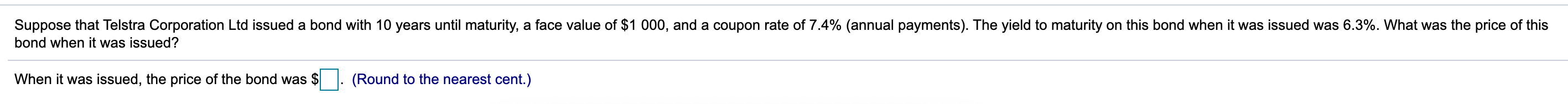

For each of the following pairs of Treasury securities (each with $1000 par value), identify which will have the higher price: a. A three-year zero-coupon bond or a five-year zero-coupon bond? b. A three-year zero-coupon bond or a three-year 4% coupon bond? c. A two-year 5% coupon bond or a two-year 6% coupon bond? a. Which will have the higher price, a three-year zero-coupon bond or a five-year zero-coupon bond? A. A 3-year, because the present value is received sooner, the future value is higher. B. A 3-year, because the future value is received sooner, the present value is higher. C. A 5-year, because the present value is received sooner, the future value is higher. OD. A 5-year, because the future value is received later, the present value is higher. b. Which will have the higher price, a three-year zero-coupon bond or a three-year 4% coupon bond? A. The zero-coupon bond, because a pure discount bond pays higher interest payments than a 4% coupon bond. B. Since they are both have a 3-year maturity, they are equal in price. O C. The 4% coupon bond, because the 4% coupon bond pays interest payments; whereas the zero-coupon bond is a pure discount bond. OD. The zero-coupon bond, because the zero-coupon bond pays interest payments. c. Which will have the higher price, a two-year 5% coupon bond or a two-year 6% coupon bond, both issued on the same date? A. Because they are both for 2 years, they are equal in price. B. The 6% coupon bond, because the coupon (interest) payments are higher, even though the timing is the same. C. The 5% coupon bond, because the coupon (interest) payments are higher, even though the timing is the same. D. The 5% coupon bond, because the future value will be received sooner, therefore the present value must be higher. Suppose that Telstra Corporation Ltd issued a bond with 10 years until maturity, a face value of $ 1 000, and a coupon rate of 7.4% (annual payments). The yield to maturity on this bond when it was issued was 6.3%. What was the price of this bond when it was issued? When it was issued, the price of the bond was $ (Round to the nearest cent.)