Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For each of the following scenarios, select which type of other cost or provision is illustrated. Raphael has had an illness and an accident

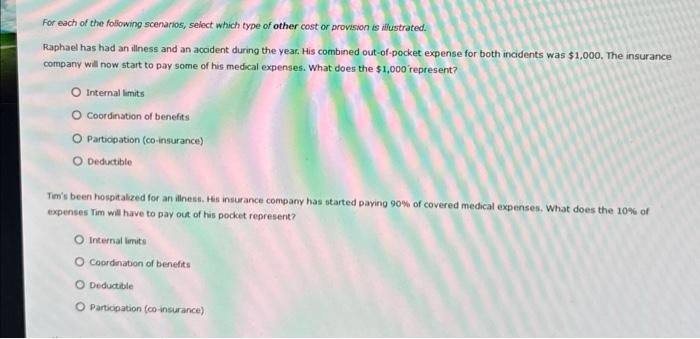

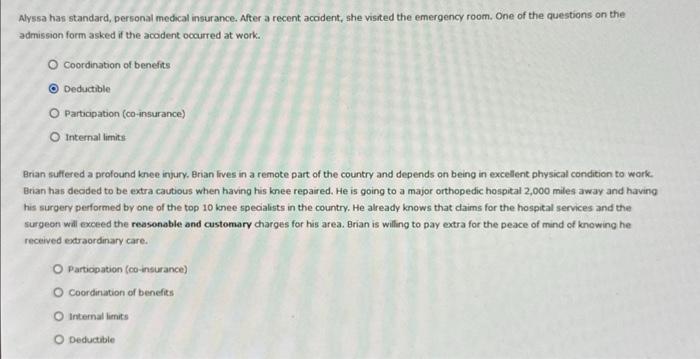

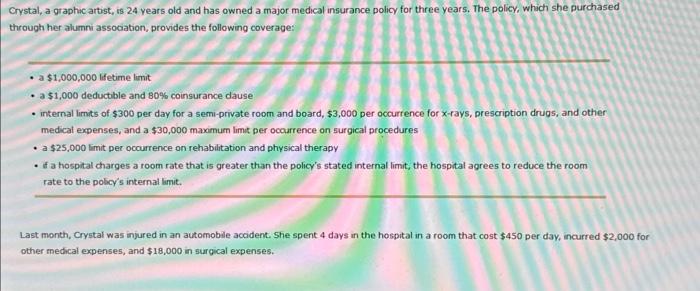

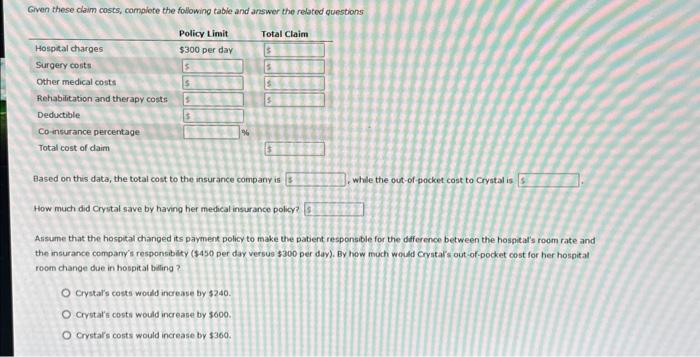

For each of the following scenarios, select which type of other cost or provision is illustrated. Raphael has had an illness and an accident during the year. His combined out-of-pocket expense for both incidents was $1,000. The insurance company will now start to pay some of his medical expenses. What does the $1,000 represent? Internal limits Coordination of benefits O Participation (co-insurance) O Deductible Tim's been hospitalized for an illness. His insurance company has started paying 90% of covered medical expenses. What does the 10% of expenses Tim will have to pay out of his pocket represent? O Internal limits O Coordination of benefits O Deductible O Participation (co-insurance) Alyssa has standard, personal medical insurance. After a recent accident, she visited the emergency room. One of the questions on the admission form asked if the accident occurred at work. O Coordination of benefits Deductible O Participation (co-insurance) O Internal limits Brian suffered a profound knee injury. Brian lives in a remote part of the country and depends on being in excellent physical condition to work. Brian has decided to be extra cautious when having his knee repaired. He is going to a major orthopedic hospital 2,000 miles away and having his surgery performed by one of the top 10 knee specialists in the country. He already knows that claims for the hospital services and the surgeon will exceed the reasonable and customary charges for his area. Brian is willing to pay extra for the peace of mind of knowing he received extraordinary care. O Participation (co-insurance) O Coordination of benefits O Internal limits O Deductible Crystal, a graphic artist, is 24 years old and has owned a major medical insurance policy for three years. The policy, which she purchased through her alumni association, provides the following coverage: a $1,000,000 lifetime limit a $1,000 deductible and 80 % coinsurance cause internal limits of $300 per day for a semi-private room and board, $3,000 per occurrence for x-rays, prescription drugs, and other medical expenses, and a $30,000 maximum limit per occurrence on surgical procedures a $25,000 limit per occurrence on rehabilitation and physical therapy if a hospital charges a room rate that is greater than the policy's stated internal limit, the hospital agrees to reduce the room rate to the policy's internal limit. Last month, Crystal was injured in an automobile accident. She spent 4 days in the hospital in a room that cost $450 per day, incurred $2,000 for other medical expenses, and $18,000 in surgical expenses. Given these claim costs, complete the following table and answer the related questions Policy Limit $300 per day Hospital charges Surgery costs Other medical costs Rehabilitation and therapy costs Deductible Co-insurance percentage Total cost of caim $ $ $ Total Claim $ 5 O Crystal's costs would increase by $240. O Crystal's costs would increase by $600. O Crystal's costs would increase by $360. $ $ Based on this data, the total cost to the insurance company is How much did Crystal save by having her medical insurance policy? Assume that the hospital changed its payment policy to make the patient responsible for the difference between the hospital's room rate and the insurance company's responsibility ($450 per day versus $300 per day). By how much would Crystal's out-of-pocket cost for her hospital room change due in hospital billing ? while the out-of-pocket cost to Crystal is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below The images you have provided depict a series of scenarios related to health insurance coverage and outofpocket costs for medical care Lets ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started