Question

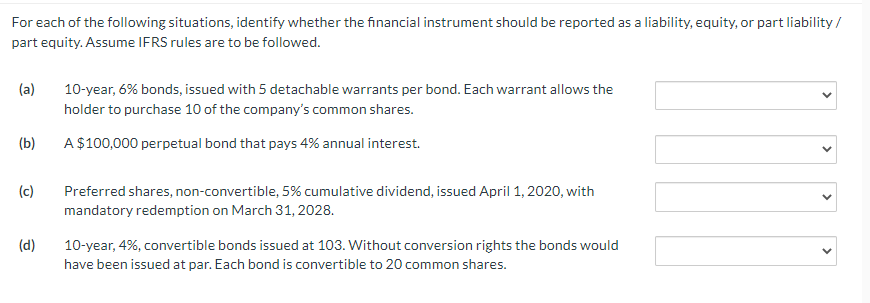

For each of the following situations, identify whether the financial instrument should be reported as a liability, equity, or part liability / part equity.

For each of the following situations, identify whether the financial instrument should be reported as a liability, equity, or part liability / part equity. Assume IFRS rules are to be followed. (a) 10-year, 6% bonds, issued with 5 detachable warrants per bond. Each warrant allows the holder to purchase 10 of the company's common shares. () A$100,000 perpetual bond that pays 4% annual interest. (c) Preferred shares, non-convertible, 5% cumulative dividend, issued April 1, 2020, with mandatory redemption on March 31, 2028. (d) 10-year, 4%, convertible bonds issued at 103. Without conversion rights the bonds would have been issued at par. Each bond is convertible to 20 common shares. > >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Part Liability Part Equity Convertible debt is bifurcate betwe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting

Authors: Karen W. Braun, Wendy M. Tietz

4th edition

978-0133428469, 013342846X, 133428370, 978-0133428377

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App