Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For each of the following situations, indicate the amount shown as current or long-term liability on the balance sheet of Anchor, Inc., at December

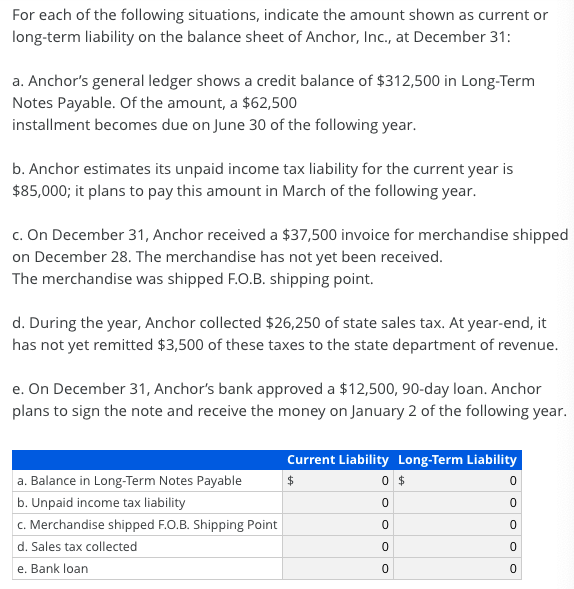

For each of the following situations, indicate the amount shown as current or long-term liability on the balance sheet of Anchor, Inc., at December 31: a. Anchor's general ledger shows a credit balance of $312,500 in Long-Term Notes Payable. Of the amount, a $62,500 installment becomes due on June 30 of the following year. b. Anchor estimates its unpaid income tax liability for the current year is $85,000; it plans to pay this amount in March of the following year. c. On December 31, Anchor received a $37,500 invoice for merchandise shipped on December 28. The merchandise has not yet been received. The merchandise was shipped F.O.B. shipping point. d. During the year, Anchor collected $26,250 of state sales tax. At year-end, it has not yet remitted $3,500 of these taxes to the state department of revenue. e. On December 31, Anchor's bank approved a $12,500, 90-day loan. Anchor plans to sign the note and receive the money on January 2 of the following year. Current Liability Long-Term Liability a. Balance in Long-Term Notes Payable 0 $ b. Unpaid income tax liability c. Merchandise shipped F.O.B. Shipping Point d. Sales tax collected e. Bank loan

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

For each of the forbwing Situalion Indicato as Curia...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started