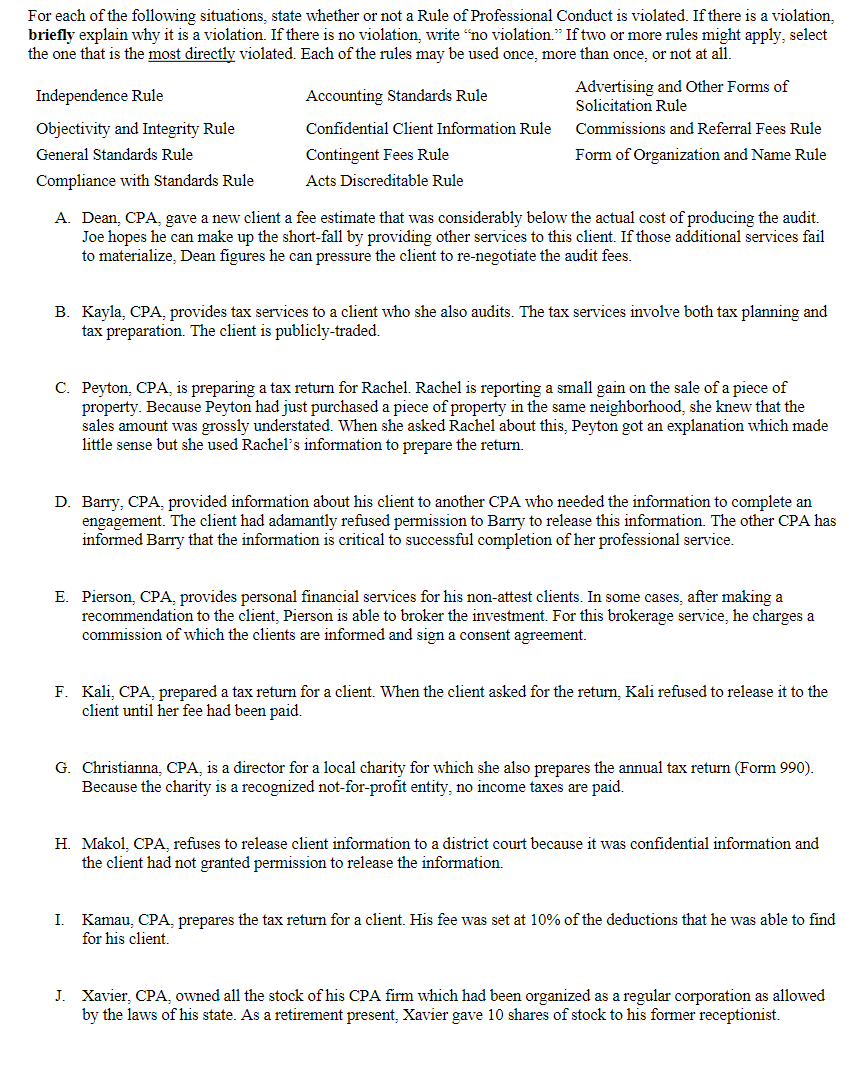

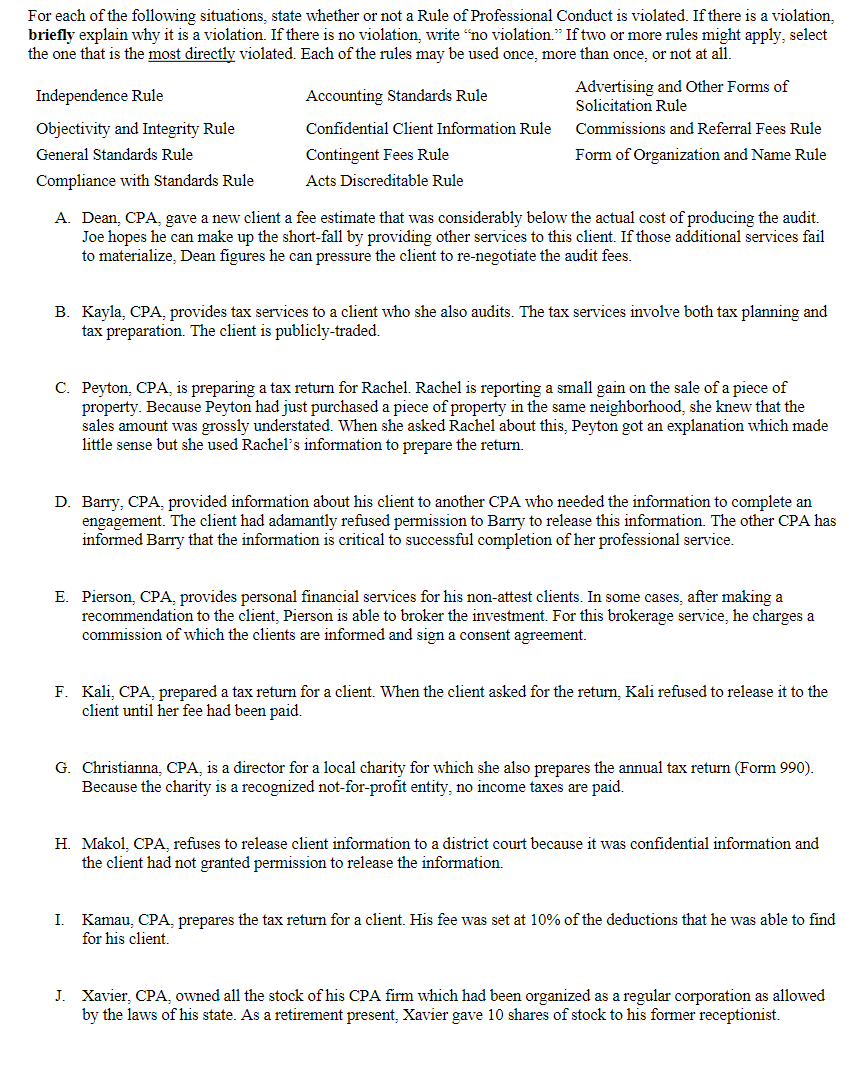

For each of the following situations, state whether or not a Rule of Professional Conduct is violated. If there is a violation, briefly explain why it is a violation. If there is no violation, write "no violation. If two or more rules might apply, select the one that is the most directly violated. Each of the rules may be used once more than once, or not at all. Independence Rule Accounting Standards Rule Advertising and Other Forms of Solicitation Rule Objectivity and Integrity Rule Confidential Client Information Rule Commissions and Referral Fees Rule General Standards Rule Contingent Fees Rule Form of Organization and Name Rule Compliance with Standards Rule Acts Discreditable Rule A. Dean, CPA, gave a new client a fee estimate that was considerably below the actual cost of producing the audit. Joe hopes he can make up the short-fall by providing other services to this client. If those additional services fail to materialize, Dean figures he can pressure the client to re-negotiate the audit fees. B. Kayla, CPA, provides tax services to a client who she also audits. The tax services involve both tax planning and tax preparation. The client is publicly-traded C. Peyton, CPA, is preparing a tax return for Rachel. Rachel is reporting a small gain on the sale of a piece of property. Because Peyton had just purchased a piece of property in the same neighborhood, she knew that the sales amount was grossly understated. When she asked Rachel about this, Peyton got an explanation which made little sense but she used Rachel's information to prepare the return. D. Barry, CPA, provided information about his client to another CPA who needed the information to complete an engagement. The client had adamantly refused permission to Barry to release this information. The other CPA has informed Barry that the information is critical to successful completion of her professional service. E. Pierson, CPA, provides personal financial services for his non-attest clients. In some cases, after making a recommendation to the client, Pierson is able to broker the investment. For this brokerage service, he charges a commission of which the clients are informed and sign a consent agreement. F. Kali, CPA, prepared a tax return for a client. When the client asked for the return, Kali refused to release it to the client until her fee had been paid. G. Christianna, CPA, is a director for a local charity for which she also prepares the annual tax return (Form 990). Because the charity is a recognized not-for-profit entity, no income taxes are paid. H. Makol, CPA, refuses to release client information to a district court because it was confidential information and the client had not granted permission to release the information. I. Kamau, CPA, prepares the tax return for a client. His fee was set at 10% of the deductions that he was able to find for his client. J. Xavier, CPA, owned all the stock of his CPA firm which had been organized as a regular corporation as allowed by the laws of his state. As a retirement present, Xavier gave 10 shares of stock to his former receptionist. For each of the following situations, state whether or not a Rule of Professional Conduct is violated. If there is a violation, briefly explain why it is a violation. If there is no violation, write "no violation. If two or more rules might apply, select the one that is the most directly violated. Each of the rules may be used once more than once, or not at all. Independence Rule Accounting Standards Rule Advertising and Other Forms of Solicitation Rule Objectivity and Integrity Rule Confidential Client Information Rule Commissions and Referral Fees Rule General Standards Rule Contingent Fees Rule Form of Organization and Name Rule Compliance with Standards Rule Acts Discreditable Rule A. Dean, CPA, gave a new client a fee estimate that was considerably below the actual cost of producing the audit. Joe hopes he can make up the short-fall by providing other services to this client. If those additional services fail to materialize, Dean figures he can pressure the client to re-negotiate the audit fees. B. Kayla, CPA, provides tax services to a client who she also audits. The tax services involve both tax planning and tax preparation. The client is publicly-traded C. Peyton, CPA, is preparing a tax return for Rachel. Rachel is reporting a small gain on the sale of a piece of property. Because Peyton had just purchased a piece of property in the same neighborhood, she knew that the sales amount was grossly understated. When she asked Rachel about this, Peyton got an explanation which made little sense but she used Rachel's information to prepare the return. D. Barry, CPA, provided information about his client to another CPA who needed the information to complete an engagement. The client had adamantly refused permission to Barry to release this information. The other CPA has informed Barry that the information is critical to successful completion of her professional service. E. Pierson, CPA, provides personal financial services for his non-attest clients. In some cases, after making a recommendation to the client, Pierson is able to broker the investment. For this brokerage service, he charges a commission of which the clients are informed and sign a consent agreement. F. Kali, CPA, prepared a tax return for a client. When the client asked for the return, Kali refused to release it to the client until her fee had been paid. G. Christianna, CPA, is a director for a local charity for which she also prepares the annual tax return (Form 990). Because the charity is a recognized not-for-profit entity, no income taxes are paid. H. Makol, CPA, refuses to release client information to a district court because it was confidential information and the client had not granted permission to release the information. I. Kamau, CPA, prepares the tax return for a client. His fee was set at 10% of the deductions that he was able to find for his client. J. Xavier, CPA, owned all the stock of his CPA firm which had been organized as a regular corporation as allowed by the laws of his state. As a retirement present, Xavier gave 10 shares of stock to his former receptionist