Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For each of the situations below, identify and describe the Real Option. Answer these specific questions: What constitutes the option cost, the exercise window, the

- For each of the situations below, identify and describe the Real Option. Answer these specific questions: What constitutes the option cost, the exercise window, the trigger strategy? How could you estimate the value it gives you? (analytical answer only, no numerical analyses required, be short and precise)

- Real Estate Development: You have been offered the opportunity to invest in the development of an apartment building in a year. Current expected value of the building is $25m. For the right to decide in a year, you have to pay $1m today, which will be adjusted against the required investment only if you choose to invest, otherwise forfeited. What kind of option is it, and how would you decide if the down payment is fair?

- Research and development Project: A start-up company is offering you the opportunity to invest $5m today, with the opportunity to invest another $5m a year later, and a final $10m 2 years later. If you decide not to invest at any of the subsequent years, you can accept a payment if $2.5m and quit.

- Consider the following data for Microsoft stock.

Stock price = $278

Exercise of option = $320

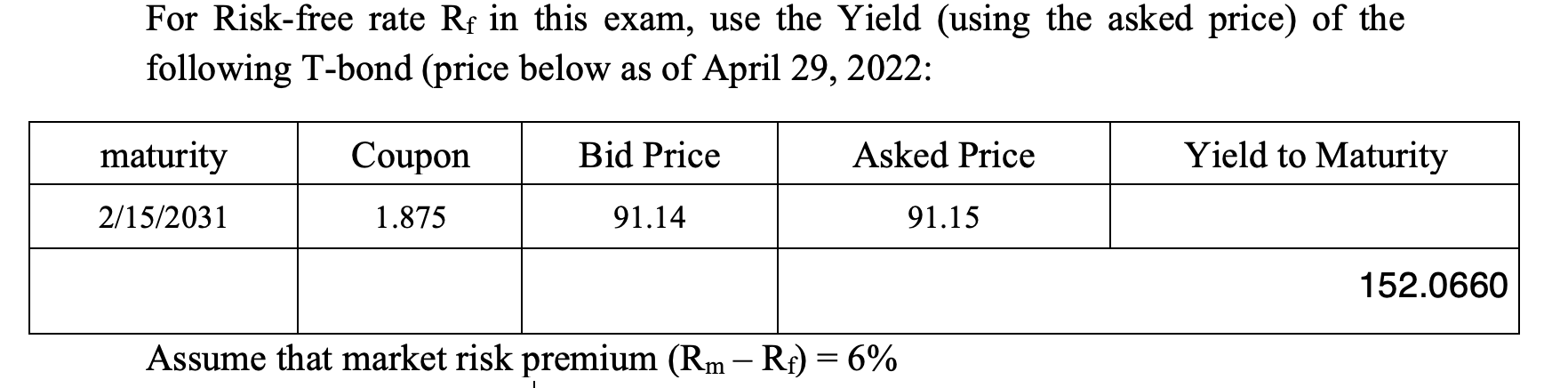

For annual Risk-free rate, use the YTM of the 10-year T-bond given in the test

Time to maturity = 2 years

Assume that the stock price can go up or down every year by 15%.

- Use the 2-state Option Pricing model to find the values of Call and Put options with above specifications.

- Use the Black-Scholes Option Pricing model to find the values of Call and Put options with above specifications (for s, use the average variance from Q 1)

- How do these prices compare? Why are the prices different?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started