Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For each question below, copy your LC model to a new worksheet (tab) within your file, and change the numbers within that sheet as

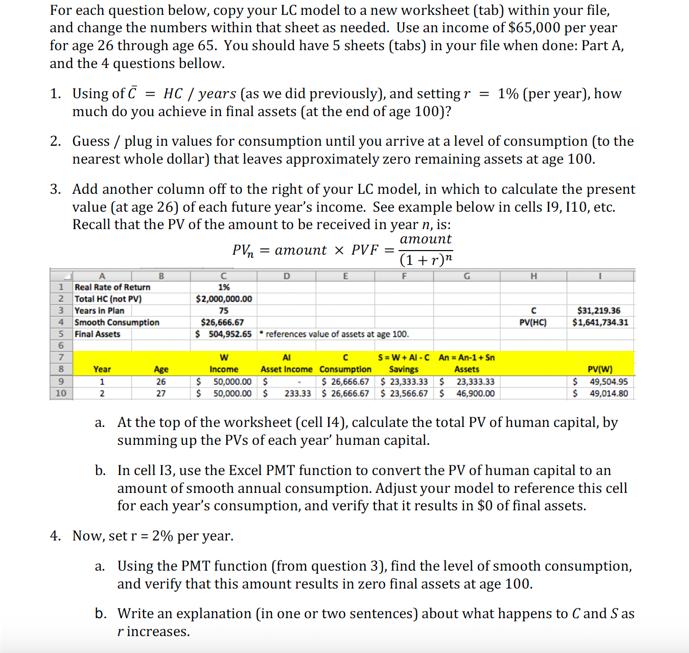

For each question below, copy your LC model to a new worksheet (tab) within your file, and change the numbers within that sheet as needed. Use an income of $65,000 per year for age 26 through age 65. You should have 5 sheets (tabs) in your file when done: Part A, and the 4 questions bellow. 1. Using of C = HC / years (as we did previously), and setting r = 1% (per year), how much do you achieve in final assets (at the end of age 100)? 2. Guess / plug in values for consumption until you arrive at a level of consumption (to the nearest whole dollar) that leaves approximately zero remaining assets at age 100. 3. Add another column off to the right of your LC model, in which to calculate the present value (at age 26) of each future year's income. See example below in cells 19, 110, etc. Recall that the PV of the amount to be received in year n, is: amount PV = amount x PVF = (1+r)n Real Rate of Return Total HC (not PV) 3 Years in Plan 1 2 23456789 4 Smooth Consumption Final Assets 10 Year 1 2 Age 26 27 D 1% $2,000,000.00 75 $26,666.67 $ 504,952.65 references value of assets at age 100. G W Al Income Asset Income Consumption $ 50,000.00 $ S=W+Al-C An = An-1+ Sn Savings Assets $ 23,333.33 $ 23,333.33 $ 26,666.67 $ 50,000.00 $ 233.33 $26,666.67 $23,566.67 $ 46,900.00 H PV(HO $31,219.36 $1,641,734.31 PV(W) $ 49,504.95 $ 49,014.80 a. At the top of the worksheet (cell 14), calculate the total PV of human capital, by summing up the PVs of each year' human capital. b. In cell 13, use the Excel PMT function to convert the PV of human capital to an amount of smooth annual consumption. Adjust your model to reference this cell for each year's consumption, and verify that it results in $0 of final assets. 4. Now, set r = 2% per year. a. Using the PMT function (from question 3), find the level of smooth consumption, and verify that this amount results in zero final assets at age 100. b. Write an explanation (in one or two sentences) about what happens to C and Sas r increases.

Step by Step Solution

★★★★★

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 To calculate the final assets at the end of age 100 you can use the formula for the prese...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started