Answered step by step

Verified Expert Solution

Question

1 Approved Answer

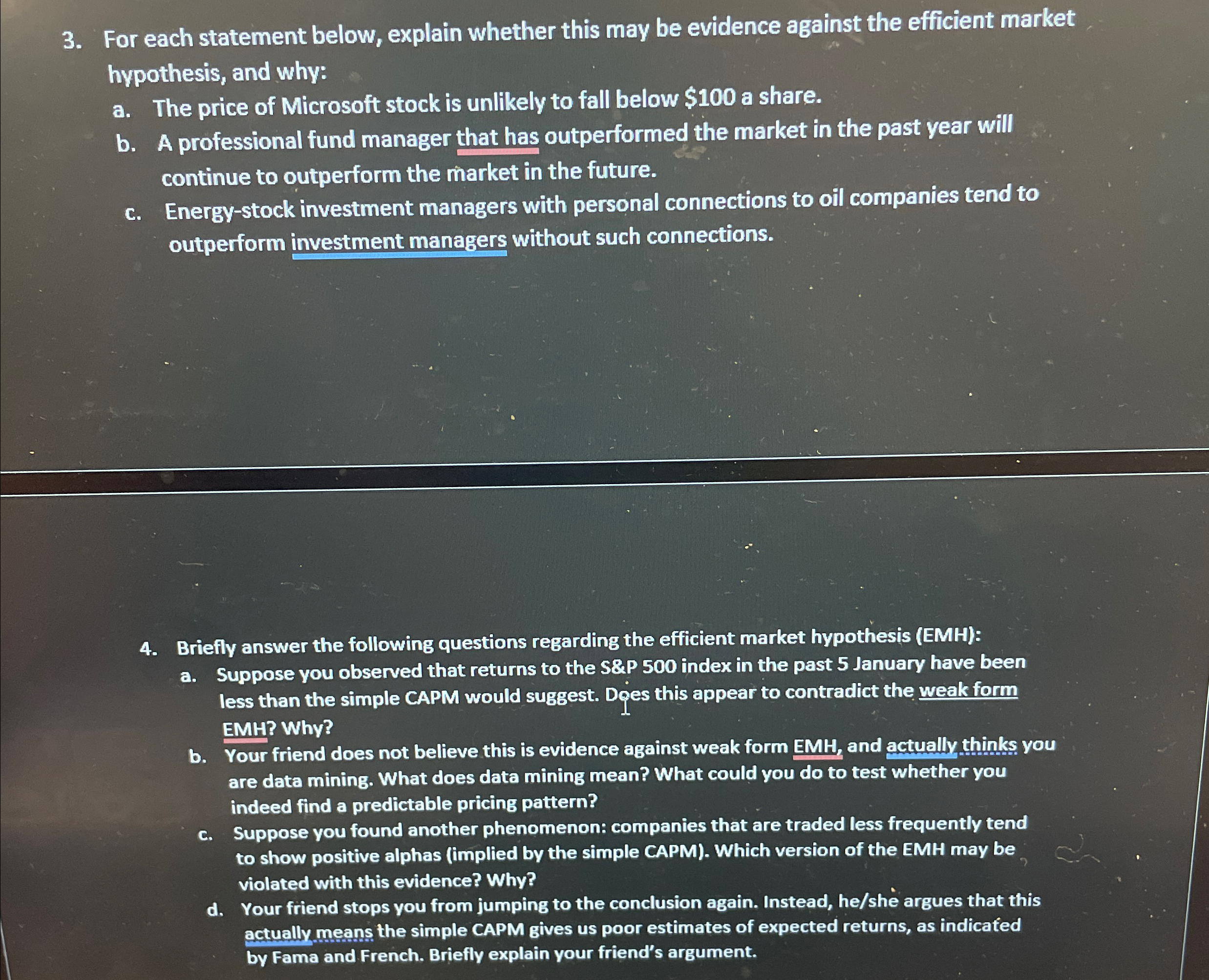

For each statement below, explain whether this may be evidence against the efficient market hypothesis, and why: a . The price of Microsoft stock is

For each statement below, explain whether this may be evidence against the efficient market hypothesis, and why:

a The price of Microsoft stock is unlikely to fall below $ a share.

b A professional fund manager that has outperformed the market in the past year will continue to outperform the market in the future.

c Energystock investment managers with personal connections to oil companies tend to outperform investment managers without such connections.

Briefly answer the following questions regarding the efficient market hypothesis EMH:

a Suppose you observed that returns to the S&P index in the past January have been less than the simple CAPM would suggest. Does this appear to contradict the weak form EMH? Why?

b Your friend does not believe this is evidence against weak form EMH, and actually thinks you are data mining. What does data mining mean? What could you do to test whether you indeed find a predictable pricing pattern?

c Suppose you found another phenomenon: companies that are traded less frequently tend to show positive alphas implied by the simple CAPM Which version of the EMH may be violated with this evidence? Why?

d Your friend stops you from jumping to the conclusion again. Instead, heshe argues that this actually means the simple CAPM gives us poor estimates of expected returns, as indicated by Fama and French. Briefly explain your friend's argument.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started