Answered step by step

Verified Expert Solution

Question

1 Approved Answer

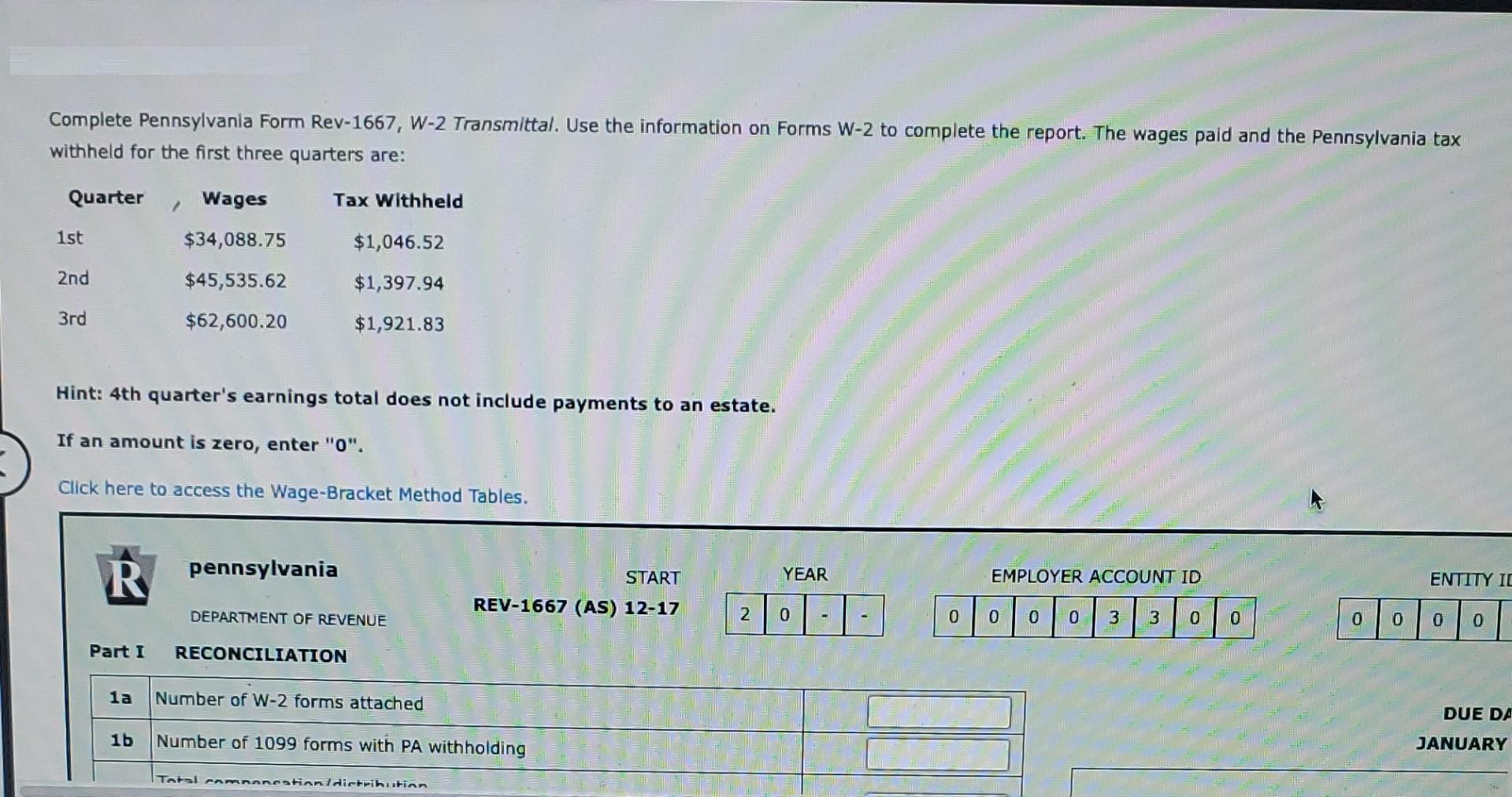

Complete Pennsylvania Form Rev-1667, W-2 Transmittal. Use the information on Forms W-2 to complete the report. The wages paid and the Pennsylvania tax withheld

Complete Pennsylvania Form Rev-1667, W-2 Transmittal. Use the information on Forms W-2 to complete the report. The wages paid and the Pennsylvania tax withheld for the first three quarters are: Quarter 1st 2nd 3rd R Part I " Hint: 4th quarter's earnings total does not include payments to an estate. If an amount is zero, enter "0". Click here to access the Wage-Bracket Method Tables. Wages $34,088.75 $45,535.62 $62,600.20 1b Tax Withheld $1,046.52 $1,397.94 $1,921.83 pennsylvania DEPARTMENT OF REVENUE RECONCILIATION 1a Number of W-2 forms attached START REV-1667 (AS) 12-17 Number of 1099 forms with PA withholding Total comooncation/distribution 2 YEAR 0 0 EMPLOYER ACCOUNT ID 0 0 0 3 3 0 0 0 0 ENTITY ID 0 0 DUE DA JANUARY Part I 1a Number of W-2 forms attached RECONCILIATION 1b Number of 1099 forms with PA withholding Total compensation/distribution subject to PA withholding PA personal income tax withheld 2 3 Part II ANNUAL RECONCILIATION 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter TOTAL Wages/distribution paid subject to PA withholding PA tax withheld LEGAL NAME TRADE NAME GLO-BRITE PAINT COMPANY ADDRESS ANNUAL WITHHOLDING RECONCILIATION STATEMEI DUE DATE JANUARY 31 BUSINESS NAME AND ADDRE 2215 SALVADOR STREET CITY, STATE, ZIP PHILADELPHIA, PA 19175-0682 DO NOT SEND PAYMENT WITH THI SIGNATURE

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

How to fill out Pennsylvania Form REV1667 W2 Transmittal using the provided information To complete ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started