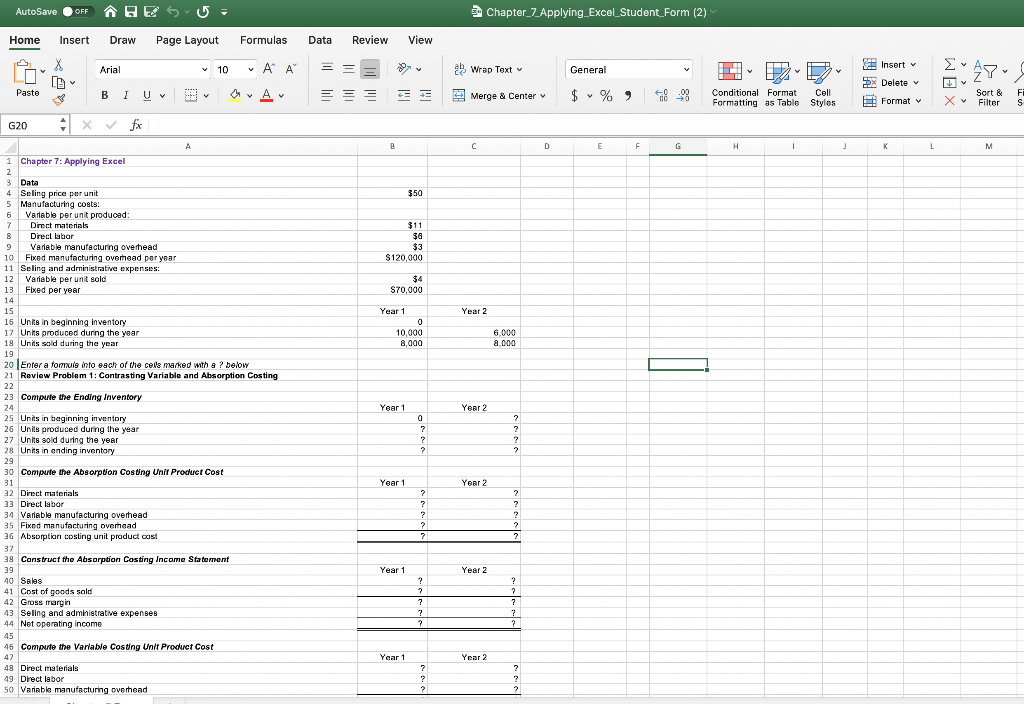

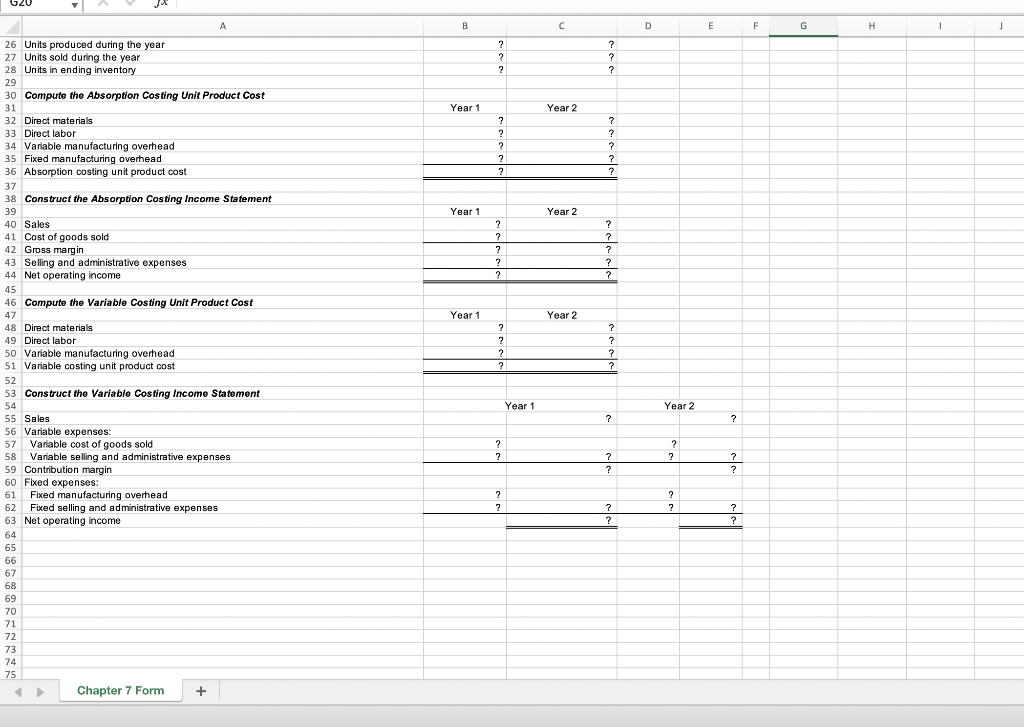

For example, in cell B26 enter the formula "= B17".

For example, in cell B26 enter the formula "= B17".

After entering formulas in all of the cells that contained question marks, verify that the dollar amounts match the numbers in Review Problem 1.

The LIFO inventory flow assumption is used throughout the problem.

Check your worksheet by changing the units sold in the Data to 6,000 for Year 2. The cost of goods sold under absorption costing for Year 2 should now be $240,000. If it isnt, check cell C41. The formula in this cell should be =IF(C26

AutoSave OFF ARE S U Chapter_7Applying_Excel_Student Form (2) Home Insert Draw Page Layout Formulas Data Review View 10 = = = D P D LE AA A Arial B IV fx Wrap Text Merge & Center General $ % Insort Ex Delete Format 2 47 J 4 Sort & X Filters B E - Fi Conditional Format Formatting as Table Cell Styles Paste G20 x Chapter 7: Applying Excel $50 $11 3 Data 4 Seling price per unit 5 Manufacturing costs: 6 Variable per unit produced: 7 Direct materials 8 Direct labor 9 Variable manufacturing overhead 10 Fixed manufacturing overead per year 11 Seling and administrative expenses: 12 Variable per unit sold 13 Fixed per year 14 $120.000 $4 S70,000 Year 1 Year 2 16 Units in beginning inventory 17 Units produced during the year 19 Units sold during the year 10,000 6.000 8.000 8.000 19 20 Enter a fome into each of the cele marked with a ? below 21 Review Problem 1: Contrasting Variable and Absorption Costing 23 Compute the Ending Inventory Year 2 25 Units in beginning inventory 26 Units produced during the year 27 Units sold during the year 28 Unitsin ending inventary 29 Year 2 30 Compute the Absorption Costing Unit Product Cost 31 32 Direct materials 33 Direct labor 34 Vareble manufacturing overhead 35 Fixed manufacturing overcad 36 Absorption conting unit product cast 29 Construct the Absorption Costing Income Statement 39 40 Sales 41 Cost of goods sold 42 Gross margin 43 Seling and administrative expenses 44 Net operating income 46 Compute the Variable Costing Unit Product Cost Year 1 48 Direct materials 49 Direct labor 50 Variable manufacturing overhead 620 26 Units produced during the year 27 Units sold during the year 28 Units in ending inventory 29 30 Compute the Absorption Costing Unit Product Cost 31 Year 1 Year 2 32 Direct materials 33 Direct labor 34 Variable manufacturing overhead 35 Fixed manufacturing overhead 36 Absorption costing unit product cost 37 38 Construct the Absorption Costing Income Statement Year 1 Year 2 40 Sales 41 Cost of goods sold 42 Gross margin 43 Selling and administrative expenses 44 Net operating income ? 7 45 Year 1 Year 2 46 Compute the Variable Costing Unit Product Cost 47 48 Direct materials 49 Direct labor 50 Variable manufacturing overhead 51 Variable costing unit product cost ? 53 Construct the Variable Costing Income Statement Year 1 Year 2 ? Sales 56 Variable expenses: 57 Variable cost of goods sold 58 Variable selling and administrative expenses 59 Contribution margin 60 Fixed expenses: 61 Fixed manufacturing overhead 62 Fixed selling and administrative expenses 63 Net operating income Chapter 7 Form +

For example, in cell B26 enter the formula "= B17".

For example, in cell B26 enter the formula "= B17".