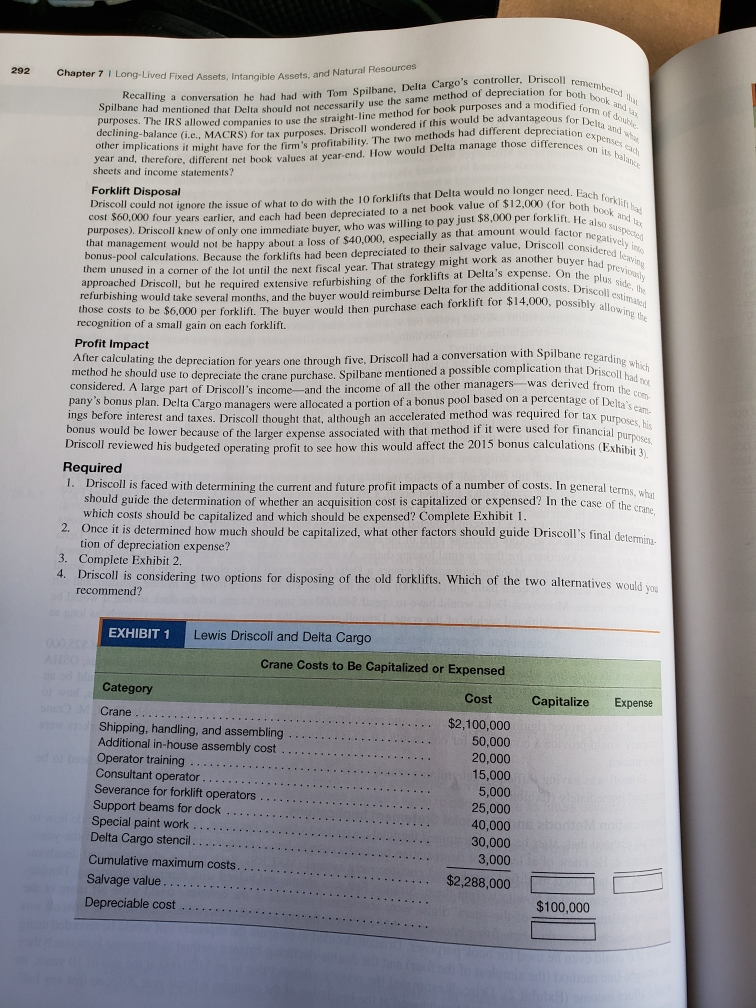

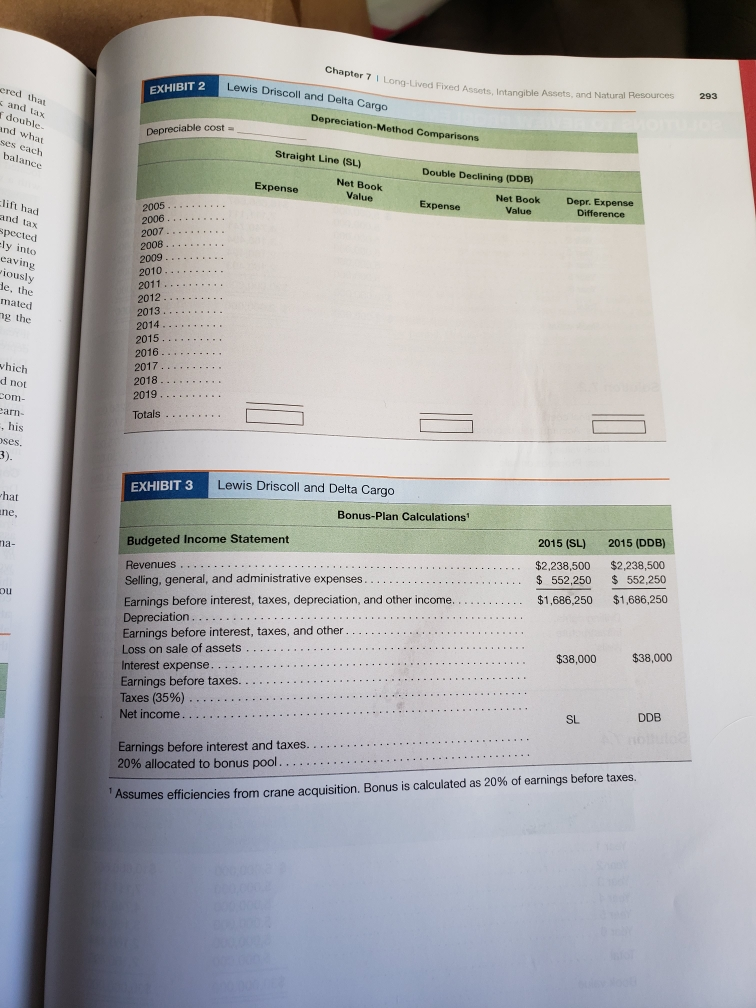

For exhibit two, calculations should be for 2015 - 2029, please explain how you got the answer.

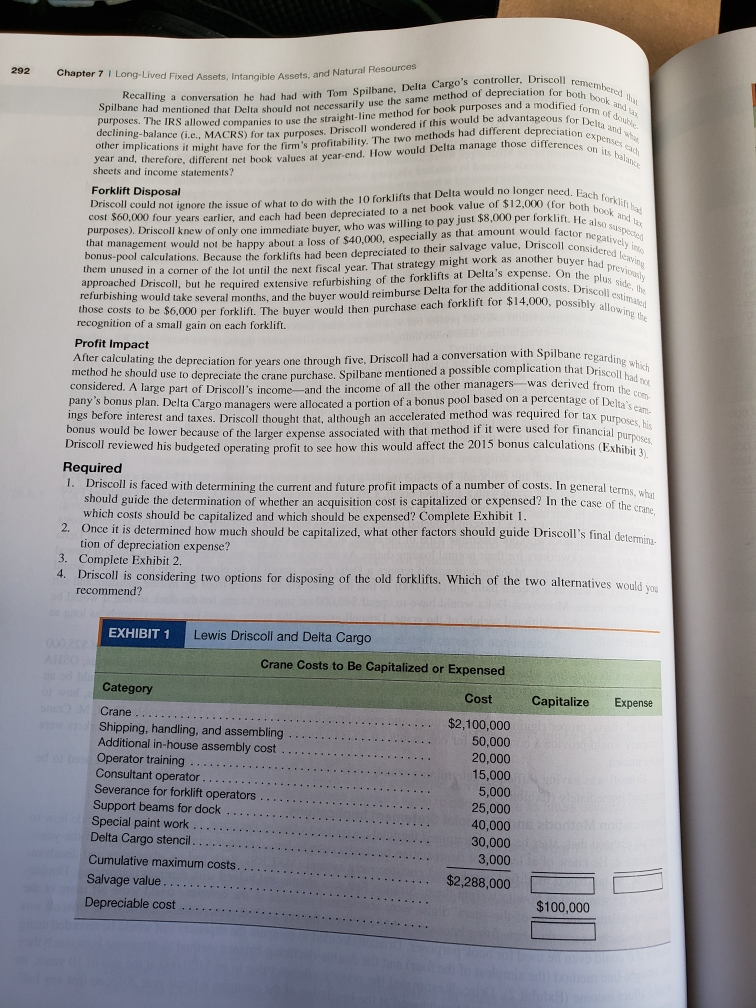

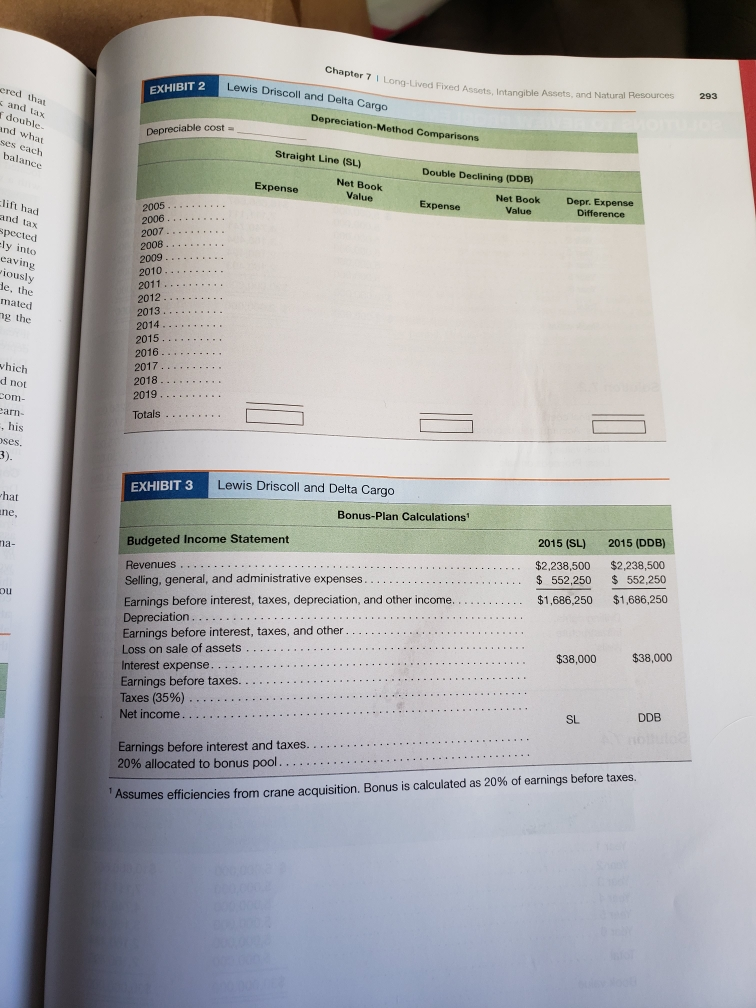

Chapter 7 I Long-Lived Fixed Assets, Intangible Assets, and Natural Resources Long-Live 291 CASE LEWIS DRISC Lewis Dris vis Driscoll was excited about ated near the mouth of the Missi with a wide variety of goods ship Transportation, a to load and unlos Crane Company has efficiency and so approve the utilize the tech market, which has S DRISCOLL AND DELTA CARGO the proposal that had just cssed his desk As logistics manager for Delta Cargo, 1135issippi River, Driscoll and his team were responsible for loading and unloading barcs Pped in standard shipping containers Delta Caro was an operating division of Deita ration, a company that provided a host of transportation services in the Gulf Coast region. With 10 forint and unload Darges, Delta Cargo employees onerated around the clock A sales representative from the J. M. Company had recently demonstrated a new crane that would allow Delta to replace its forklifts, improving bou ncy and speed. Although it sounded like a great idea, Driscoll began to wonder if corporate management would the expenditure. The Crane would allow cargo to he essed much more efficiently. As the first company to the technology, Delta would have an advantage over its numerous competitors in the Mississippi River freight which handled 175 million tons a year. he crane investment would certainly affect Delta's profitability as the forklifts were nearly fully depreciated and w crane would involve a substantial capital investment Driscoll recalled the business-management class that Delta nonsored after his last promotion. How much depreciation would Delta incur for this new investment? But did ily matter as depreciation affected profits but was not an actual cash outflow? Would his selection of a particular ciation method straight-line, double-declining balance. sum-of-the-years' digits, or tax-based MACRS-affect Delta's botto la's bottom line and total profitability? Driscoll also knew that retaining the forklifts would be unnecessary, as the crane's capacity was much larger than al needed. If the crane were indeed purchased, what disposal options would he have? And how would that affect ofitability? Although the forklifts had been substantially depreciated. Driscoll expected that any disposal would result loss to Delta. New technologies on the market rendered the forklifts obsolete: thus, although the crane investment certainly made sense for the company under any valuation method, it would be very expensive and corporate manage- went might hesitate both to bear the cost and to write off its previous forklift investment. the new crane had sponsored after his las depreciation Capitalized Costs Driscoll began to evaluate the proposal. The crane itself a brand-new United Industries BH115 115.ton hydraulic crawler crane with a 150-foot boom, a 70-foot tubular iib, and a quiet Cummins diesel engine. Priced was a real beauty a $2.1 million, it would have to be shipped in pieces from Savannah. Georgia, adding another $50,000 in shipping, assembling, and handling costs. Driscoll budgeted in his calculations that Delta could defray some of the assembly costs by having its own dockworkers assemble parts of the crane, at a savings of about $20.00), approximately what Delta would pay the dockworkers for their normal loading duties. As the dockworkers were occasionally idle, Driscoll viewed this as a real cost savings. Management would require a Delta Cargo stencil to be placed on the crane, which would cost $3,000, as well as a special paint job ($30,000) so that the crane would not rust from the intense moisture and salt at the Delta docks. Moreover, Delta would have to spend $40,000 on support beams for the dock so that it would be able to withstand the additional weight of the crane, Driscoll expected the heams would last approximately as long as the crane itself. Other costs included mandatory training of the crane operators (estimated at $15,000) and severance pay of $25,000 for the forklift operators who could not be reassigned. Although severance costs were clearly one-time charges, OSHA regulations required all persons operating the crane to be periodically recertified, so that training costs would be an ongoing expenditure. Training activities included, but were not limited to, how to use correct hand signals, how to read load charts, proper rigging and inspections, and procedures for boom assembly and disassembly. The J. M. Crane Company would provide a consultant for one month (at $5,000) to assist in those operations while Delta workers were being trained. Driscoll was having difficulty determining which costs should be capitalized and which costs would need to be expensed immediately (Exhibit 1). Depreciation Methods and Financial Statement Implications Driscoll realized that, after he had determined the total capitalized value of the crane, he would have to decide how to depreciate it. He knew of at least four depreciation methods: straight-line, double-declining-balance, sum-of-the-years digits, or the tax-based modified accelerated cost-recovery system (MACRS). Each had its advantages and disadvan- lages, but he was unsure how to weight them. Straight line was simple and helped with earnings consistency. Double- declining-balance and sum-of-the-years' digits were accelerated methods so the company could write off more of the vost in the early years, thus benefiting later years. MACRS was the tax method prescribed by the IRS, but Driscoll was sure if it could even be used for book purposes. Driscoll decided to compare the expenses that would be recorded usine We straight-line method (the simplest of the four) and the double-declining-balance method to determine how much they afect income (Fvhihit 2) Driscoll estimated the crane s salvage value to be $100.000 at the end of expected useful life. The asset was to be purchased at the beginning of the company's fiscal year 2015, so that any half- year convention measures would be unnecessary. 292 Chapter 7 I Long-Lived Fixed Assets, Intangible Assots, and remember Recalling a conversation Spilbane had mentioned that Delta should not nece purposes. The IRS allowed companies to use the si Assets, Intangible Assets, and Natural Resources conversation he had had with Tom Spilbane, Delta Cargo's controller. Driscoll mentioned that Delta should not necessarily use the same method of depreciation for har allowed companies to use the straight-line method for book purposes and a modified declining-balance (ie MACRS) for ay purposes. Driscoll wondered d if this would be advantageous for Del Prications it might have for the firm's profitability. The two methods had different depreciation and, therefore, different netbook valueel wear-end. Ilow would Delta manage those differences cd form of de teha and other implications it might have for the form es on is balat so wesome pella 1. Each forks poth book and ta He also super actor negatively in considered leavine er had prewall the plus de riscollestwa ssibly allowee orklift for $14,000, possibly allow sheets and income statements? Forklift Disposal Driscoll could not ignore the issue of what to do with the 10 forklifts that Delta would no longer need, O 00.000 four years earlier and each had been depreciated to a net book value OT-514000 (for both per forklift. He Purposes). Driscoll knew of only one immediate bu ver, who was willing to pay JUSE 10, mat management would not be happy about a loss of $40.000, especially as that amount would factor mus pool calculations. Because the forklifts had been depreciated to their salvage Value, Driscoll consi unused in a corner of the lot until the next fiscal year. That strategy might work as another buyer he "PP acred Driscoll, but be required extensive refurbishing of the forklifts al Deltas cxpense. On the refurbishing would take several months and the buyer would reimburse Delta for the additional costs. Drie those costs to be $6,000 per forklift. The buyer would then purchase each fork recognition of a small gain on each forklift. Profit Impact Aller calculating the depreciation for years one through five. Driscoll had a conversation with Spilbane ropardi method he should use to depreciate the crane purchase. Spilbane mentioned a possible complication that Drisce considered. A large part of Driscoll's income and the income of all the other managers was derived from pany s bonus plan. Delta Cargo managers were allocated a portion of a bonus pool based on a percentage of Delta ings before interest and taxes Driscoll thought that although an accelerated method was required for tax burn bonus would be lower because of the larger expense associated with that method if it were used for financial nu Driscoll reviewed his budgeted operating profit to see how this would affect the 2015 bonus calculations (Exhibi Required regarding which hat Driscoll had to from the com Delta's eam tax purposes, his 1. Driscoll is faced with determining the current and future profit impacts of a number of costs. In general terms should guide the determination of whether an acquisition cost is capitalized or expensed? In the case of the which costs should be capitalized and which should be expensed? Complete Exhibit 1. 2. Once it is determined how much should be capitalized, what other factors should guide Driscoll's final deter tion of depreciation expense? 3. Complete Exhibit 2. 4. Driscoll is considering two options for disposing of the old forklifts. Which of the two alternatives would you recommend? EXHIBIT 1 Lewis Driscoll and Delta Cargo Crane Costs to Be Capitalized or Expensed Category Capitalize Expense Crane .............................................. Shipping, handling, and assembling .. Additional in-house assembly cost. Operator training ....... Consultant operator .... Severance for forklift operators .... Support beams for dock Special paint work.. Delta Cargo stencil...... Cumulative maximum costs... Salvage value... Depreciable cost ... $2,100,000 50,000 20,000 15,000 5,000 25,000 40,000 30,000 3,000 $2,288,000 $100,000 Chapter 7 I Long-Lived Fixed HIBIT 2 Lewis Driscoll and Delta Cargo ved Fixed Assets intangible Arts and Natural Resources 293 cred than and tax double- and what ses each balance Depreciation-Method Comparisons Depreciable cost = Straight Line (SL) Double Declining (DDB) Expense Net Book Value lift hvad and tax 2005 Expense Net Book Value Depr. Expense Difference 2006... 2007 2008 spected ely into eaving iously He, the mated ng the 2009.. 2010... 2011. 2012.. 2013 2014.. 2015..... 2016... 2017.. 2018... 2019... Totals ... which d not com- earn- his oses. EXHIBIT 3 Lewis Driscoll and Delta Cargo what ane, Bonus-Plan Calculations! ma- Budgeted Income Statement 2015 (SL) $2,238,500 $ 552,250 $1,686,250 2015 (DDB) $2,238,500 $ 552,250 $1,686,250 Revenues ..... Selling, general, and administrative expenses. ..... Earnings before interest, taxes, depreciation, and other income. m e ............ Depreciation ......... Earnings before interest, taxes, and other......... Loss on sale of assets Interest expense........... Earnings before taxes........... Taxes (35%) .............. . Net income. . . . . . . . $38,000 $38,000 SL DDB Earnings before interest and taxes....... 20% allocated to bonus pool.......... Assumes efficiencies from crane acquisition, Bonus is calculated as 20% of earnings before taxes. Chapter 7 I Long-Lived Fixed Assets, Intangible Assets, and Natural Resources Long-Live 291 CASE LEWIS DRISC Lewis Dris vis Driscoll was excited about ated near the mouth of the Missi with a wide variety of goods ship Transportation, a to load and unlos Crane Company has efficiency and so approve the utilize the tech market, which has S DRISCOLL AND DELTA CARGO the proposal that had just cssed his desk As logistics manager for Delta Cargo, 1135issippi River, Driscoll and his team were responsible for loading and unloading barcs Pped in standard shipping containers Delta Caro was an operating division of Deita ration, a company that provided a host of transportation services in the Gulf Coast region. With 10 forint and unload Darges, Delta Cargo employees onerated around the clock A sales representative from the J. M. Company had recently demonstrated a new crane that would allow Delta to replace its forklifts, improving bou ncy and speed. Although it sounded like a great idea, Driscoll began to wonder if corporate management would the expenditure. The Crane would allow cargo to he essed much more efficiently. As the first company to the technology, Delta would have an advantage over its numerous competitors in the Mississippi River freight which handled 175 million tons a year. he crane investment would certainly affect Delta's profitability as the forklifts were nearly fully depreciated and w crane would involve a substantial capital investment Driscoll recalled the business-management class that Delta nonsored after his last promotion. How much depreciation would Delta incur for this new investment? But did ily matter as depreciation affected profits but was not an actual cash outflow? Would his selection of a particular ciation method straight-line, double-declining balance. sum-of-the-years' digits, or tax-based MACRS-affect Delta's botto la's bottom line and total profitability? Driscoll also knew that retaining the forklifts would be unnecessary, as the crane's capacity was much larger than al needed. If the crane were indeed purchased, what disposal options would he have? And how would that affect ofitability? Although the forklifts had been substantially depreciated. Driscoll expected that any disposal would result loss to Delta. New technologies on the market rendered the forklifts obsolete: thus, although the crane investment certainly made sense for the company under any valuation method, it would be very expensive and corporate manage- went might hesitate both to bear the cost and to write off its previous forklift investment. the new crane had sponsored after his las depreciation Capitalized Costs Driscoll began to evaluate the proposal. The crane itself a brand-new United Industries BH115 115.ton hydraulic crawler crane with a 150-foot boom, a 70-foot tubular iib, and a quiet Cummins diesel engine. Priced was a real beauty a $2.1 million, it would have to be shipped in pieces from Savannah. Georgia, adding another $50,000 in shipping, assembling, and handling costs. Driscoll budgeted in his calculations that Delta could defray some of the assembly costs by having its own dockworkers assemble parts of the crane, at a savings of about $20.00), approximately what Delta would pay the dockworkers for their normal loading duties. As the dockworkers were occasionally idle, Driscoll viewed this as a real cost savings. Management would require a Delta Cargo stencil to be placed on the crane, which would cost $3,000, as well as a special paint job ($30,000) so that the crane would not rust from the intense moisture and salt at the Delta docks. Moreover, Delta would have to spend $40,000 on support beams for the dock so that it would be able to withstand the additional weight of the crane, Driscoll expected the heams would last approximately as long as the crane itself. Other costs included mandatory training of the crane operators (estimated at $15,000) and severance pay of $25,000 for the forklift operators who could not be reassigned. Although severance costs were clearly one-time charges, OSHA regulations required all persons operating the crane to be periodically recertified, so that training costs would be an ongoing expenditure. Training activities included, but were not limited to, how to use correct hand signals, how to read load charts, proper rigging and inspections, and procedures for boom assembly and disassembly. The J. M. Crane Company would provide a consultant for one month (at $5,000) to assist in those operations while Delta workers were being trained. Driscoll was having difficulty determining which costs should be capitalized and which costs would need to be expensed immediately (Exhibit 1). Depreciation Methods and Financial Statement Implications Driscoll realized that, after he had determined the total capitalized value of the crane, he would have to decide how to depreciate it. He knew of at least four depreciation methods: straight-line, double-declining-balance, sum-of-the-years digits, or the tax-based modified accelerated cost-recovery system (MACRS). Each had its advantages and disadvan- lages, but he was unsure how to weight them. Straight line was simple and helped with earnings consistency. Double- declining-balance and sum-of-the-years' digits were accelerated methods so the company could write off more of the vost in the early years, thus benefiting later years. MACRS was the tax method prescribed by the IRS, but Driscoll was sure if it could even be used for book purposes. Driscoll decided to compare the expenses that would be recorded usine We straight-line method (the simplest of the four) and the double-declining-balance method to determine how much they afect income (Fvhihit 2) Driscoll estimated the crane s salvage value to be $100.000 at the end of expected useful life. The asset was to be purchased at the beginning of the company's fiscal year 2015, so that any half- year convention measures would be unnecessary. 292 Chapter 7 I Long-Lived Fixed Assets, Intangible Assots, and remember Recalling a conversation Spilbane had mentioned that Delta should not nece purposes. The IRS allowed companies to use the si Assets, Intangible Assets, and Natural Resources conversation he had had with Tom Spilbane, Delta Cargo's controller. Driscoll mentioned that Delta should not necessarily use the same method of depreciation for har allowed companies to use the straight-line method for book purposes and a modified declining-balance (ie MACRS) for ay purposes. Driscoll wondered d if this would be advantageous for Del Prications it might have for the firm's profitability. The two methods had different depreciation and, therefore, different netbook valueel wear-end. Ilow would Delta manage those differences cd form of de teha and other implications it might have for the form es on is balat so wesome pella 1. Each forks poth book and ta He also super actor negatively in considered leavine er had prewall the plus de riscollestwa ssibly allowee orklift for $14,000, possibly allow sheets and income statements? Forklift Disposal Driscoll could not ignore the issue of what to do with the 10 forklifts that Delta would no longer need, O 00.000 four years earlier and each had been depreciated to a net book value OT-514000 (for both per forklift. He Purposes). Driscoll knew of only one immediate bu ver, who was willing to pay JUSE 10, mat management would not be happy about a loss of $40.000, especially as that amount would factor mus pool calculations. Because the forklifts had been depreciated to their salvage Value, Driscoll consi unused in a corner of the lot until the next fiscal year. That strategy might work as another buyer he "PP acred Driscoll, but be required extensive refurbishing of the forklifts al Deltas cxpense. On the refurbishing would take several months and the buyer would reimburse Delta for the additional costs. Drie those costs to be $6,000 per forklift. The buyer would then purchase each fork recognition of a small gain on each forklift. Profit Impact Aller calculating the depreciation for years one through five. Driscoll had a conversation with Spilbane ropardi method he should use to depreciate the crane purchase. Spilbane mentioned a possible complication that Drisce considered. A large part of Driscoll's income and the income of all the other managers was derived from pany s bonus plan. Delta Cargo managers were allocated a portion of a bonus pool based on a percentage of Delta ings before interest and taxes Driscoll thought that although an accelerated method was required for tax burn bonus would be lower because of the larger expense associated with that method if it were used for financial nu Driscoll reviewed his budgeted operating profit to see how this would affect the 2015 bonus calculations (Exhibi Required regarding which hat Driscoll had to from the com Delta's eam tax purposes, his 1. Driscoll is faced with determining the current and future profit impacts of a number of costs. In general terms should guide the determination of whether an acquisition cost is capitalized or expensed? In the case of the which costs should be capitalized and which should be expensed? Complete Exhibit 1. 2. Once it is determined how much should be capitalized, what other factors should guide Driscoll's final deter tion of depreciation expense? 3. Complete Exhibit 2. 4. Driscoll is considering two options for disposing of the old forklifts. Which of the two alternatives would you recommend? EXHIBIT 1 Lewis Driscoll and Delta Cargo Crane Costs to Be Capitalized or Expensed Category Capitalize Expense Crane .............................................. Shipping, handling, and assembling .. Additional in-house assembly cost. Operator training ....... Consultant operator .... Severance for forklift operators .... Support beams for dock Special paint work.. Delta Cargo stencil...... Cumulative maximum costs... Salvage value... Depreciable cost ... $2,100,000 50,000 20,000 15,000 5,000 25,000 40,000 30,000 3,000 $2,288,000 $100,000 Chapter 7 I Long-Lived Fixed HIBIT 2 Lewis Driscoll and Delta Cargo ved Fixed Assets intangible Arts and Natural Resources 293 cred than and tax double- and what ses each balance Depreciation-Method Comparisons Depreciable cost = Straight Line (SL) Double Declining (DDB) Expense Net Book Value lift hvad and tax 2005 Expense Net Book Value Depr. Expense Difference 2006... 2007 2008 spected ely into eaving iously He, the mated ng the 2009.. 2010... 2011. 2012.. 2013 2014.. 2015..... 2016... 2017.. 2018... 2019... Totals ... which d not com- earn- his oses. EXHIBIT 3 Lewis Driscoll and Delta Cargo what ane, Bonus-Plan Calculations! ma- Budgeted Income Statement 2015 (SL) $2,238,500 $ 552,250 $1,686,250 2015 (DDB) $2,238,500 $ 552,250 $1,686,250 Revenues ..... Selling, general, and administrative expenses. ..... Earnings before interest, taxes, depreciation, and other income. m e ............ Depreciation ......... Earnings before interest, taxes, and other......... Loss on sale of assets Interest expense........... Earnings before taxes........... Taxes (35%) .............. . Net income. . . . . . . . $38,000 $38,000 SL DDB Earnings before interest and taxes....... 20% allocated to bonus pool.......... Assumes efficiencies from crane acquisition, Bonus is calculated as 20% of earnings before taxes