Answered step by step

Verified Expert Solution

Question

1 Approved Answer

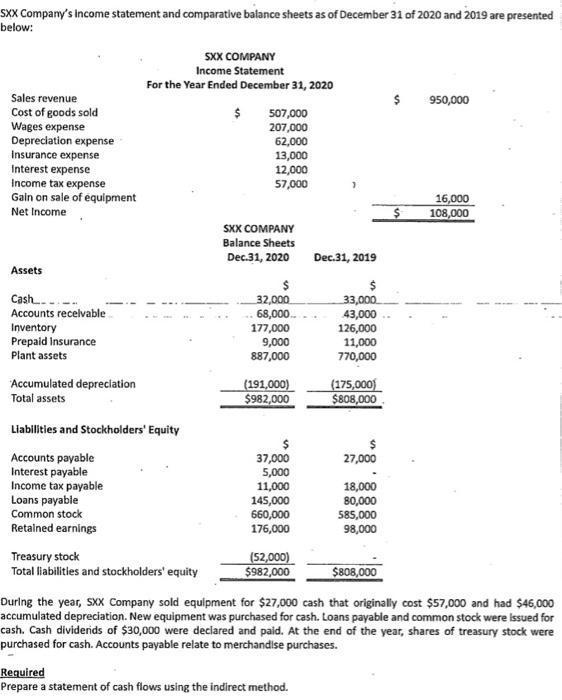

SXX Company's Income statement and comparative balance sheets as of December 31 of 2020 and 2019 are presented below: Sales revenue Cost of goods

SXX Company's Income statement and comparative balance sheets as of December 31 of 2020 and 2019 are presented below: Sales revenue Cost of goods sold Wages expense Depreciation expense Insurance expense Interest expense Income tax expense Gain on sale of equipment Net Income Assets Cash... Accounts receivable Inventory Prepaid Insurance Plant assets Accumulated depreciation Total assets SXX COMPANY Income Statement For the Year Ended December 31, 2020 $ Liabilities and Stockholders' Equity Accounts payable Interest payable Income tax payable Loans payable Common stock Retained earnings Treasury stock Total liabilities and stockholders' equity 507,000 207,000 62,000 13,000 12,000 57,000 SXX COMPANY Balance Sheets Dec.31, 2020 32,000 68,000.. 177,000 9,000 887,000 (191,000) $982,000 37,000 5,000 11,000 145,000 660,000 176,000 (52,000) $982,000 Dec.31, 2019 Required Prepare a statement of cash flows using the indirect method. 33,000 43,000 126,000 11,000 770,000 (175,000) $808,000 27,000 18,000 80,000 585,000 98,000 950,000 16,000 108,000 $808,000 During the year, SXX Company sold equipment for $27,000 cash that originally cost $57,000 and had $46,000 accumulated depreciation. New equipment was purchased for cash. Loans payable and common stock were issued for cash. Cash dividerids of $30,000 were declared and paid. At the end of the year, shares of treasury stock were purchased for cash. Accounts payable relate to merchandise purchases.

Step by Step Solution

★★★★★

3.59 Rating (174 Votes )

There are 3 Steps involved in it

Step: 1

SXX Company Statement of Cash Flows For the Year Ended December 31 2020 Cash Fl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started