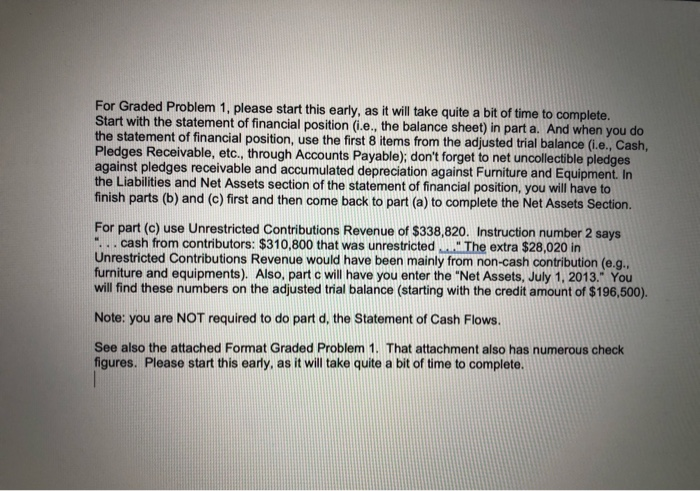

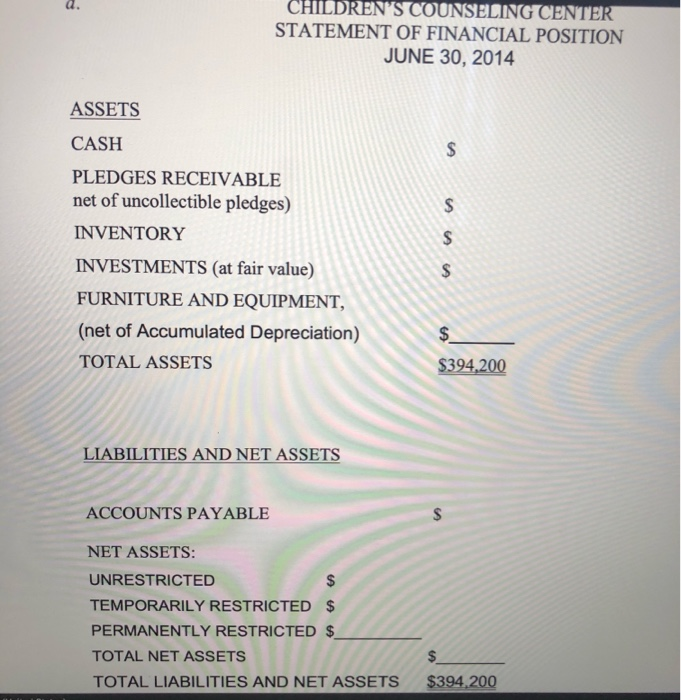

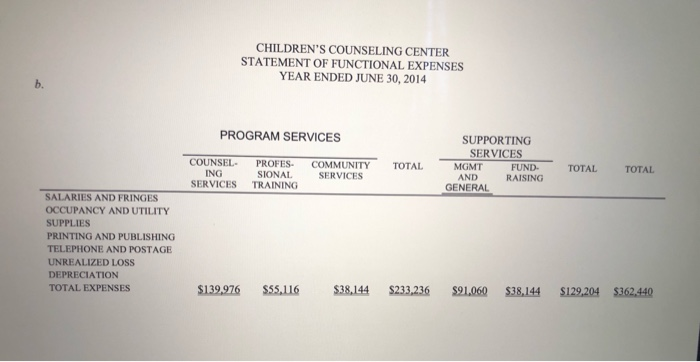

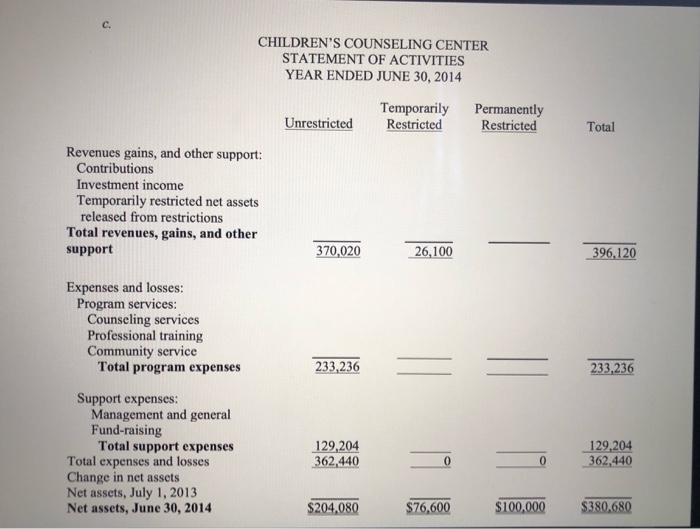

For Graded Problem 1. please start this early, as it will take quite a bit of time to complete. Start with the statement of financial position (i.e., the balance sheet) in part a. And when you do the statement of financial position, use the first 8 items from the adjusted trial balance (i.e., Cash, Pledges Receivable, etc., through Accounts Payable); don't forget to net uncollectible pledges against pledges receivable and accumulated depreciation against Furniture and Equipment. In the Liabilities and Net Assets section of the statement of financial position, you will have to finish parts (b) and (c) first and then come back to part (a) to complete the Net Assets Section For part (C) use Unrestricted Contributions Revenue of $338,820. Instruction number 2 says 1... cash from contributors: $310,800 that was unrestricted The extra $28,020 in Unrestricted Contributions Revenue would have been mainly from non-cash contribution (e.g. furniture and equipments). Also, partc will have you enter the "Net Assets, July 1, 2013." You will find these numbers on the adjusted trial balance (starting with the credit amount of $196,500). Note: you are NOT required to do part d, the Statement of Cash Flows. See also the attached Format Graded Problem 1. That attachment also has numerous check figures. Please start this early, as it will take quite a bit of time to complete. CHILDREN'S COUNSELING CENTER STATEMENT OF FINANCIAL POSITION JUNE 30, 2014 ASSETS CASH PLEDGES RECEIVABLE net of uncollectible pledges) INVENTORY INVESTMENTS (at fair value) FURNITURE AND EQUIPMENT, (net of Accumulated Depreciation) TOTAL ASSETS $394,200 LIABILITIES AND NET ASSETS ACCOUNTS PAYABLE NET ASSETS: UNRESTRICTED TEMPORARILY RESTRICTED $ PERMANENTLY RESTRICTED $ TOTAL NET ASSETS TOTAL LIABILITIES AND NET ASSETS $394, 200 CHILDREN'S COUNSELING CENTER STATEMENT OF FUNCTIONAL EXPENSES YEAR ENDED JUNE 30, 2014 PROGRAM SERVICES COUNSEL. ING SERVICES TOTAL PROFES. SIONAL TRAINING COMMUNITY SERVICES SUPPORTING SERVICES M GMT FUND. AND RAISING GENERAL TOTAL TOTAL SALARIES AND FRINGES OCCUPANCY AND UTILITY SUPPLIES PRINTING AND PUBLISHING TELEPHONE AND POSTAGE UNREALIZED LOSS DEPRECIATION TOTAL EXPENSES $139,976 $55,116 $38,144 $233,236 $91,060 $38,144 $129,204 $362,440 CHILDREN'S COUNSELING CENTER STATEMENT OF ACTIVITIES YEAR ENDED JUNE 30, 2014 Unrestricted Temporarily Restricted Permanently Restricted Total Revenues gains, and other support: Contributions Investment income Temporarily restricted net assets released from restrictions Total revenues, gains, and other support 370,020 26,100 396,120 Expenses and losses: Program services: Counseling services Professional training Community service Total program expenses 233,236 233,236 Support expenses: Management and general Fund-raising Total support expenses Total expenses and losses Change in net assets Net assets, July 1, 2013 Net assets, June 30, 2014 129,204 362,440 129,204 362,440 $204,080 $76,600 $100,000 $380.680 For Graded Problem 1. please start this early, as it will take quite a bit of time to complete. Start with the statement of financial position (i.e., the balance sheet) in part a. And when you do the statement of financial position, use the first 8 items from the adjusted trial balance (i.e., Cash, Pledges Receivable, etc., through Accounts Payable); don't forget to net uncollectible pledges against pledges receivable and accumulated depreciation against Furniture and Equipment. In the Liabilities and Net Assets section of the statement of financial position, you will have to finish parts (b) and (c) first and then come back to part (a) to complete the Net Assets Section For part (C) use Unrestricted Contributions Revenue of $338,820. Instruction number 2 says 1... cash from contributors: $310,800 that was unrestricted The extra $28,020 in Unrestricted Contributions Revenue would have been mainly from non-cash contribution (e.g. furniture and equipments). Also, partc will have you enter the "Net Assets, July 1, 2013." You will find these numbers on the adjusted trial balance (starting with the credit amount of $196,500). Note: you are NOT required to do part d, the Statement of Cash Flows. See also the attached Format Graded Problem 1. That attachment also has numerous check figures. Please start this early, as it will take quite a bit of time to complete. CHILDREN'S COUNSELING CENTER STATEMENT OF FINANCIAL POSITION JUNE 30, 2014 ASSETS CASH PLEDGES RECEIVABLE net of uncollectible pledges) INVENTORY INVESTMENTS (at fair value) FURNITURE AND EQUIPMENT, (net of Accumulated Depreciation) TOTAL ASSETS $394,200 LIABILITIES AND NET ASSETS ACCOUNTS PAYABLE NET ASSETS: UNRESTRICTED TEMPORARILY RESTRICTED $ PERMANENTLY RESTRICTED $ TOTAL NET ASSETS TOTAL LIABILITIES AND NET ASSETS $394, 200 CHILDREN'S COUNSELING CENTER STATEMENT OF FUNCTIONAL EXPENSES YEAR ENDED JUNE 30, 2014 PROGRAM SERVICES COUNSEL. ING SERVICES TOTAL PROFES. SIONAL TRAINING COMMUNITY SERVICES SUPPORTING SERVICES M GMT FUND. AND RAISING GENERAL TOTAL TOTAL SALARIES AND FRINGES OCCUPANCY AND UTILITY SUPPLIES PRINTING AND PUBLISHING TELEPHONE AND POSTAGE UNREALIZED LOSS DEPRECIATION TOTAL EXPENSES $139,976 $55,116 $38,144 $233,236 $91,060 $38,144 $129,204 $362,440 CHILDREN'S COUNSELING CENTER STATEMENT OF ACTIVITIES YEAR ENDED JUNE 30, 2014 Unrestricted Temporarily Restricted Permanently Restricted Total Revenues gains, and other support: Contributions Investment income Temporarily restricted net assets released from restrictions Total revenues, gains, and other support 370,020 26,100 396,120 Expenses and losses: Program services: Counseling services Professional training Community service Total program expenses 233,236 233,236 Support expenses: Management and general Fund-raising Total support expenses Total expenses and losses Change in net assets Net assets, July 1, 2013 Net assets, June 30, 2014 129,204 362,440 129,204 362,440 $204,080 $76,600 $100,000 $380.680