Answered step by step

Verified Expert Solution

Question

1 Approved Answer

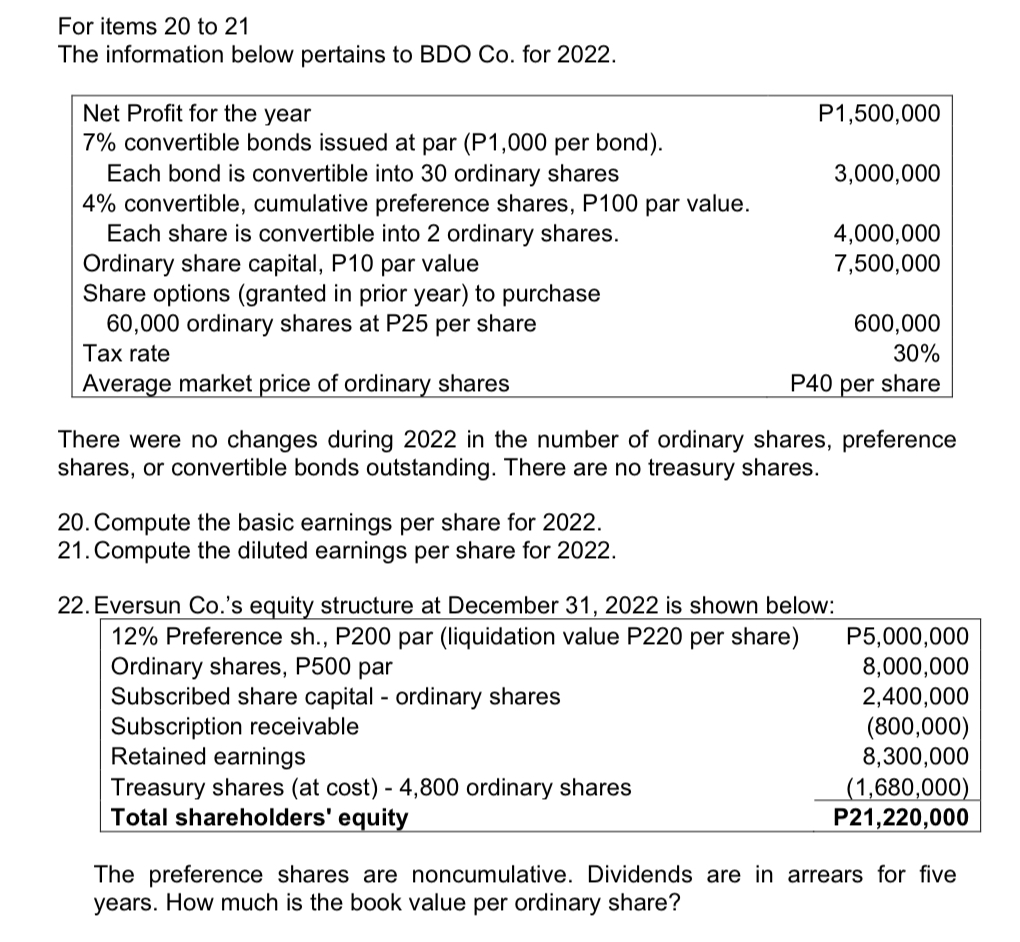

For items 20 to 21 The information below pertains to BDO Co. for 2022. Net Profit for the year 7% convertible bonds issued at

For items 20 to 21 The information below pertains to BDO Co. for 2022. Net Profit for the year 7% convertible bonds issued at par (P1,000 per bond). Each bond is convertible into 30 ordinary shares 4% convertible, cumulative preference shares, P100 par value. Each share is convertible into 2 ordinary shares. Ordinary share capital, P10 par value Share options (granted in prior year) to purchase 60,000 ordinary shares at P25 per share Tax rate Average market price of ordinary shares P1,500,000 3,000,000 4,000,000 7,500,000 600,000 30% P40 per share There were no changes during 2022 in the number of ordinary shares, preference shares, or convertible bonds outstanding. There are no treasury shares. 20. Compute the basic earnings per share for 2022. 21. Compute the diluted earnings per share for 2022. 22. Eversun Co.'s equity structure at December 31, 2022 is shown below: 12% Preference sh., P200 par (liquidation value P220 per share) Ordinary shares, P500 par Subscribed share capital - ordinary shares Subscription receivable Retained earnings Treasury shares (at cost) - 4,800 ordinary shares Total shareholders' equity P5,000,000 8,000,000 2,400,000 (800,000) 8,300,000 (1,680,000) P21,220,000 The preference shares are noncumulative. Dividends are in arrears for five years. How much is the book value per ordinary share?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the stepbystep calculations 20 Calculation of basic EPS for BDO Co Net profit for the year ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663eaf7d8db15_953281.pdf

180 KBs PDF File

663eaf7d8db15_953281.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started