Answered step by step

Verified Expert Solution

Question

1 Approved Answer

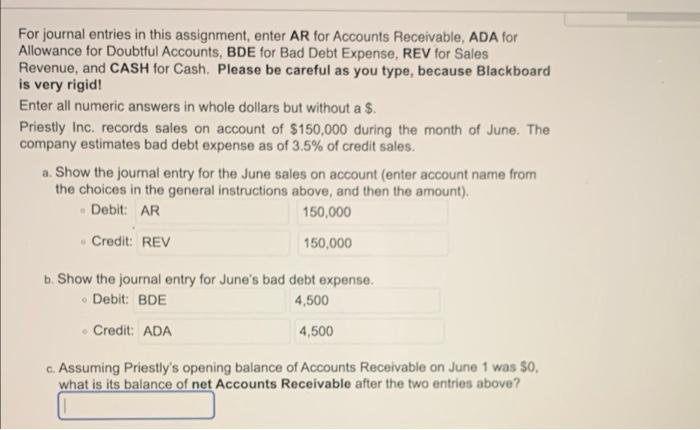

For journal entries in this assignment, enter AR for Accounts Receivable, ADA for Allowance for Doubtful Accounts, BDE for Bad Debt Expense, REV for

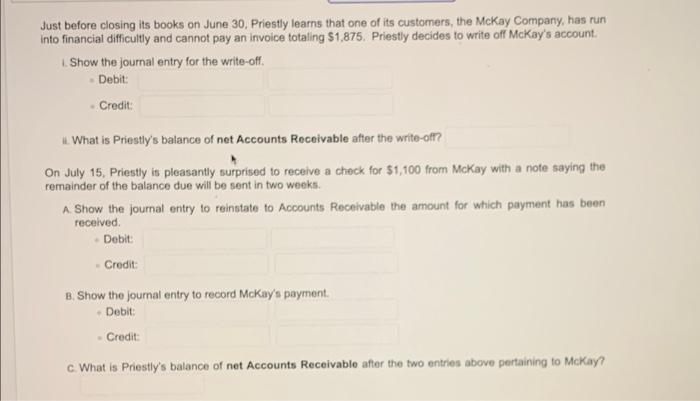

For journal entries in this assignment, enter AR for Accounts Receivable, ADA for Allowance for Doubtful Accounts, BDE for Bad Debt Expense, REV for Sales Revenue, and CASH for Cash. Please be careful as you type, because Blackboard is very rigid! Enter all numeric answers in whole dollars but without a $. Priestly Inc. records sales on account of $150,000 during the month of June. The company estimates bad debt expense as of 3.5% of credit sales. a. Show the journal entry for the June sales on account (enter account name from the choices in the general instructions above, and then the amount). Debit: AR Credit: REV 150,000 150,000 b. Show the journal entry for June's bad debt expense. Debit: BDE 4,500 Credit: ADA 4,500 c. Assuming Priestly's opening balance of Accounts Receivable on June 1 was $0. what is its balance of net Accounts Receivable after the two entries above?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started