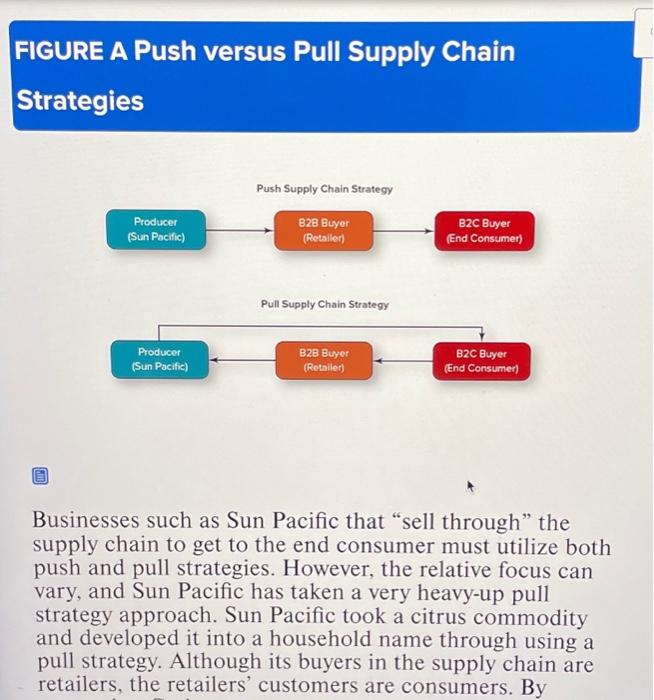

For many years in the United States, navel oranges reigned supreme in citrus. There weren't any particularly well-known brands of navel oranges or any other citrus for that matter; there were just various varieties of breeds of citrus that were supplied to retailers as commodity products. Retailers would remove the fruit from shipping packaging that sometimes had a supplier company brand and offer them in grocery displays devoid of any brand at all. However, around the turn of the twenty-first century, shifting consumer tastes and savvy marketers changed the entire face of the citrus industry in the United States. Grocers began noticing an uptick in consumer demand for Spanish clementines and mandarins over navel oranges. This shift was driven in large part by consumers valuing the convenience of easy peeling and dislike of the presence of seeds in fruit. Citrus farmers in California began noticing this change and in turn began uprooting navel, lemon, and grapefruit groves and replacing them with clementines and mandarins. Sun Pacific and Paramount Citrus, two huge citrus farming operations in California that also were aware of these shifting consumer tastes, joined forces and planted massive acreage of clementines to meet this demand. But more importantly, these two companies successfully branded their produce as Cuties. Within a few years, the Cuties group produced more than three-quarters of the seedless mandarins in the United States. The companies parted ways a number of years later, and Sun Pacific retained the Cuties brand, while Paramount Citrus created a different brand, Wonderful Halos, for the same fruit grown in the groves that they retained. According to Sun Pacific Vice President of Business Development Howard Nager: There are very few brands in the produce industry that a three-year-old can recognize with u ut a label on it and say "that's a Cutie." A lot of work has been done. We were the first to come to market here and the category has just exploded. It has really driven the citrus category. The Cuties brand is actually three different types of fruit depending on the season of the year. From the California groves, Cuties are clementines in mid-October through early January, but from January through May, they are murcotts and tangos. Sun Pacific describes all the fruits under the umbrella of mandarins. By branding all of these fruits as Cuties, Sun Pacific is able to supply retailers throughout a longer period of the year to keep up with consumer demand. Moreover, they have outsourced production to countries such as Chile and Peru for greater supply and a longer availability window for consumers. It is important to note that Sun Pacific is dealing with two types of buyers, namely the business-to-business (B2B) customer such as retailers as well as business-to-consumer (B2C) end consumers such as individuals and households. Both are important since retailers (B2B) must stock Cuties for consumers to be able to purchase them and consumers (B2C) must want the pproduct for it to sell. Promotions targeted at the end consumer (B2C) are called "pull strategies" because they create demand at the end of the supply chain that pulls the product through the chain. Promotions targeted at the retailer (B2B) customer are called "push strategies" because they focus on getting products on store shelves and thus pushing product through the chain. This push and pull for Cuties is shown in 3 Figure A. Businesses such as Sun Pacific that "sell through" the supply chain to get to the end consumer must utilize both push and pull strategies. However, the relative focus can vary, and Sun Pacific has taken a very heavy-up pull strategy approach. Sun Pacific took a citrus commodity and developed it into a household name through using a pull strategy. Although its buyers in the supply chain are retailers, the retailers' customers are consumers. By retailers, the retailers' customers are consumers. By promoting Cuties to consumers directly, Sun Pacific was able to stimulate consumer demand at the end of the supply chain, which in turn stimulates the retailers' demand for Cuties to sell to consumers and pulls the brand through the supply chain. The primary consumer target of Cuties promotions is Millennial and Generation X parents. For example, Cuties' 2017 "100 Days of Summer" campaign featured celebrity endorsers who were popular with Millennial and Generation X parents, a crowdsourcing contest from Snapchat to design new stickers for Cuties, and tie-ins with iHeartRadio stations. The efforts appear to be working as Cuties were named the preferred produce brand among parents in the 2017 Brand Love study by a youth research firm, Smarty Pants. According to Howard Nager: The Brand Love study is great affirmation that our approach to creating strong relationships with parents-especially Millennials, who are now the largest generation-is working. Millennials represent immense purchasing power now and in the future. It's why we spend a great deal of time learning about what's important to them, and use those insights to guide our marketing efforts.... The positivity of our brand and family-friendly As mentioned above, the customers of Sun Pacific are industrial buyers. For several years after the introduction of Cuties, retailers, such as grocery stores and wholesale clubs that sell to end consumers, primarily made up that group of customers. However, Cuties experienced a boost in distribution and consumer awareness in 2014, when Sun Pacific struck a deal with McDonald's to include Cuties as an option in Happy Meals and for sale la carte. The vast majority of Cuties ( 83 percent) are sold as part of Happy Meals rather than a la carte, which reflects the success of the consumer promotions geared toward Millennial and Generation X parents. This co-branding agreement with McDonald's was originally a limited-time promotion lasting from December 2014 through March 2015, but it was highly successful. It was so successful that McDonald's brought Cuties back again in 2016 and thereafter. The incorporation of Cuties into Happy Meals is part of McDonald's larger efforts to offer various healthier options in Happy Meals. This is a very significant move for health advocates, such as The Alliance for Healthier Generation, which partners with McDonald's to improve healthy nutrition for children, because it marked the first time that McDonald's offered a whole fruit option. By June 2018, McDonald's made a transition to healthier Happy Meals at all McDonald's retail locations in the U.S.- and made a commitment to have similar changes implemented in half of its locations globally, within the implemented in half of its locations globally, within the 120 countries where McDonald's stores are located, by 2022. Between 2014 and 2017 alone, McDonald's sold 78 million Cuties to consumers, which translates to roughly 180 Cuties per minute. The branding of Cuties has been so successful that Sun Pacific is not stopping there. The company is expanding the branding efforts to other commodity Page 724 produce and experiencing good results so far. The newest relatives of Cuties mandarins are Mighties kiwi fruits and Sunnies grapes. Other produce companies are following suit and branding their own citrus products as well. Chapter 19 discusses the differences between transactional exchanges versus relational exchanges and various factors that influence whether business relationships would be more likely to be one or the other (industry structure, decision-making culture, decision-making structure, risk tolerance, and nature of purchase). a. Do you think grocery retailers are engaged in transactional or felational exchanges with Sun Pacific? Explain your reasoning relative to the factors listed in the text and case. b. Do you think McDonald's is engaged in transactional or relational exchanges with Sun Pacific? Explain your reasoning relative to the factors listed in the text and case. 4. Are buyers of Cuties just "paying more for the name," or is it due to the economic benefits associated with the name? What, if any, economic benefits accrue to buyers of Cuties? 5. The case distinguishes push and pull strategies. The case mentions that Sun Pacific heavily uses a pull strategy because the promotions target the end consumers of the supply chain. However, they also would have to promote to the retailers (B2B) customers as well to ensure they stock the product on their stores and outlets. Design promotional materials, including key selling "points, that Sun Pacific could use to "sell" its product successfully to its B2B customers. 6. Executives of Sun Pacific explicitly state that advertising and promotions are targeting Millennials as part of the pull strategy. In what ways do the promotions for Cuties, as well as the product itself, appeal to this generation