Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For May 2023, ABC CORP. had cost of goods manufactured equal to P90,000 of which 75% is considered variable within the entire production for

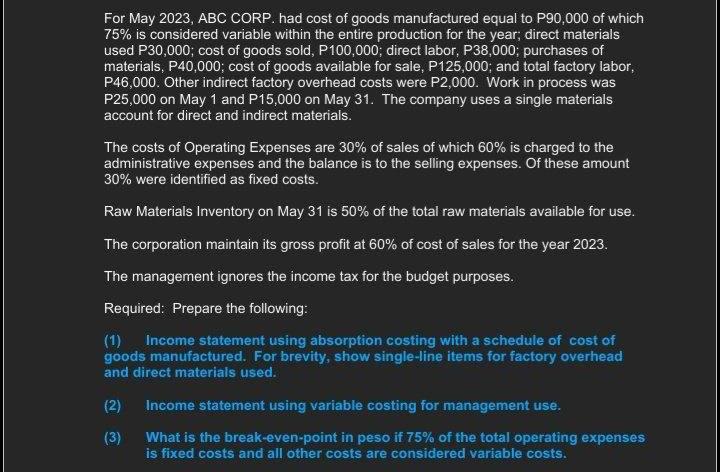

For May 2023, ABC CORP. had cost of goods manufactured equal to P90,000 of which 75% is considered variable within the entire production for the year; direct materials used P30,000; cost of goods sold, P100,000; direct labor, P38,000; purchases of materials, P40,000; cost of goods available for sale, P125,000; and total factory labor, P46,000. Other indirect factory overhead costs were P2,000. Work in process was P25,000 on May 1 and P15,000 on May 31. The company uses a single materials account for direct and indirect materials. The costs of Operating Expenses are 30% of sales of which 60% is charged to the administrative expenses and the balance is to the selling expenses. Of these amount 30% were identified as fixed costs. Raw Materials Inventory on May 31 is 50% of the total raw materials available for use. The corporation maintain its gross profit at 60% of cost of sales for the year 2023. The management ignores the income tax for the budget purposes. Required: Prepare the following: (1) Income statement using absorption costing with a schedule of cost of goods manufactured. For brevity, show single-line items for factory overhead and direct materials used. (2) Income statement using variable costing for management use. (3) What is the break-even-point in peso if 75% of the total operating expenses is fixed costs and all other costs are considered variable costs.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

ABC CORP May 2023 Statements and BreakEven Point Calculation 1 Income Statement using Absorption Costing Schedule of Cost of Goods Manufactured ItemAm...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started