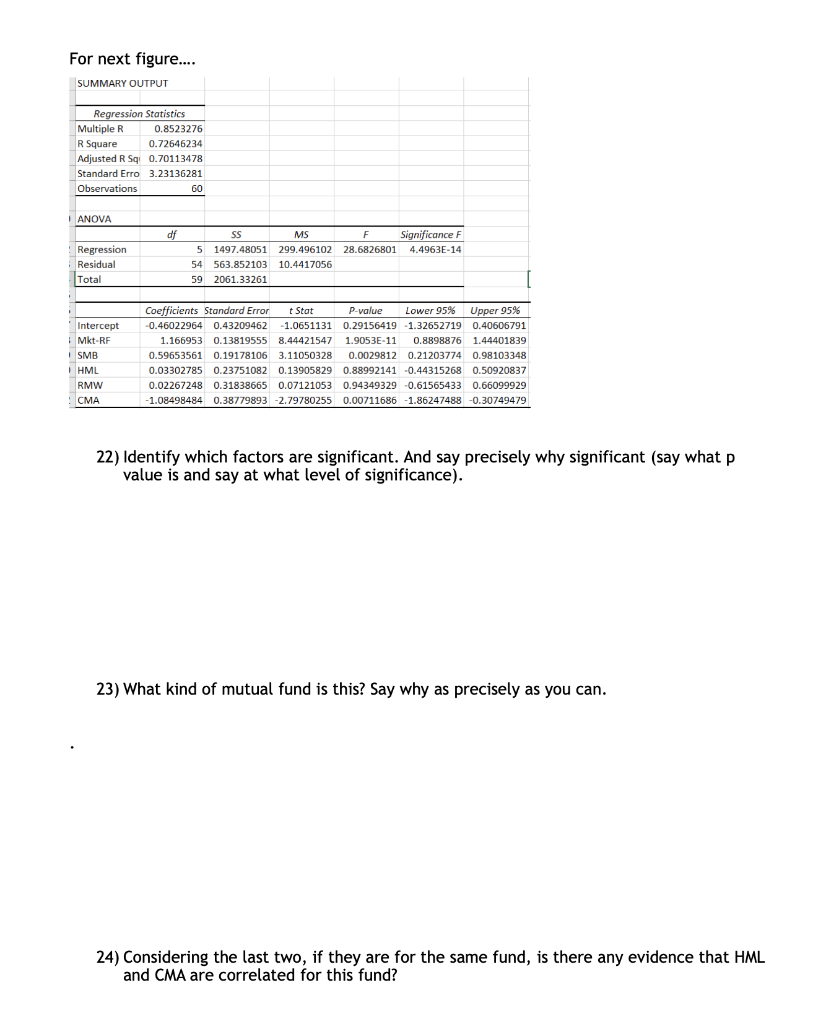

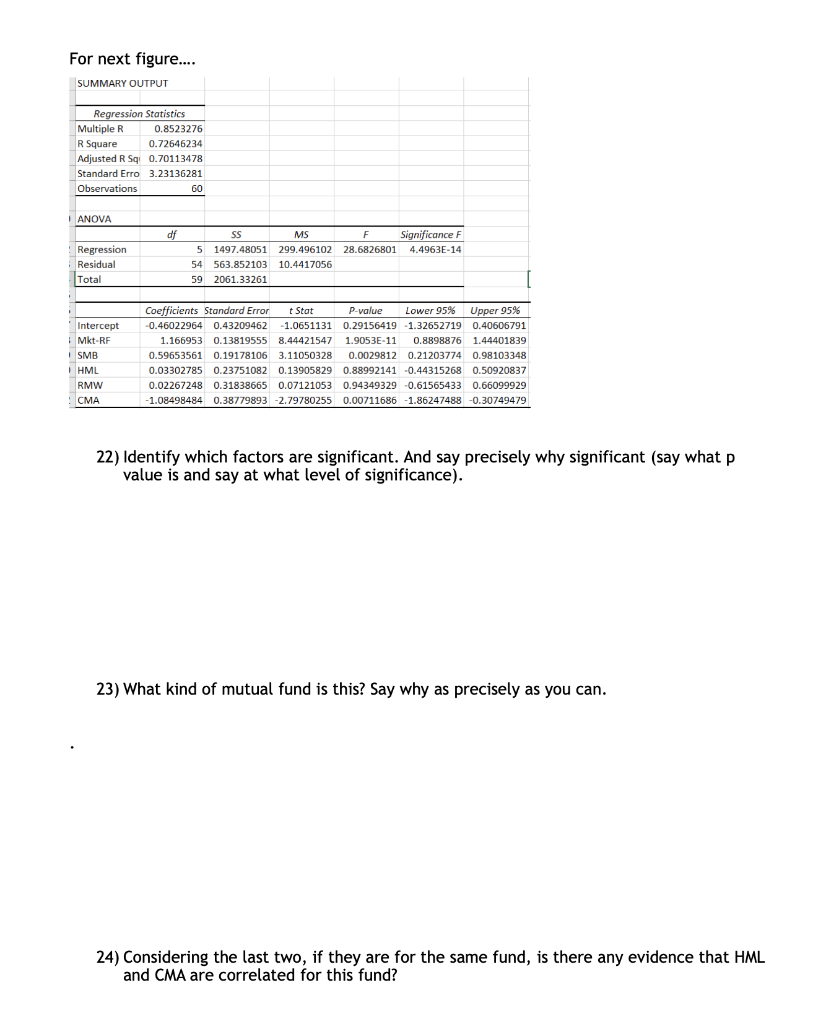

For next figure.... SUMMARY OUTPUT Regression Statistics Multiple R 0.8523276 R Square 0.72646234 Adjusted R S 0.70113478 Standard Erro 3.23136281 Observations 60 ANOVA df Regression Residual Total SS MS F Significance F 5 5 1497.48051 299.496102 28.6826801 4.4963E-14 54 563.852103 10.4417056 59 2061.33261 Intercept Mkt-RF SMB HML RMW CMA Coefficients Standard Error t Stat P-value Lower 95% Upper 95% % -0.46022964 0.43209462 -1.0651131 0.29156419 -1.32652719 0.40606791 1.166953 0.13819555 8,44421547 1.9053E-11 0.8898876 1.44401839 0.59653561 0.19178106 3.11050328 0.0029812 0.21203774 0.98103348 0.03302785 0.23751082 0.13905829 0.88992141 -0.44315268 0.50920837 0.02267248 0.31838665 0.07121053 0.94349329 -0.61565433 0.66099929 -1.08498484 0.38779893 -2.79780255 0.00711686 -1.86247488 -0.30749479 22) Identify which factors are significant. And say precisely why significant (say what p value is and say at what level of significance). 23) What kind of mutual fund is this? Say why as precisely as you can. 24) Considering the last two, if they are for the same fund, is there any evidence that HML and CMA are correlated for this fund? For next figure.... SUMMARY OUTPUT Regression Statistics Multiple R 0.8523276 R Square 0.72646234 Adjusted R S 0.70113478 Standard Erro 3.23136281 Observations 60 ANOVA df Regression Residual Total SS MS F Significance F 5 5 1497.48051 299.496102 28.6826801 4.4963E-14 54 563.852103 10.4417056 59 2061.33261 Intercept Mkt-RF SMB HML RMW CMA Coefficients Standard Error t Stat P-value Lower 95% Upper 95% % -0.46022964 0.43209462 -1.0651131 0.29156419 -1.32652719 0.40606791 1.166953 0.13819555 8,44421547 1.9053E-11 0.8898876 1.44401839 0.59653561 0.19178106 3.11050328 0.0029812 0.21203774 0.98103348 0.03302785 0.23751082 0.13905829 0.88992141 -0.44315268 0.50920837 0.02267248 0.31838665 0.07121053 0.94349329 -0.61565433 0.66099929 -1.08498484 0.38779893 -2.79780255 0.00711686 -1.86247488 -0.30749479 22) Identify which factors are significant. And say precisely why significant (say what p value is and say at what level of significance). 23) What kind of mutual fund is this? Say why as precisely as you can. 24) Considering the last two, if they are for the same fund, is there any evidence that HML and CMA are correlated for this fund