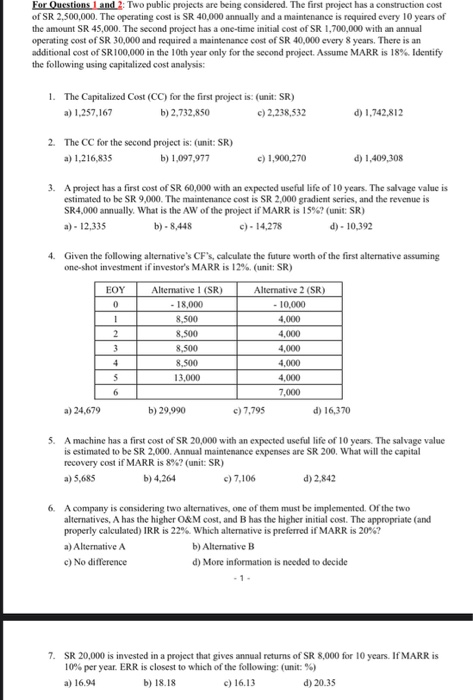

For Ouestions and 2: Two public projects are being considered. The first project has a construction cost of SR 2,500,000. The operating cost is SR 40,000 annually and a maintenance is required every 10 years of the amount SR 45,000. The second project has a one-time initial cost of SR 1,700,000 with an annual operating cost of SR 30,000 and required a maintenance cost of SR 40,000 every 8 years. There is an additional cost of SR100,000 in the 10th year only for the second project. Assume MARR is 18%. Identify the following using capitalized cost analysis 1. The Capitalized Cost (CC) for the first project is: (unit: SR) a) 1,257,167 b) 2,732,850 c)2,238,532 d) 1,742,812 2. The CC for the second project is (unit: SR) a) 1,216,835 b) 1,097,977 c) 1,900,270 d) 1,409,308 3. A project has a first cost of SR 60,000 with an expected useful life of 10 years. The salvage value is estimated to be SR 9,000. The maintenance cost is SR 2.000 gradient series, and the revenue is SR4,000 annually. What is the AW of the project if MARR is 15% (unit: SR) a)- 12,335 b) - 8,448 c) - 14.278 d) - 10,392 4. Given the following alternative's CF's, calculate the future worth of the first alternative assuming one-shot investment if investor's MARR is 12% (unit: SR) FOY 0 1 2 Alternative I (SR) -18,000 8 .500 8.500 8 ,500 8.500 13,000 3 Alternative 2 (SR) - 10.000 4,000 4,000 4,000 4.000 4,000 7,000 c) 7,795 d) 16,370 5 a) 24,679 b) 29,990 5. A machine has a first cost of SR 20,000 with an expected useful life of 10 years. The salvage value is estimated to be SR 2,000. Annual maintenance expenses are SR 200. What will the capital recovery cost if MARR is 8%? (unit: SR) a) 5,685 b ) 4,264 c) 7,106 d) 2,842 6. Acompany is considering two alternatives, one of them must be implemented. Of the two alternatives. A has the higher O&M cost, and B has the higher initial cost. The appropriate and properly calculated) IRR is 22%. Which alternative is preferred if MARR is 20%? a) Alternative A b) Alternative B c) No difference d) More information is needed to decide 7. SR 20,000 is invested in a project that gives annual returns of SR 8,000 for 10 years. If MARR is 10% per year. ERR is closest to which of the following: (unit: %) a) 16,94 b) 18.18 c) 16.13 d) 20.35