Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For P6-2, prepare: (1) a Value Analysis; (2) a D&D schedule; (3) an Analysis of the Balance Sheet Changes on the Acquisition Date (as illustrated

For P6-2, prepare: (1) a Value Analysis; (2) a D&D schedule; (3) an Analysis of the Balance Sheet Changes on the Acquisition Date (as illustrated in the first video for the first lecture and similar to the one on the bottom of p. 327); (4) the T-Account worksheet (see link below); (5) the formal Statement of Cash Flows and (6) the Schedule of Noncash Investing Activity.

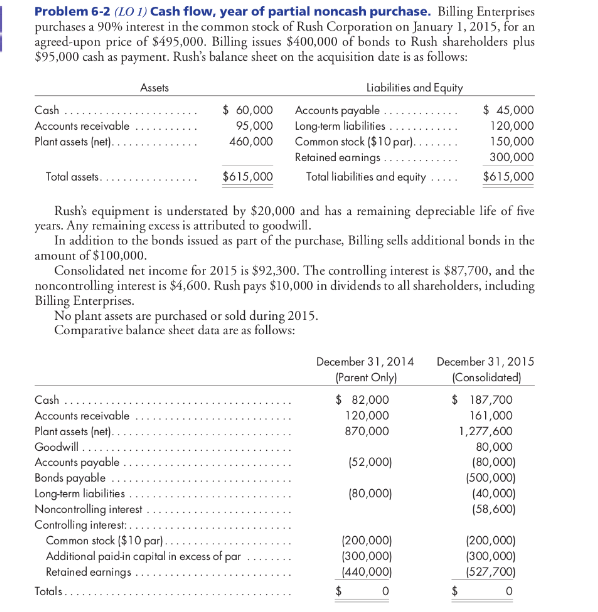

Problem 6-2 (LOI) Cash flow, year of partial noncash purchase. Billing Enterprises purchases a 90% interest in the common stock of Rush Corporation on January 1, 2015, for an agreed-upon price of $495,000. Billing issues $400,000 of bonds to Rush shareholders plus $95,000 cash as payment. Rush's balance sheet on the acquisition date is as follows: Assets Cash ........... Accounts receivable Plant assets (net).......... $ 60,000 95,000 460,000 Liabilities and Equity Accounts payable Long-term liabilities ............ Common stock ($10 par)........ Retained earings Total liabilities and equity ..... . $ 45,000 120,000 150,000 300,000 $615,000 Total assets........... $615,000 Rush's equipment is understated by $20,000 and has a remaining depreciable life of five years. Any remaining excess is attributed to goodwill. In addition to the bonds issued as part of the purchase, Billing sells additional bonds in the amount of $100,000. Consolidated net income for 2015 is $92,300. The controlling interest is $87,700, and the noncontrolling interest is $4,600. Rush pays $10,000 in dividends to all shareholders, including Billing Enterprises. No plant assets are purchased or sold during 2015. Comparative balance sheet data are as follows: December 31, 2014 (Parent Only) $ 82,000 120,000 870,000 December 31, 2015 (Consolidated) $ 187,700 161,000 1,277,600 80,000 (80,000) (500,000) (40,000) (58,600) Cash ....... Accounts receivable ................ Plant assets (net). .......................... Goodwill.......... Accounts payable ................. Bonds payable ........................ Long-term liabilities ......................... Noncontrolling interest ........................ Controlling interest:........ Common stock ($10 par)......... Additional paid.in capital in excess of par ........ Retained earnings .... Totals ........... (52,000) (80,000) 1200,000) (300,000) 1440,000) $ 0 (200,000) (300,000) (527,700) Problem 6-2 (LOI) Cash flow, year of partial noncash purchase. Billing Enterprises purchases a 90% interest in the common stock of Rush Corporation on January 1, 2015, for an agreed-upon price of $495,000. Billing issues $400,000 of bonds to Rush shareholders plus $95,000 cash as payment. Rush's balance sheet on the acquisition date is as follows: Assets Cash ........... Accounts receivable Plant assets (net).......... $ 60,000 95,000 460,000 Liabilities and Equity Accounts payable Long-term liabilities ............ Common stock ($10 par)........ Retained earings Total liabilities and equity ..... . $ 45,000 120,000 150,000 300,000 $615,000 Total assets........... $615,000 Rush's equipment is understated by $20,000 and has a remaining depreciable life of five years. Any remaining excess is attributed to goodwill. In addition to the bonds issued as part of the purchase, Billing sells additional bonds in the amount of $100,000. Consolidated net income for 2015 is $92,300. The controlling interest is $87,700, and the noncontrolling interest is $4,600. Rush pays $10,000 in dividends to all shareholders, including Billing Enterprises. No plant assets are purchased or sold during 2015. Comparative balance sheet data are as follows: December 31, 2014 (Parent Only) $ 82,000 120,000 870,000 December 31, 2015 (Consolidated) $ 187,700 161,000 1,277,600 80,000 (80,000) (500,000) (40,000) (58,600) Cash ....... Accounts receivable ................ Plant assets (net). .......................... Goodwill.......... Accounts payable ................. Bonds payable ........................ Long-term liabilities ......................... Noncontrolling interest ........................ Controlling interest:........ Common stock ($10 par)......... Additional paid.in capital in excess of par ........ Retained earnings .... Totals ........... (52,000) (80,000) 1200,000) (300,000) 1440,000) $ 0 (200,000) (300,000) (527,700)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started