For part 1 to 8, please provide the step-by-step calculations and also the solution. For part 9, please answer the question with true or false and also with explainations, thank you.

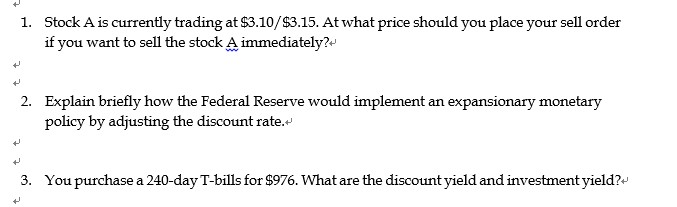

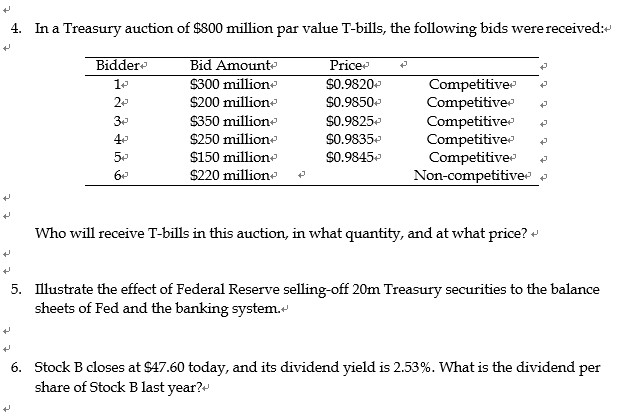

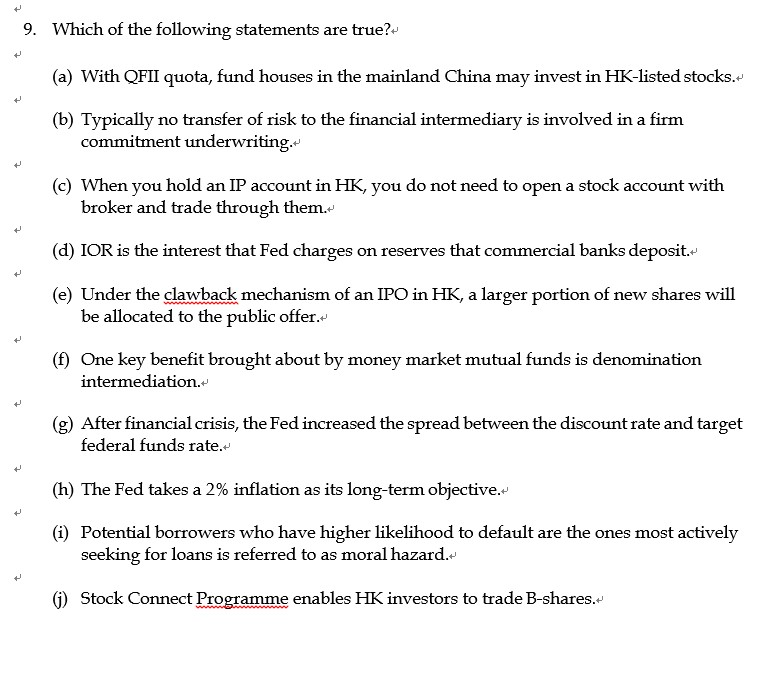

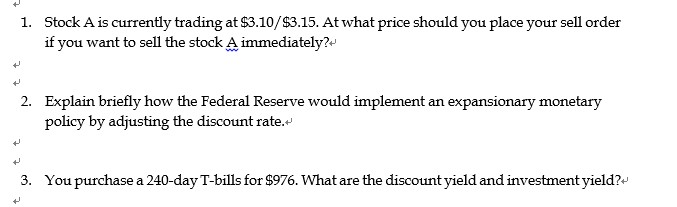

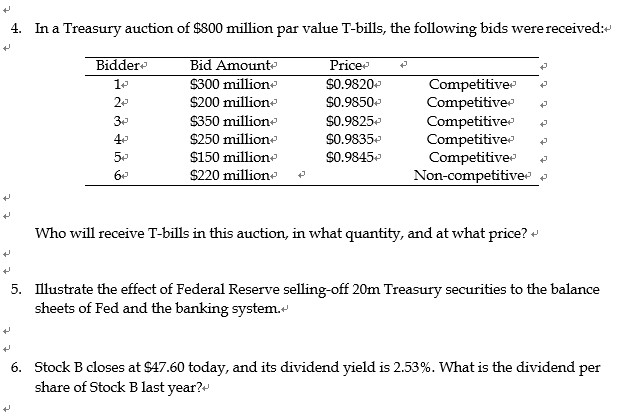

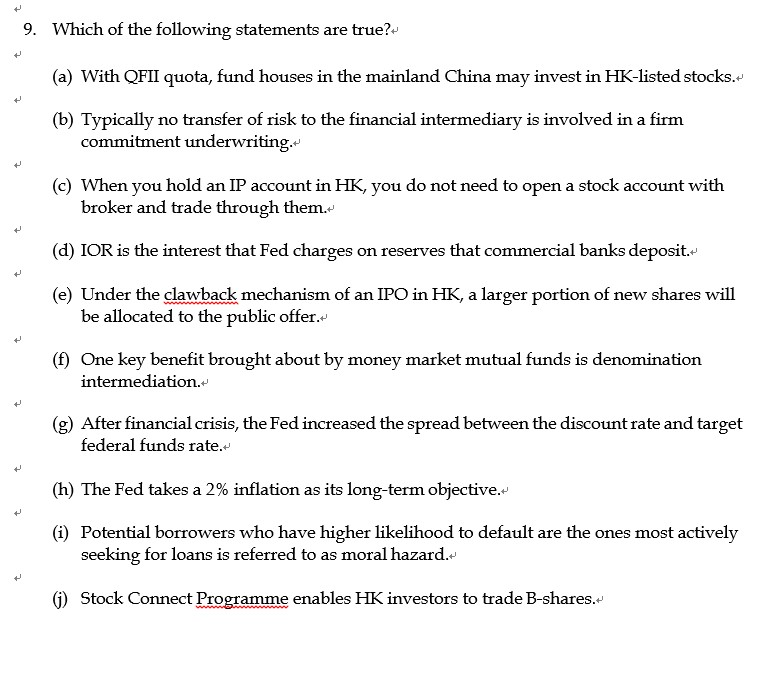

1. Stock A is currently trading at $3.10/$3.15. At what price should you place your sell order if you want to sell the stock A immediately? 2. Explain briefly how the Federal Reserve would implement an expansionary monetary policy by adjusting the discount rate. 3. You purchase a 240-day T-bills for $976. What are the discount yield and investment yield? 4. In a Treasury auction of $800 million par value T-bills, the following bids were received: Biddere Bid Amounte $300 millione $200 million $350 million- $250 million $150 million $220 million- Price $0.9820- $0.9850- $0.98254 $0.98352 $0.98452 Competitive Competitive Competitive Competitive Competitive. Non-competitive + + + + Who will receive T-bills in this auction, in what quantity, and at what price? 5. Illustrate the effect of Federal Reserve selling-off 20m Treasury securities to the balance sheets of Fed and the banking system. 6. Stock B closes at S47.60 today, and its dividend yield is 2.53%. What is the dividend per share of Stock B last year?' 7. Explain the effect of Fed's substantial trading in the MBS market during QE. 8. Do you expect a rise or drop in the share price after the announcement of the rights issue? Explain briefly. 9. Which of the following statements are true? (a) With QFII quota, fund houses in the mainland China may invest in HK-listed stocks. (b) Typically no transfer of risk to the financial intermediary is involved in a firm commitment underwriting. (c) When you hold an IP account in HK, you do not need to open a stock account with broker and trade through them.' (d) IOR is the interest that Fed charges on reserves that commercial banks deposit. (e) Under the clawback mechanism of an IPO in HK, a larger portion of new shares will be allocated to the public offer. (f) One key benefit brought about by money market mutual funds is denomination intermediation. (g) After financial crisis, the Fed increased the spread between the discount rate and target federal funds rate. (h) The Fed takes a 2% inflation as its long-term objective. (i) Potential borrowers who have higher likelihood to default are the ones most actively seeking for loans is referred to as moral hazard. (1) Stock Connect Programme enables HK investors to trade B-shares