Answered step by step

Verified Expert Solution

Question

1 Approved Answer

for Part (B and C) the second pic is posted Explain in your own words, why you think a company might or would want to

for Part (B and C) the second pic is posted

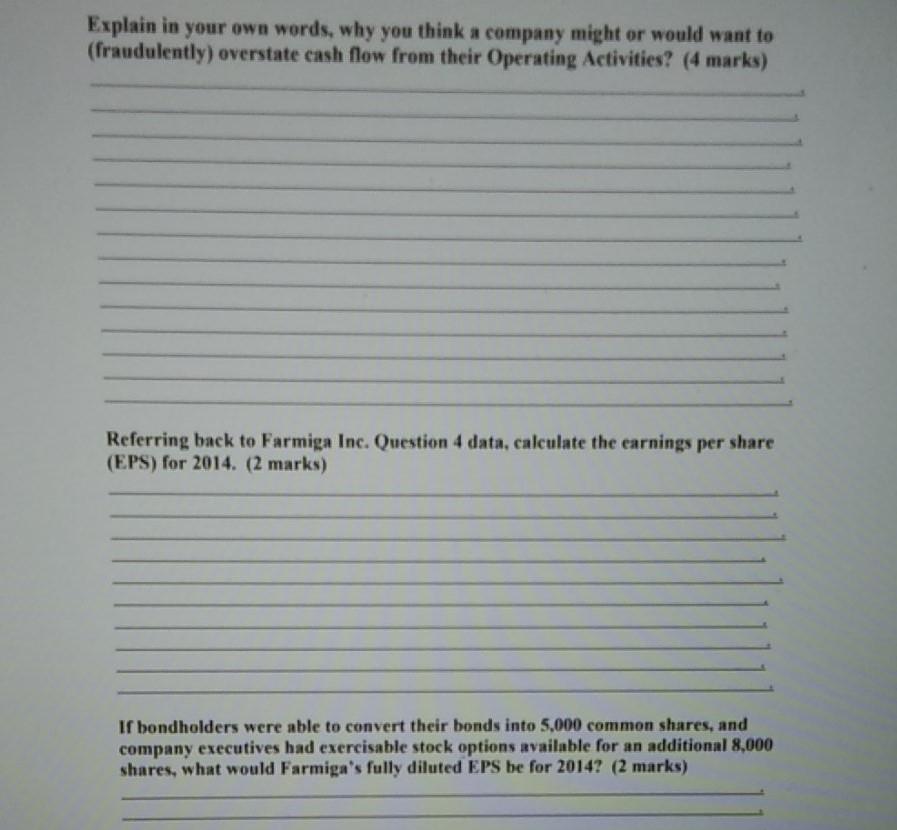

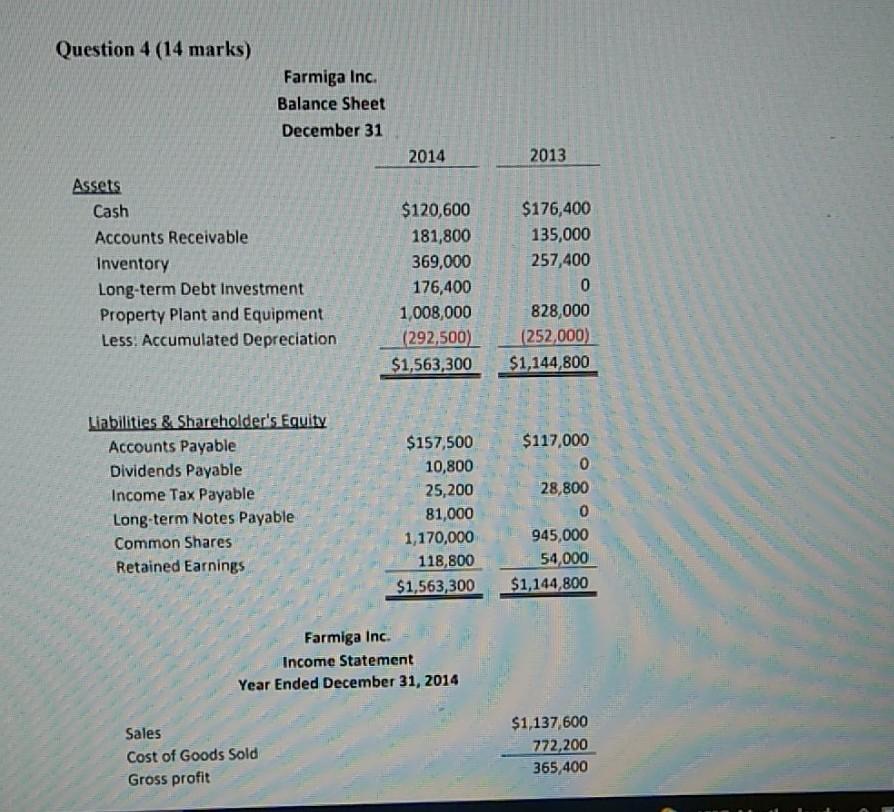

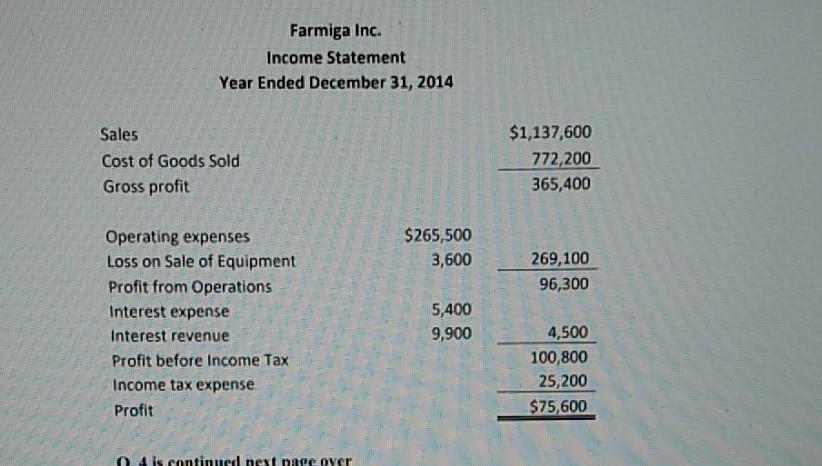

Explain in your own words, why you think a company might or would want to (fraudulently) overstate cash flow from their Operating Activities? (4 marks) Referring back to Farmiga Inc. Question 4 data, calculate the earnings per share (EPS) for 2014. (2 marks) If bondholders were able to convert their bonds into 5.000 common shares, and company executives had exercisable stock options available for an additional 8,000 shares, what would Farmiga's fully diluted EPS be for 2014? (2 marks) Question 4 (14 marks) Farmiga Inc. Balance Sheet December 31 2014 2013 Assets Cash Accounts Receivable Inventory Long-term Debt Investment Property Plant and Equipment Less. Accumulated Depreciation $120,600 181,800 369,000 176,400 1,008,000 (292,500) $1,563,300 $176,400 135,000 257,400 0 828,000 (252,000) $1,144,800 Liabilities & Shareholder's Equity Accounts Payable Dividends Payable Income Tax Payable Long-term Notes Payable Common Shares Retained Earnings $157,500 10,800 25,200 81,000 1,170,000 118,800 $1,563,300 $117,000 0 28,800 0 945,000 54,000 $1,144,800 Farmiga Inc. Income Statement Year Ended December 31, 2014 Sales Cost of Goods Sold Gross profit $1,137,600 772,200 365,400 Farmiga Inc. Income Statement Year Ended December 31, 2014 Sales Cost of Goods Sold Gross profit $1,137,600 772,200 365,400 $265,500 3,600 269,100 96,300 Operating expenses Loss on Sale of Equipment Profit from Operations Interest expense Interest revenue Profit before Income Tax Income tax expense Profit 5,400 9,900 4,500 100,800 25,200 $75,600 04 is continued next page byer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started