for part C2 please write how much the profit would increase

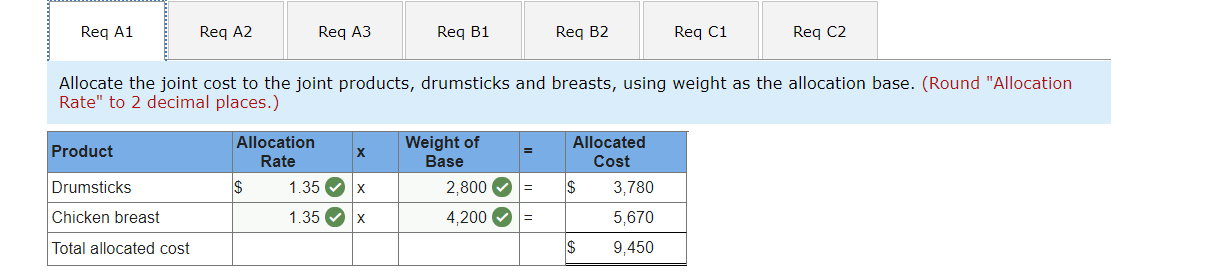

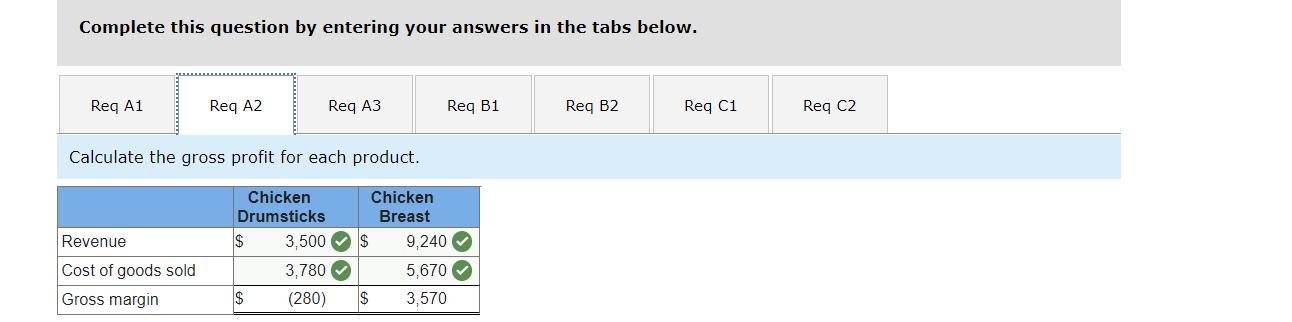

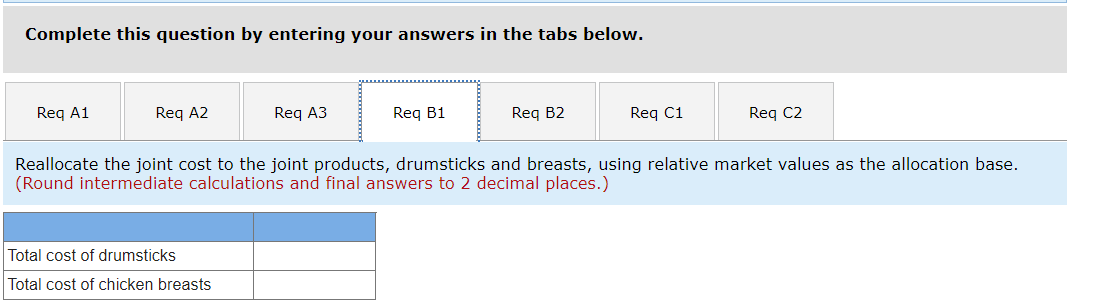

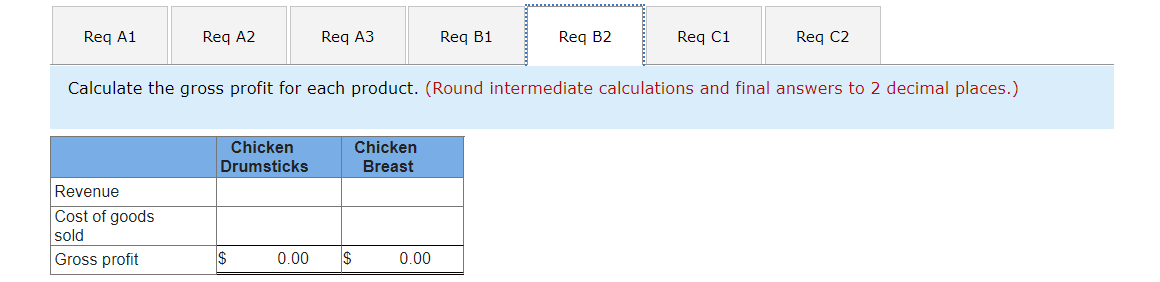

Req A1 Req A2 Req A3 Req B1 Req B2 Req C1 Req C2 Allocate the joint cost to the joint products, drumsticks and breasts, using weight as the allocation base. (Round "Allocation Rate" to 2 decimal places.) Product Allocation X Weight of Allocated Rate Base Cost Drumsticks $ 1.35 X 2,800 = $ 3,780 Chicken breast 1.35 X 4,200 = 5,670 Total allocated cost $ 9,450Complete this question by entering your answers in the tabs below. Req A1 Req A2 Req A3 Req B1 Req B2 Req C1 Req C2 Calculate the gross profit for each product. Chicken Chicken Drumsticks Breast Revenue $ 3,500 $ 9,240 Cost of goods sold 3,780 5,670 Gross margin $ (280) 3,570Complete this question by entering your answers in the tabs below. Req A1 Req A2 Req A3 Req B1 Req B2 Req C1 Reg C2 Reallocate the joint cost to the joint products, drumsticks and breasts, using relative market values as the allocation base. (Round intermediate calculations and final answers to 2 decimal places.) Total cost of drumsticks Total cost of chicken breastsReq A1 Req A2 Req A3 Req B1 Req B2 Req C1 Req C2 Calculate the gross profit for each product. (Round intermediate calculations and final answers to 2 decimal places.) Chicken Chicken Drumsticks Breast Revenue Cost of goods sold Gross profit $ 0.00 $ 0.00Req A1 Req A2 Req A3 Req B1 Req B2 Req C1 Req C2 How would the profit be affected by your answer in c-1? Effect on profit increase VHarper Chicken Corporation processes and packages chicken for grocery stores. It purchases chickens from farmers and processes them into two different products: chicken drumsticks and chicken steak. From a standard batch of 12,000 pounds of raw chicken that costs $7,000, the company produces two parts: 2,800 pounds of drumsticks and 4,200 pounds of breast for a processing cost of $2,450. The chicken breast is further processed into 3,200 pounds of steak for a processing cost of $2,000. The market price of drumsticks per pound is $1.25 and the market price per pound of chicken steak is $4.20. If Harper decided to sell chicken breast instead of chicken steak, the price per pound would be $2.20. Required u-1. Allocate thejoint cost to the joint products, drumsticks and breasts, using weight as the allocation base. a-2. Calculate the gross profit for each product. a-3. lfthe drumsticks are producing a loss, should that product line be eliminated? b-1. Reallocate thejoint cost to thejoint products, drumsticks and breasts, using relative market values as the allocation base. b-2. Calculate the gross prot for each product. c-1. Should Harper further process chicken breasts into chicken steak? [Use the assumption made in requirement bi). c-2. How would the prot be affected by your answer in cT