Answered step by step

Verified Expert Solution

Question

1 Approved Answer

for Peter and Jenny. Peter and Jenny are married and live in Melbourne. Peter is age 63 and Jenny is age 57. They are

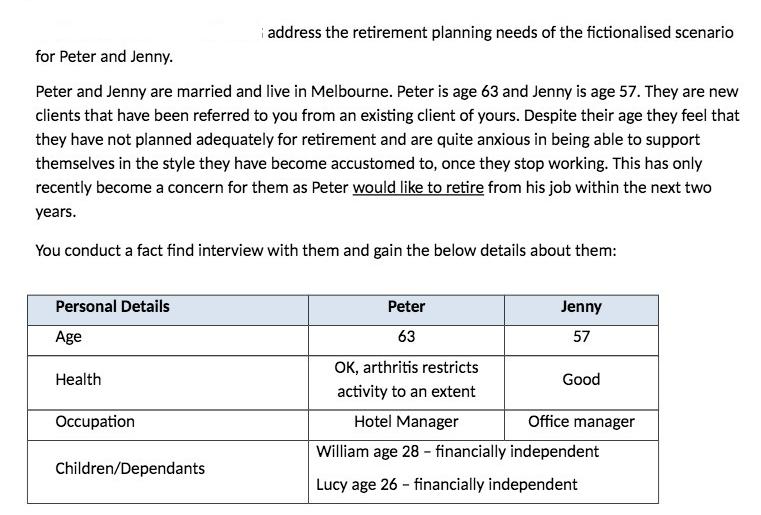

for Peter and Jenny. Peter and Jenny are married and live in Melbourne. Peter is age 63 and Jenny is age 57. They are new clients that have been referred to you from an existing client of yours. Despite their age they feel that they have not planned adequately for retirement and are quite anxious in being able to support themselves in the style they have become accustomed to, once they stop working. This has only recently become a concern for them as Peter would like to retire from his job within the next two years. You conduct a fact find interview with them and gain the below details about them: Personal Details Age Health Occupation address the retirement planning needs of the fictionalised scenario Children/Dependants Peter 63 OK, arthritis restricts activity to an extent Jenny 57 Good Hotel Manager William age 28 - financially independent Lucy age 26 - financially independent Office manager

Step by Step Solution

★★★★★

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Solution Based on the information provided it appears that Peter and Jenny are facing a common problem many people encounter when it comes to retirement planning they have not planned adequately for r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started