Question

For problems 13-14, first calculate the unlevered industry beta from the table below. Next, calculate the adjusted levered beta for each company from the table

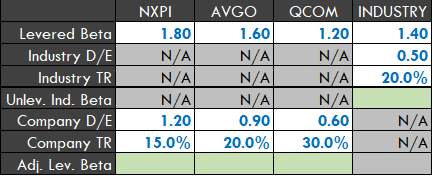

For problems 13-14, first calculate the unlevered industry beta from the table below. Next, calculate the adjusted levered beta for each company from the table below. Assume that capital structure is the only factor in determining relative risk of companies within the industry.

13- NXPIs adjusted levered beta is closest to (2 points):

A) 1.18

B) 1.65

C) 1.72

D) 2.02

E) 2.12

14- Which of the following statements is most likely FASLE:

A) Based on the adjusted levered betas, NXPI is more risky than Company AVGO

B) Based on the adjusted levered betas, AVGO is more risky than Company QCOM

C) Based on the adjusted levered betas, NXPI is more risky than Company QCOM

D) Comparing Company NXPIs adjusted levered beta to the levered beta of the industry, it can be assumed that NXPI is more risky than the average company in the industry

E) Comparing QCOMs adjusted levered beta to the levered beta of the industry, it can be assumed that QCOM is less risky than the average company in the industry

NXPI AVGO QCOM INDUSTRY 1.40 N/A N/A N/A 0.50 N/A20.0% 1.80 1.60 Levered Beta Industry D/E Industry TR Unlev. Ind. Beta Company D/E (AMmf "Almy ,IR Adj. Lev. Beta 1.20 N/A N/A N/A N/A N/A 1.200.900.60 N/A 15.0% 20.0% 30.0% /AStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started