Answered step by step

Verified Expert Solution

Question

1 Approved Answer

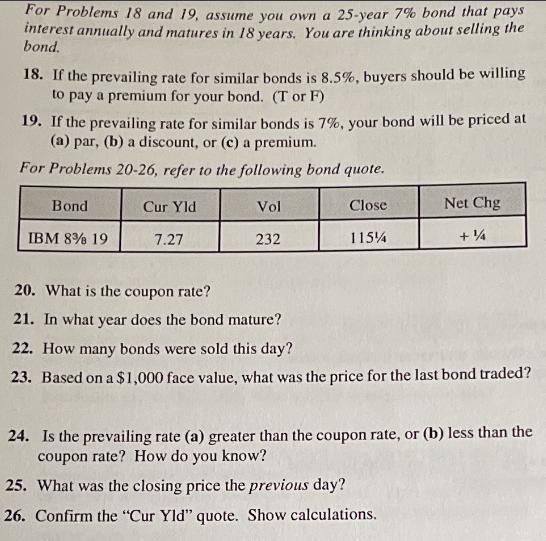

For Problems 18 and 19, assume you own a 25-year 7% bond that pays interest annually and matures in 18 years. You are thinking

For Problems 18 and 19, assume you own a 25-year 7% bond that pays interest annually and matures in 18 years. You are thinking about selling the bond. 18. If the prevailing rate for similar bonds is 8.5%, buyers should be willing to pay a premium for your bond. (T or F) 19. If the prevailing rate for similar bonds is 7%, your bond will be priced at (a) par, (b) a discount, or (c) a premium. For Problems 20-26, refer to the following bond quote. Close Bond IBM 8% 19 Cur Yld 7.27 Vol 232 115% Net Chg + 20. What is the coupon rate? 21. In what year does the bond mature? 22. How many bonds were sold this day? 23. Based on a $1,000 face value, what was the price for the last bond traded? 25. What was the closing price the previous day? 26. Confirm the "Cur Yld" quote. Show calculations. 24. Is the prevailing rate (a) greater than the coupon rate, or (b) less than the coupon rate? How do you know?

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started