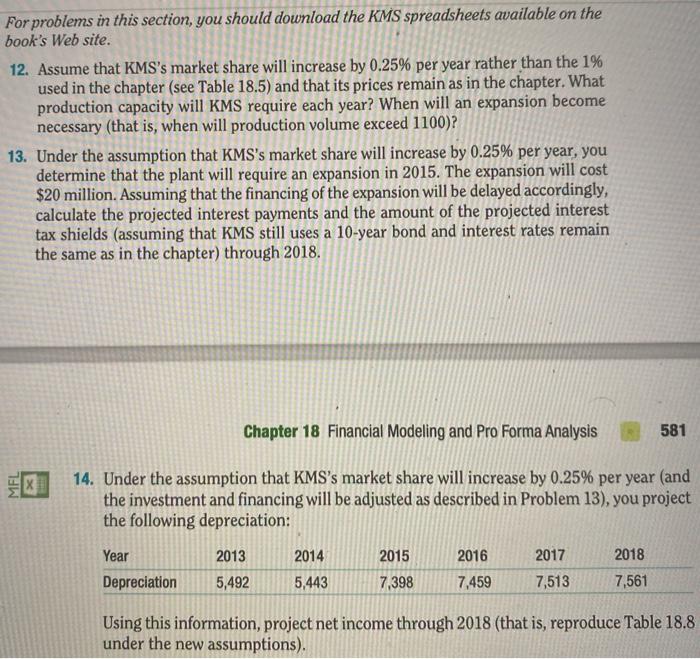

For problems in this section, you should download the KMS spreadsheets available on the book's Web site. 12. Assume that KMS's market share will increase by 0.25% per year rather than the 1% used in the chapter (see Table 18.5) and that its prices remain as in the chapter. What production capacity will KMS require each year? When will an expansion become necessary (that is, when will production volume exceed 1100)? 13. Under the assumption that KMS's market share will increase by 0.25% per year, you determine that the plant will require an expansion in 2015. The expansion will cost $20 million. Assuming that the financing of the expansion will be delayed accordingly, calculate the projected interest payments and the amount of the projected interest tax shields (assuming that KMS still uses a 10-year bond and interest rates remain the same as in the chapter) through 2018. Chapter 18 Financial Modeling and Pro Forma Analysis 581 MFL 14. Under the assumption that KMS's market share will increase by 0.25% per year (and the investment and financing will be adjusted as described in Problem 13), you project the following depreciation: 2016 2018 Year Depreciation 2013 5,492 2014 5,443 2015 7,398 2017 7,513 7.459 7,561 Using this information, project net income through 2018 (that is, reproduce Table 18.8 under the new assumptions). For problems in this section, you should download the KMS spreadsheets available on the book's Web site. 12. Assume that KMS's market share will increase by 0.25% per year rather than the 1% used in the chapter (see Table 18.5) and that its prices remain as in the chapter. What production capacity will KMS require each year? When will an expansion become necessary (that is, when will production volume exceed 1100)? 13. Under the assumption that KMS's market share will increase by 0.25% per year, you determine that the plant will require an expansion in 2015. The expansion will cost $20 million. Assuming that the financing of the expansion will be delayed accordingly, calculate the projected interest payments and the amount of the projected interest tax shields (assuming that KMS still uses a 10-year bond and interest rates remain the same as in the chapter) through 2018. Chapter 18 Financial Modeling and Pro Forma Analysis 581 MFL 14. Under the assumption that KMS's market share will increase by 0.25% per year (and the investment and financing will be adjusted as described in Problem 13), you project the following depreciation: 2016 2018 Year Depreciation 2013 5,492 2014 5,443 2015 7,398 2017 7,513 7.459 7,561 Using this information, project net income through 2018 (that is, reproduce Table 18.8 under the new assumptions)