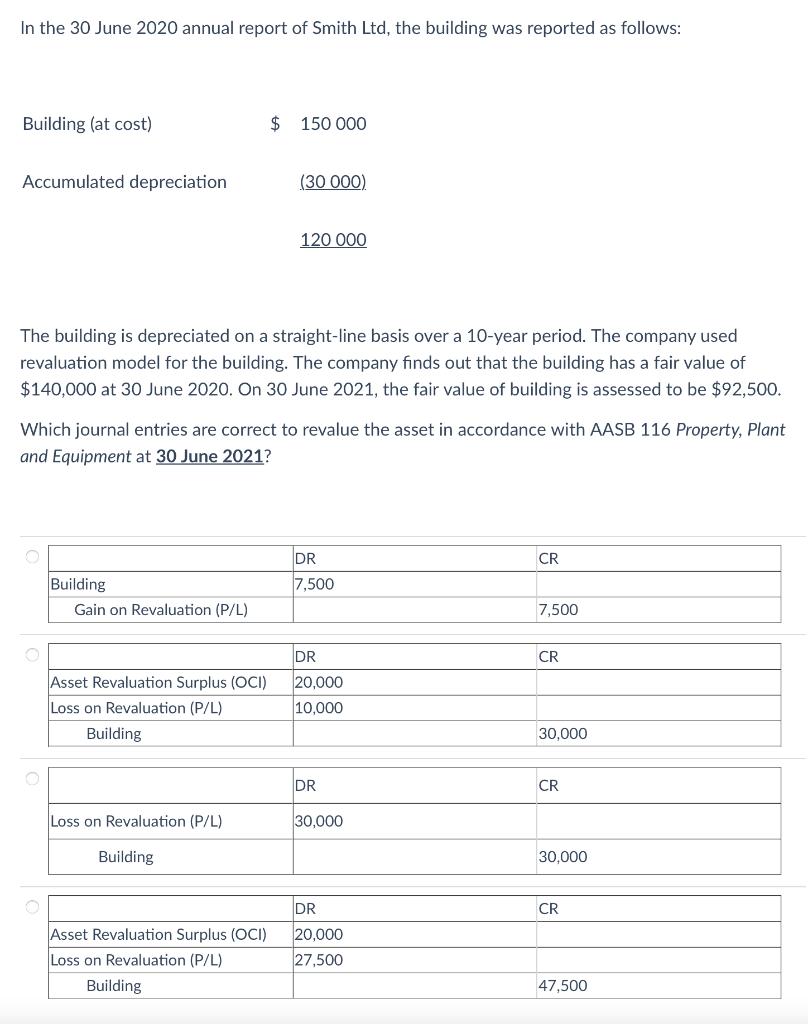

In the 30 June 2020 annual report of Smith Ltd, the building was reported as follows: Building (at cost) Accumulated depreciation O The building

In the 30 June 2020 annual report of Smith Ltd, the building was reported as follows: Building (at cost) Accumulated depreciation O The building is depreciated on a straight-line basis over a 10-year period. The company used revaluation model for the building. The company finds out that the building has a fair value of $140,000 at 30 June 2020. On 30 June 2021, the fair value of building is assessed to be $92,500. Building Which journal entries are correct to revalue the asset in accordance with AASB 116 Property, Plant and Equipment at 30 June 2021? Gain on Revaluation (P/L) Asset Revaluation Surplus (OCI) Loss on Revaluation (P/L) Building $ 150 000 Loss on Revaluation (P/L) (30 000) Building 120 000 DR 7.500 DR 20,000 10,000 DR 30,000 DR Asset Revaluation Surplus (OCI) 20,000 Loss on Revaluation (P/L) 27,500 Building CR 7,500 CR 30,000 CR 30,000 CR 47,500

Step by Step Solution

3.45 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Particulars Cost Accumulated Depreciation WDV Value as on 30062020 Fair Va...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started