Answered step by step

Verified Expert Solution

Question

1 Approved Answer

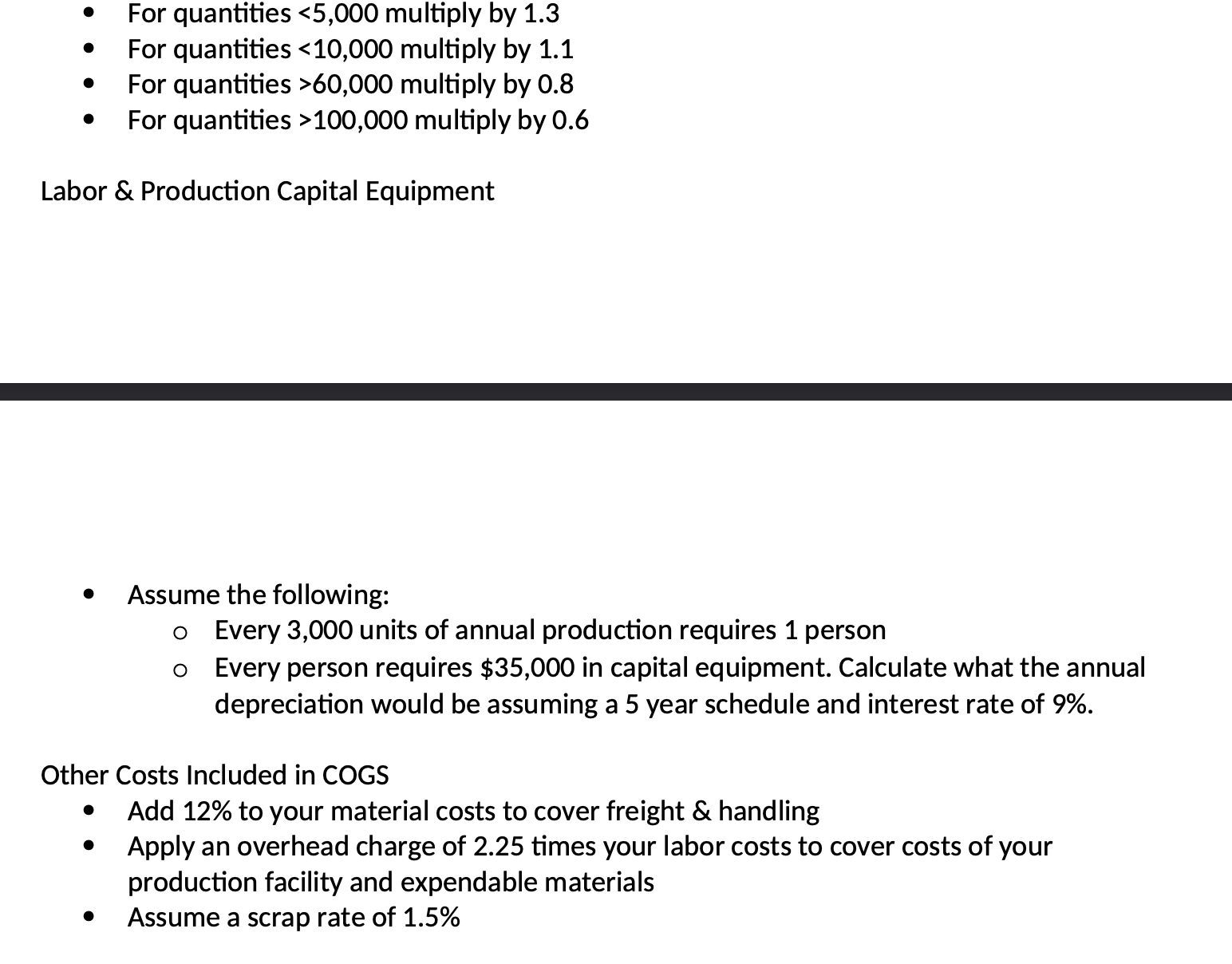

- For quantities 60,000 multiply by 0.8 - For quantities >100,000 multiply by 0.6 Labor & Production Capital Equipment - Assume the following: Every 3,000

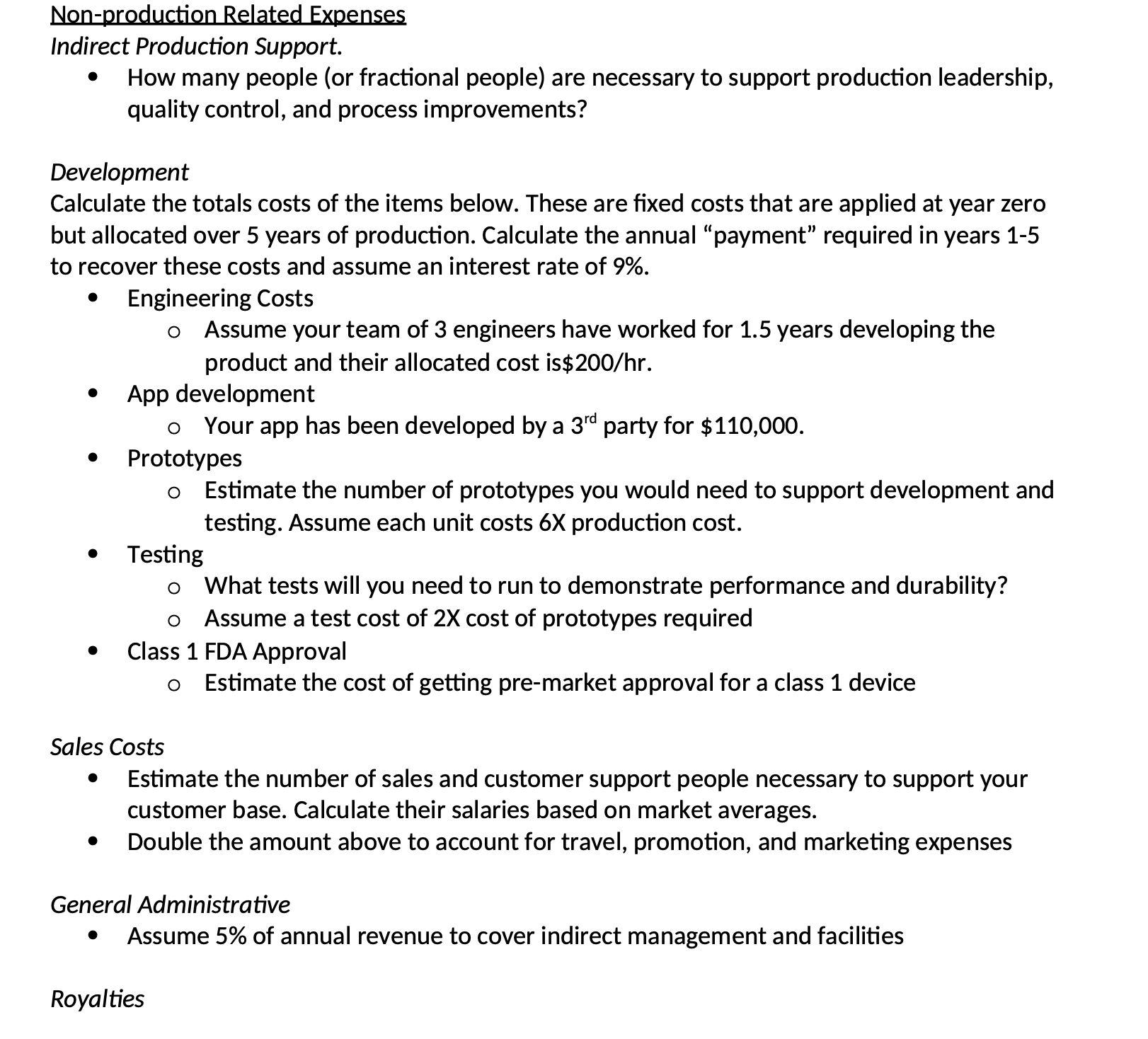

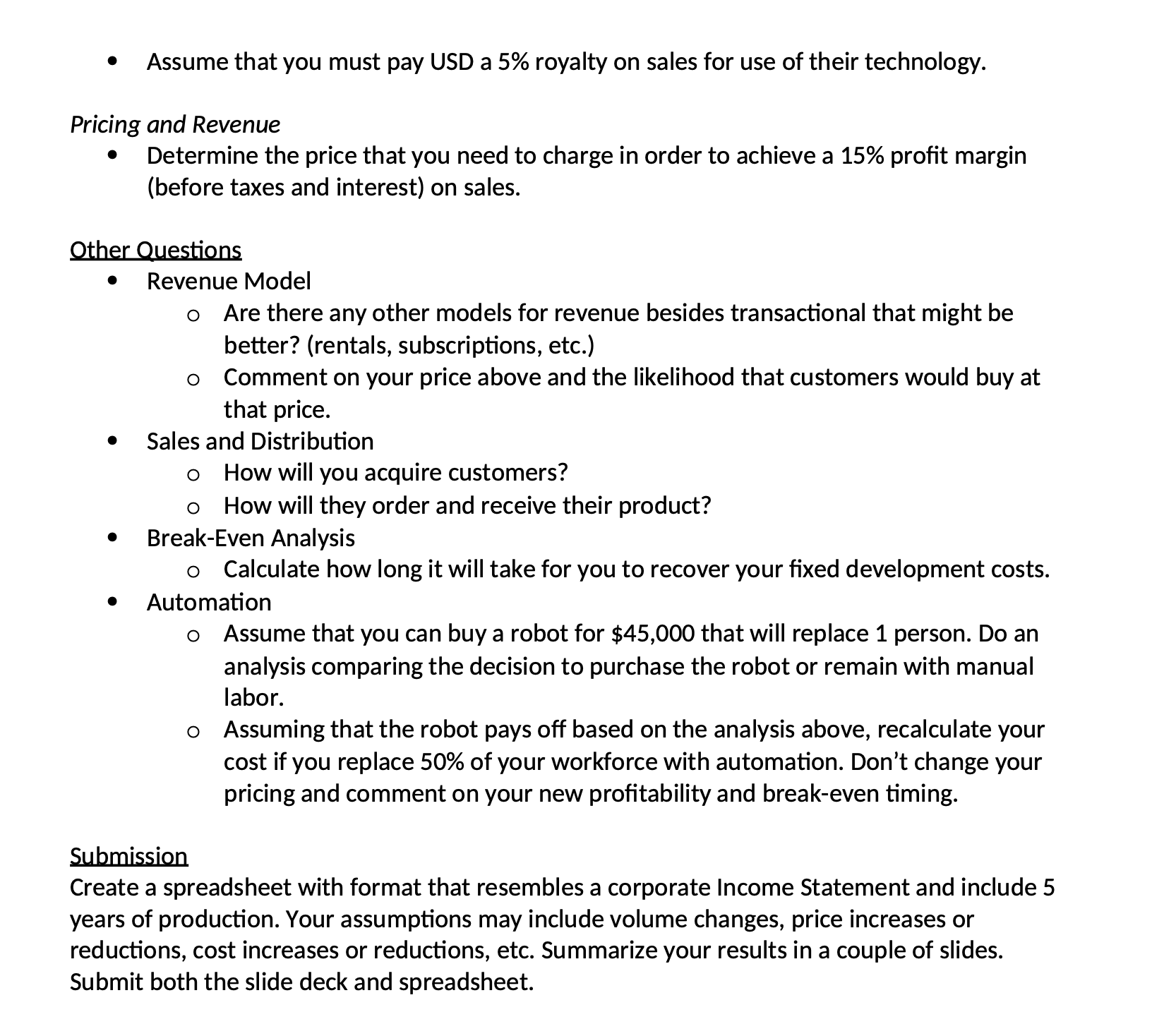

- For quantities 60,000 multiply by 0.8 - For quantities >100,000 multiply by 0.6 Labor \& Production Capital Equipment - Assume the following: Every 3,000 units of annual production requires 1 person - Every person requires $35,000 in capital equipment. Calculate what the annual depreciation would be assuming a 5 year schedule and interest rate of 9%. Other Costs Included in COGS - Add 12% to your material costs to cover freight \& handling - Apply an overhead charge of 2.25 times your labor costs to cover costs of your production facility and expendable materials - Assume a scrap rate of 1.5% Indirect Production Support. - How many people (or fractional people) are necessary to support production leadership, quality control, and process improvements? Development Calculate the totals costs of the items below. These are fixed costs that are applied at year zero but allocated over 5 years of production. Calculate the annual "payment" required in years 1-5 to recover these costs and assume an interest rate of 9%. - Engineering Costs Assume your team of 3 engineers have worked for 1.5 years developing the product and their allocated cost is $200/hr. - App development Your app has been developed by a 3rd party for $110,000. - Prototypes Estimate the number of prototypes you would need to support development and testing. Assume each unit costs 6X production cost. - Testing What tests will you need to run to demonstrate performance and durability? - Assume a test cost of 2X cost of prototypes required - Class 1 FDA Approval Estimate the cost of getting pre-market approval for a class 1 device Sales Costs - Estimate the number of sales and customer support people necessary to support your customer base. Calculate their salaries based on market averages. - Double the amount above to account for travel, promotion, and marketing expenses General Administrative - Assume 5% of annual revenue to cover indirect management and facilities - Assume that you must pay USD a 5\% royalty on sales for use of their technology. Pricing and Revenue - Determine the price that you need to charge in order to achieve a 15% profit margin (before taxes and interest) on sales. Other Questions - Revenue Model Are there any other models for revenue besides transactional that might be better? (rentals, subscriptions, etc.) Comment on your price above and the likelihood that customers would buy at that price. - Sales and Distribution How will you acquire customers? How will they order and receive their product? - Break-Even Analysis Calculate how long it will take for you to recover your fixed development costs. - Automation - Assume that you can buy a robot for $45,000 that will replace 1 person. Do an analysis comparing the decision to purchase the robot or remain with manual labor. Assuming that the robot pays off based on the analysis above, recalculate your cost if you replace 50% of your workforce with automation. Don't change your pricing and comment on your new profitability and break-even timing. Submission Create a spreadsheet with format that resembles a corporate Income Statement and include 5 years of production. Your assumptions may include volume changes, price increases or reductions, cost increases or reductions, etc. Summarize your results in a couple of slides. Submit both the slide deck and spreadsheet

- For quantities 60,000 multiply by 0.8 - For quantities >100,000 multiply by 0.6 Labor \& Production Capital Equipment - Assume the following: Every 3,000 units of annual production requires 1 person - Every person requires $35,000 in capital equipment. Calculate what the annual depreciation would be assuming a 5 year schedule and interest rate of 9%. Other Costs Included in COGS - Add 12% to your material costs to cover freight \& handling - Apply an overhead charge of 2.25 times your labor costs to cover costs of your production facility and expendable materials - Assume a scrap rate of 1.5% Indirect Production Support. - How many people (or fractional people) are necessary to support production leadership, quality control, and process improvements? Development Calculate the totals costs of the items below. These are fixed costs that are applied at year zero but allocated over 5 years of production. Calculate the annual "payment" required in years 1-5 to recover these costs and assume an interest rate of 9%. - Engineering Costs Assume your team of 3 engineers have worked for 1.5 years developing the product and their allocated cost is $200/hr. - App development Your app has been developed by a 3rd party for $110,000. - Prototypes Estimate the number of prototypes you would need to support development and testing. Assume each unit costs 6X production cost. - Testing What tests will you need to run to demonstrate performance and durability? - Assume a test cost of 2X cost of prototypes required - Class 1 FDA Approval Estimate the cost of getting pre-market approval for a class 1 device Sales Costs - Estimate the number of sales and customer support people necessary to support your customer base. Calculate their salaries based on market averages. - Double the amount above to account for travel, promotion, and marketing expenses General Administrative - Assume 5% of annual revenue to cover indirect management and facilities - Assume that you must pay USD a 5\% royalty on sales for use of their technology. Pricing and Revenue - Determine the price that you need to charge in order to achieve a 15% profit margin (before taxes and interest) on sales. Other Questions - Revenue Model Are there any other models for revenue besides transactional that might be better? (rentals, subscriptions, etc.) Comment on your price above and the likelihood that customers would buy at that price. - Sales and Distribution How will you acquire customers? How will they order and receive their product? - Break-Even Analysis Calculate how long it will take for you to recover your fixed development costs. - Automation - Assume that you can buy a robot for $45,000 that will replace 1 person. Do an analysis comparing the decision to purchase the robot or remain with manual labor. Assuming that the robot pays off based on the analysis above, recalculate your cost if you replace 50% of your workforce with automation. Don't change your pricing and comment on your new profitability and break-even timing. Submission Create a spreadsheet with format that resembles a corporate Income Statement and include 5 years of production. Your assumptions may include volume changes, price increases or reductions, cost increases or reductions, etc. Summarize your results in a couple of slides. Submit both the slide deck and spreadsheet Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started