Answered step by step

Verified Expert Solution

Question

1 Approved Answer

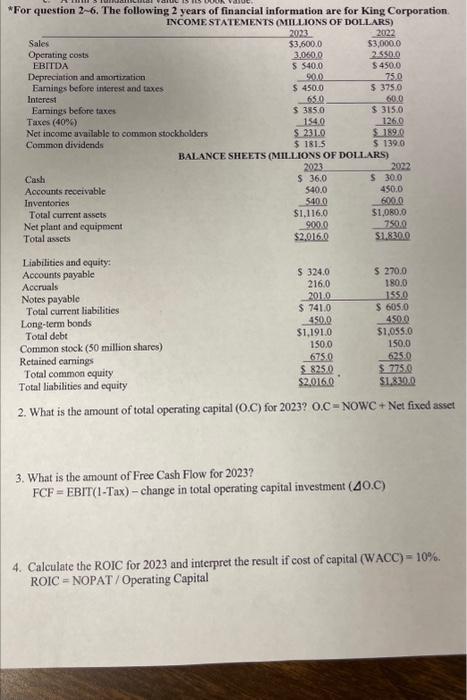

*For question 2-6. The following 2 years of financial information are for King Corporation. INCOME STATEMENTS (MILLIONS OF DOLLARS) 2023 Sales Operating costs EBITDA

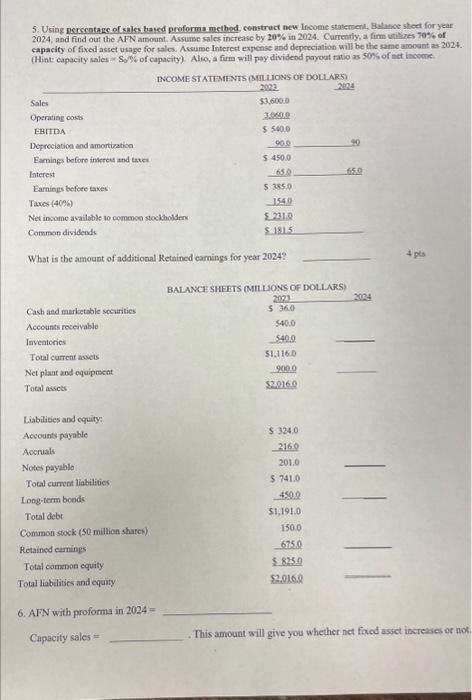

*For question 2-6. The following 2 years of financial information are for King Corporation. INCOME STATEMENTS (MILLIONS OF DOLLARS) 2023 Sales Operating costs EBITDA Depreciation and amortization Earnings before interest and taxes Interest Earnings before taxes Taxes (40 %) Net income available to common stockholders Common dividends Cash Accounts receivable Inventories Total current assets Net plant and equipment Total assets Liabilities and equity: Accounts payable Accruals Notes payable Total current liabilities. Long-term bonds $3,600.0 3,060,0 $ 540.0 90.0 $ 450.0 65.0 $385.0 154.0 $ 231.0 $181.5 60.0 $315.0 126.0 $189.0 $ 139.0 BALANCE SHEETS (MILLIONS OF DOLLARS) 2023 $36.0 $40,0 540.0 $1,116.0 900.0 $2,016.0 $ 324.0 216.0 201.0 $ 741.0 450.0 $1,191.0 150.0 675.0 2022 $3,000.0 2.550.0 $450.0 75.0 $ 375.0 $825.0 $2.016.0 2022 $ 30.0 450.0 600.0 $1,080.0 750.0 $1.830.0 $ 270.0 180.0 155.0 $ 605.0 450.0 $1,055.0 Total debt Common stock (50 million shares) 150.0 625.0 Retained earnings Total common equity $ 775.0 $1,830.0 Total liabilities and equity 2. What is the amount of total operating capital (O.C) for 2023? OC-NOWC + Net fixed asset 3. What is the amount of Free Cash Flow for 2023? FCF = EBIT(1-Tax)- change in total operating capital investment (40.C) 4. Calculate the ROIC for 2023 and interpret the result if cost of capital (WACC) = 10%. ROICNOPAT/Operating Capital 5. Using percentage of sales based proforma method, construct new Income statement, Balance sheet for year 2024, and find out the AFN amount. Assume sales increase by 20% in 2024. Currently, a firm utilizes 70% of capacity of fixed asset usage for sales. Assume Interest expense and depreciation will be the same amount as 2024. (Hint: capacity sales So% of capacity). Also, a firm will pay dividend payout ratio as 50% of net income Sales Operating costs EBITDA Depreciation and amortization Earnings before interest and taxes Interest Earnings before taxes Cash and marketable securities Accounts receivable Inventories Total current assets Net plant and equipment Total assets Liabilities and equity: Accounts payable Accruals Notes payable Total current liabilities; Taxes (40%) Net income available to common stockholders Common dividends What is the amount of additional Retained earnings for year 2024? Long-term bonds Total debt Common stock (50 million shares) Retained earnings Total common equity Total liabilities and equity i INCOME STATEMENTS (MILLIONS OF DOLLARS) 2023 2024 6. AFN with proforma in 2024- Capacity sales = $3,600.0 13.060.0 $ 540.0 90.0 $ 450.0 $ 385.0 1540 $.231.0 $181.5 BALANCE SHEETS (MILLIONS OF DOLLARS) 2023 5 36.0 $40.0 $40.0 $1,116.0 900.0 $2.0160 $ 324.0 2160 201.0 $741.0 450.0 $1,191.0 150.0 675.0 $825.0 $2.016.0 90 65.0 2024 11 4 pts . This amount will give you whether net fixed asset increases or not.

Step by Step Solution

★★★★★

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

The question seems to be divided into multiple parts Given these images I will first address them one by one based on the provided instructions 1 Total Operating Capital OC for 2023 Operating Capital ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started