Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For question 4, the face value of the bond. It now reads that it is a $10,000 bond . Please use spreadsheet to solve it,

For question 4, the face value of the bond. It now reads that it is a $10,000 bond.

Please use spreadsheet to solve it, thanks. I will give a good rate.

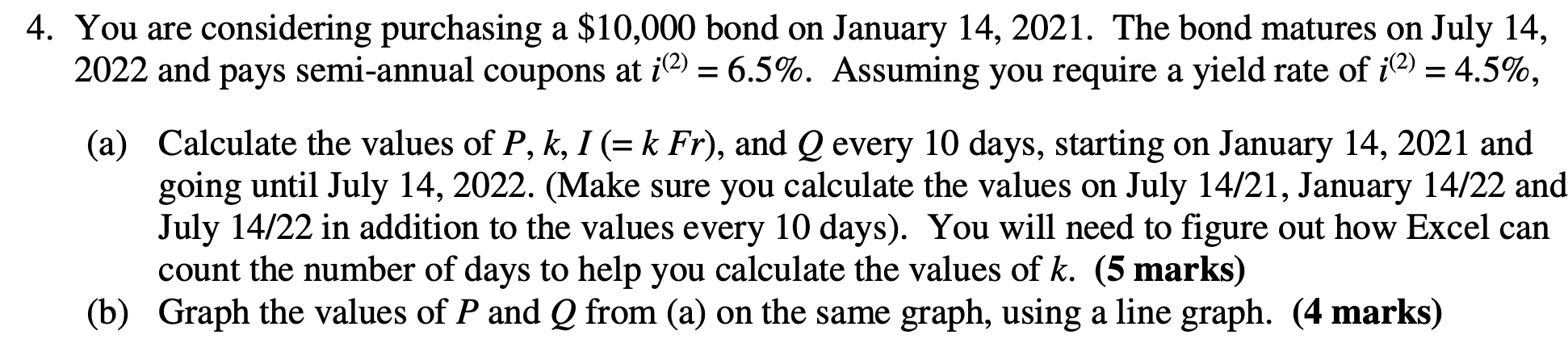

4. You are considering purchasing a $10,000 bond on January 14, 2021. The bond matures on July 14, 2022 and pays semi-annual coupons at i(2) = 6.5%. Assuming you require a yield rate of i(2) = 4.5%, = - (a) Calculate the values of P, k, 1 (=k Fr), and Q every 10 days, starting on January 14, 2021 and going until July 14, 2022. (Make sure you calculate the values on July 14/21, January 14/22 and July 14/22 in addition to the values every 10 days). You will need to figure out how Excel can count the number of days to help you calculate the values of k. (5 marks) (b) Graph the values of P and Q from (a) on the same graph, using a line graph. (4 marks) 4. You are considering purchasing a $10,000 bond on January 14, 2021. The bond matures on July 14, 2022 and pays semi-annual coupons at i(2) = 6.5%. Assuming you require a yield rate of i(2) = 4.5%, = - (a) Calculate the values of P, k, 1 (=k Fr), and Q every 10 days, starting on January 14, 2021 and going until July 14, 2022. (Make sure you calculate the values on July 14/21, January 14/22 and July 14/22 in addition to the values every 10 days). You will need to figure out how Excel can count the number of days to help you calculate the values of k. (5 marks) (b) Graph the values of P and Q from (a) on the same graph, using a line graph. (4 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started