Answered step by step

Verified Expert Solution

Question

1 Approved Answer

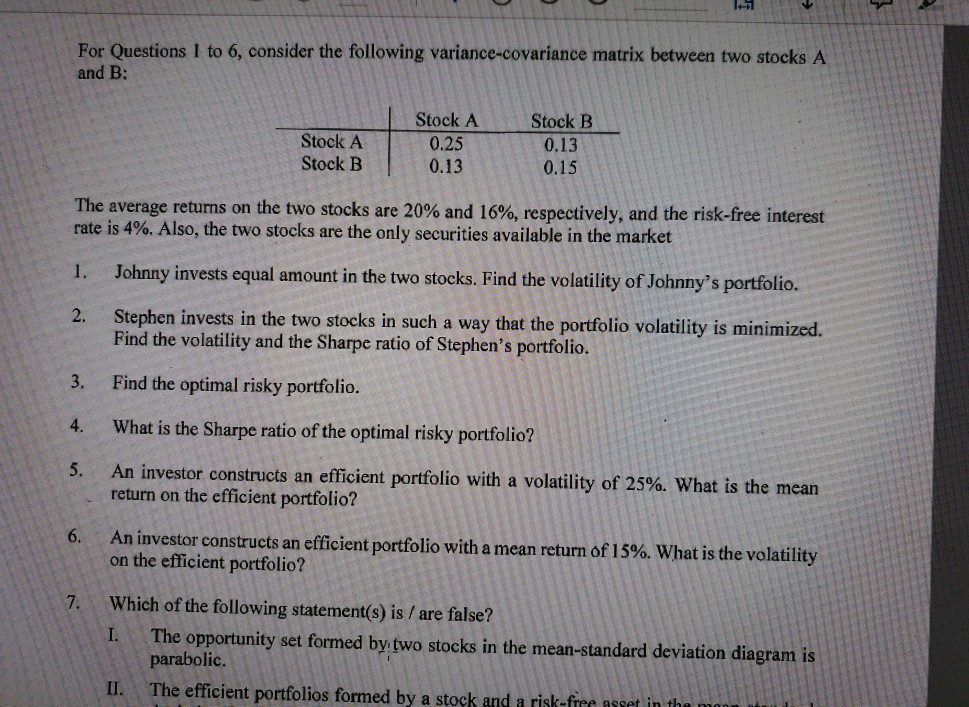

For Questions 1 to 6, consider the following variance-covariance matrix between two stocks A and B: Stock AStock B Stock A Stock B 0.25 0.13

For Questions 1 to 6, consider the following variance-covariance matrix between two stocks A and B: Stock AStock B Stock A Stock B 0.25 0.13 0.13 0.15 The average returns on the two stocks are 20% and 16%, respectively, and the risk-free interest rate is 4%. Also, the two stocks are the only securities available in the market 1. Johnny invests equal amount in the two stocks. Find the volatility of Johnny's portfolio. 2. Stephen invests in the two stocks in such a way that the portfolio volatility is minimized. Find the volatility and the Sharpe ratio of Stephen's portfolio. 3. Find the optimal risky portfolio. 4. What is the Sharpe ratio of the optimal risky portfolio? An investor constructs an efficient portfolio with a volatility of 25%, what is the mean return on the efficient portfolio? 6 An investor constructs an efficient portfolio with a mean return of 15%. What is the volatility on the efficient portfolio? Which of the following statement(s) is / are false? I. The opportunity set formed bytwo stocks in the mean-standard deviation diagram is 7. parabolic Il. The efficient portolios formed by a stork and arik-finurt in t For Questions 1 to 6, consider the following variance-covariance matrix between two stocks A and B: Stock AStock B Stock A Stock B 0.25 0.13 0.13 0.15 The average returns on the two stocks are 20% and 16%, respectively, and the risk-free interest rate is 4%. Also, the two stocks are the only securities available in the market 1. Johnny invests equal amount in the two stocks. Find the volatility of Johnny's portfolio. 2. Stephen invests in the two stocks in such a way that the portfolio volatility is minimized. Find the volatility and the Sharpe ratio of Stephen's portfolio. 3. Find the optimal risky portfolio. 4. What is the Sharpe ratio of the optimal risky portfolio? An investor constructs an efficient portfolio with a volatility of 25%, what is the mean return on the efficient portfolio? 6 An investor constructs an efficient portfolio with a mean return of 15%. What is the volatility on the efficient portfolio? Which of the following statement(s) is / are false? I. The opportunity set formed bytwo stocks in the mean-standard deviation diagram is 7. parabolic Il. The efficient portolios formed by a stork and arik-finurt in t

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started